Image Source:

Image Source:

Asian stock markets displayed a mixed performance on Wednesday, mirroring the generally optimistic signals from Wall Street overnight. Investors are exercising caution in anticipation of a key U.S. inflation report, the upcoming Thanksgiving holiday in the U.S., and the ongoing uncertainty regarding Trump’s tariff proposals. The announcement of a U.S.-brokered ceasefire agreement between Israel and Lebanon’s Hezbollah has elicited a favourable response from the markets. China investors appear to be relieved that the threat of additional 10% tariffs on Chinese products is not the 60% levy that Trump campaigned on. They are confident that Beijing will increase stimulus to address any impact on trade. While the Yuan, Mexican peso, and Canadian dollar are still at or near multi-month or multi-year lows, the market consensus is that the tariff threats are likely a bargaining tactic and may not be implemented in January. Japan’s Nikkei index underperformed on Wednesday, declining 0.9%. The automotive sector was the worst-performing industry group on the Tokyo Stock Exchange, dropping more than 3% as both the threat of tariffs and the impact of a stronger yen weighed on the profit outlook. The FOMC minutes from November 6-7 appeared more dated than normal due to the market’s forward-looking attention on the ramifications of Trump’s election triumph. Nonetheless, there were at least a few important lessons learnt. Initially, participants perceived “the risk of an excessive cooling in the labour market as having lessened significantly” in relation to the labour market. This was supported by the employment component of yesterday’s Consumer Confidence survey, which showed a second-month increase in “jobs plentiful minus jobs hard to get” (see chart). Second, the Committee once again highlighted uncertainty over the “level of the neutral rate of interest” in order to signal a gradual approach to rate decreases and, presumably, to some extent, capture political issues without having to mention them directly. Be prepared for another upward revision in December, which will support the message of a shallow path of rate decreases since the estimate of the longer-run Fed Funds rate was still only 2.9% in the September “dot plot.” Upside inflation risks were characterised as “little changed,” but today that aspect of the tale is going to be called into question. It will be difficult to reconcile the October core PCE deflator’s predicted 2.8% year-over-year increase with the September Fed’s 2.6% forecast for Q4 overall.The October PCE report will be released later today. Expect headline PCE to climb 0.2% m/m, or 2.3% y/y vs. 2.1% in September. Core prices to climb 0.3% m/m and 2.8% y/y from 2.7%. Both metrics are above the inflation objective, and core PCE would exceed the 2.6% Fed forecast in the latest Summary of Economic Projections for this year. That may be the Q4/Q4 change, so there is more wood to chop, but base effects suggest that core PCE will overshoot that forecast. Disinflation appears to have stopped according to recent forecasts. That would match market estimates that the Fed will suspend its easing cycle in December (only 40% probability of another 25bps drop). However, markets believe the Fed still views policy settings as too restrictive, and next year would be a better time to assess the outlook, supported by the FOMC’s assumptions revisions at the December meeting and before Trump’s inauguration. Trading activity is expected to decrease further as Thursday marks the beginning of a four-day Thanksgiving weekend for many in the United States.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/11/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5990

EURUSD Bullish Above Bearish Below 1.05

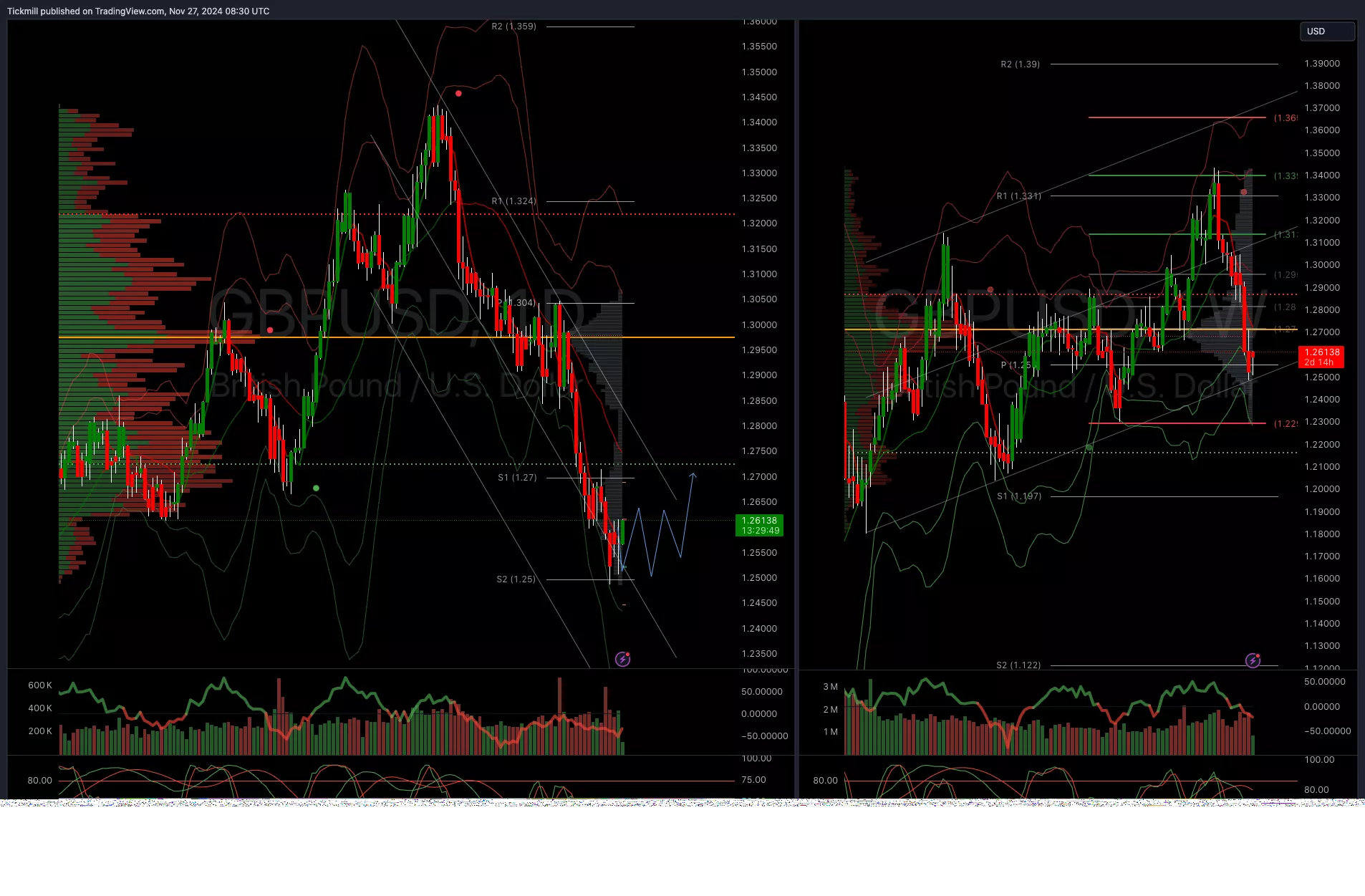

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

(Click on image to enlarge).webp) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

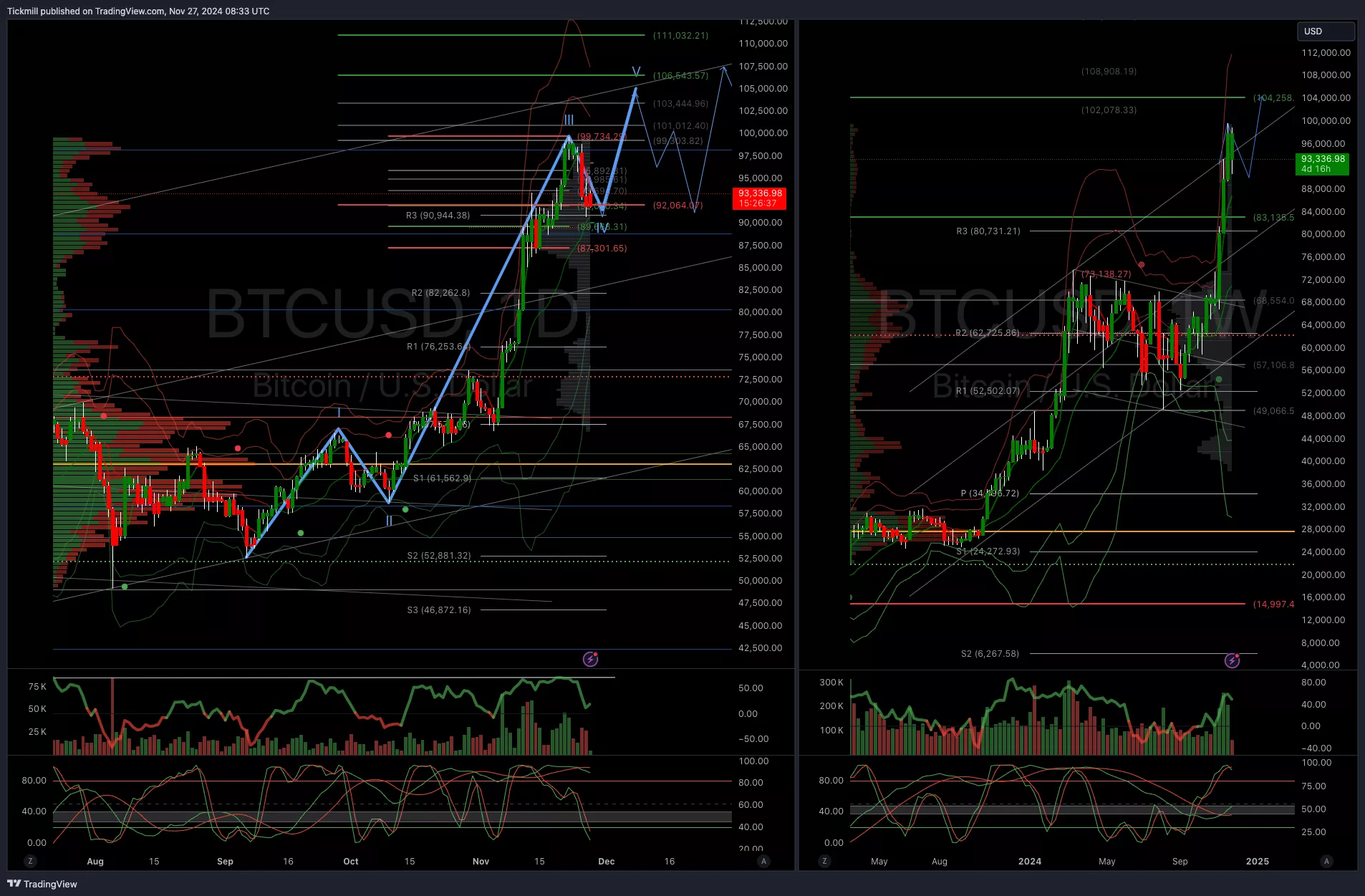

(Click on image to enlarge).webp) BTCUSD Bullish Above Bearish Below 92000

BTCUSD Bullish Above Bearish Below 92000

(Click on image to enlarge) More By This Author:

More By This Author: