Source:Â Derrick Tyson.

Dear Diary,

The Dow rose 100 points yesterday. Gold was up one lousy dollar.

We’ll take the gold, thank you very much. Because our guess is that this stock market is living not only on borrowed money but also on borrowed time.

With the addition of Chinese Web portal Alibaba (BABA), there are now 44 start-ups preparing to enter the public markets. Each of these has a valuation of more than $1 billion.

The last time there was this kind of action in the IPO market was 2000, just before the dot-com bubble blew up. And the last time stocks were this expensive was 2007, when the subprime/finance bubble blew up.

That was also the last time share buybacks by US corporations passed the $600 billion mark, which they will do again this year.

Yes, dear reader, the party has gotten out of hand – thanks to all the free booze supplied by Ben Bernanke and Janet Yellen. It’s time to look for the car keys.

Party On!

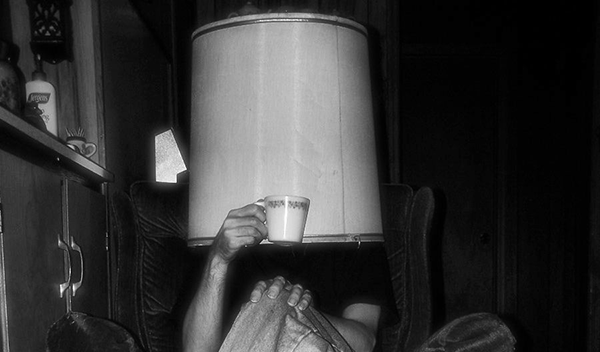

This is not to say that it won’t go on longer. And it is not to say that it won’t get wilder, too. There are already people with lampshades on their heads. And girls are dancing on the tables.

But at least no one has called the cops… yet. You don’t want to be there when they do.

What might make stocks go up further?

Well, the Fed might decide to hold off on more QE cuts, for example. The economy is not recovering and the Fed knows it. A shock or two in the stock market or bad employment numbers would probably convince Yellen & Co. to stop their “tapering†of QE… at least for now.

Or, like the European Central Bank, the Fed could announce a new scheme of unspecified interventions. Instead of the higher interest rates everybody expects, US interest rates could go lower… and it would be “party on†again, with higher stock prices to boot.

Thanks to the ECB, Italy is now able to borrow at 13 basis points lower than the US. Lenders are giving money to France at a yield 114 basis points lower.