Image Source:

Image Source:

The dollar saw a late-day bid in US trade after the announcement by President-elect Trump that tariffs would be implemented on imports from Canada, Mexico, and China. The nomination of fund manager Scott Bessent as Treasury Secretary, who is perceived as a representative of Wall Street in Washington, spurred a decline in stocks, thereby reversing some of the significant gains of the previous session. Bessent’s appointment also resulted in a significant decrease in U.S. yields, as investors purchased Treasury bonds, which caused the dollar to decline in the previous session. It seems that Trump is seeking to assert his authority following his nomination of Bessent as Treasury Secretary, a decision that markets anticipated would moderate Trump’s policies. Trump expressed his affection for the term “tariff” only last month; therefore, his recent remarks should not have been unexpected, although their timing was. The Hang Seng index in Hong Kong and mainland blue-chip equities both experienced a rise, reversing previous declines, as investors anticipate the possibility of additional stimulus to address tariffs. Trump announced that he would implement a 25% tariff on all products from Mexico and Canada, as well as an additional 10% tariff on goods from China, on his first day in office. He cited concerns regarding the trade of illicit narcotics and illegal immigration. Trump has previously expressed his intention to terminate China’s most-favoured-nation trading status and impose tariffs on Chinese imports that exceed 60%. This has undoubtedly caused an initial adverse reaction in Asian markets, exerting pressure on Chinese assets, particularly those in the export sector. The episode evokes uneasy recollections for markets that have grown accustomed to responding to scheduled events such as Federal Reserve policy announcements and monthly employment reports during Joe Biden’s presidency. Now, investors must prepare for market-moving Trump posts at any time, similar to his first term in office.With the exception of a few central bank speakers from the region, there is little scheduled in Europe to divert attention from Trump’s post. Huw Pill, the chief economist of the Bank of England, is scheduled to appear before the House of Lords to address enquiries regarding the economic state of Britain or the absence thereof. Elizabeth McCaul, member of the European Central Bank’s board of directors, will deliver a speech in Frankfurt. Mario Centeno, a peer, will present the Bank of Portugal’s financial stability report. The Federal Reserve will release the minutes of its early November meeting later in the day. This meeting saw a quarter percentage point reduction in interest rates, which followed the initial, larger half-point cut in September as part of the current easing cycle.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/11/24

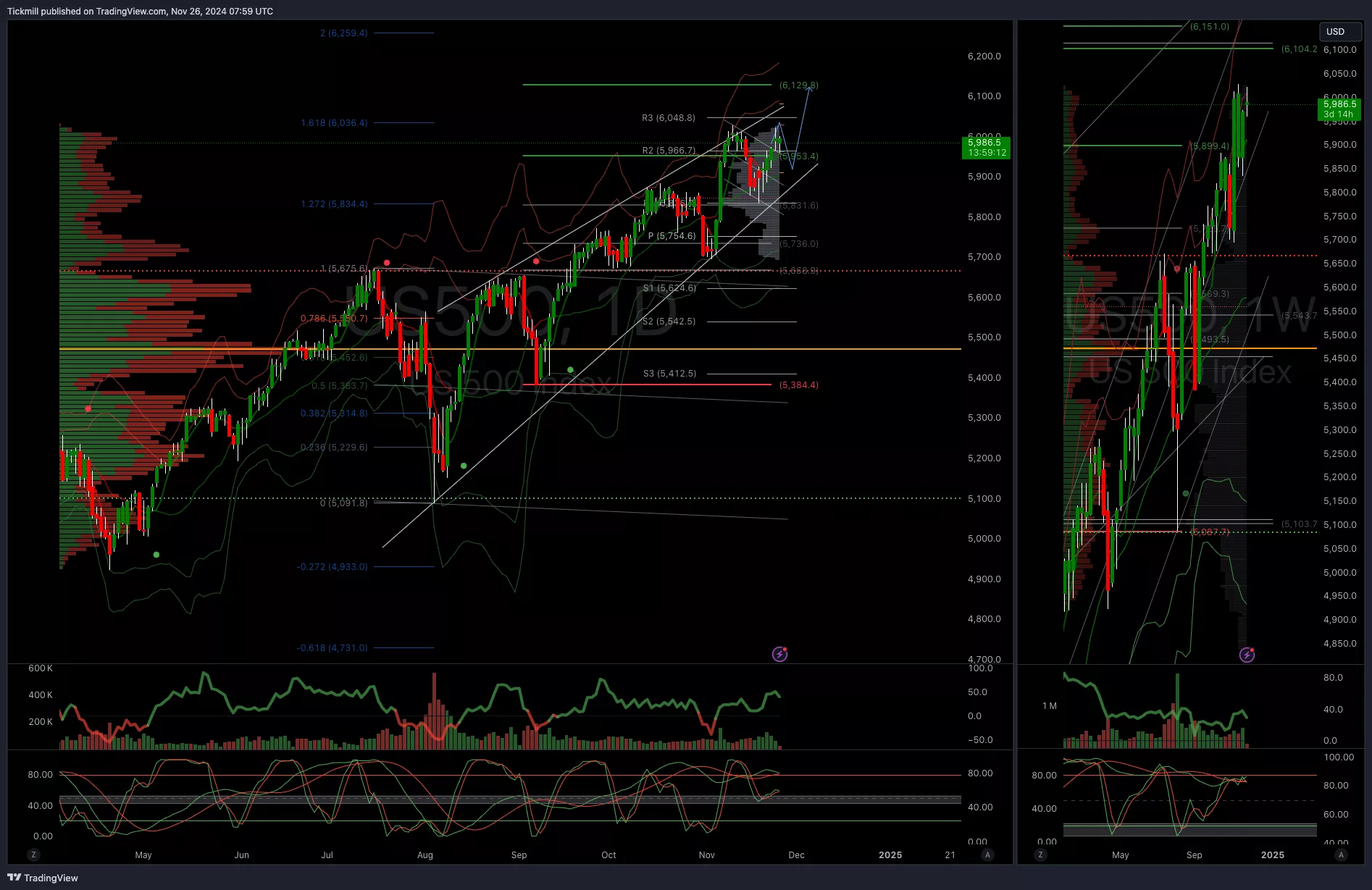

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

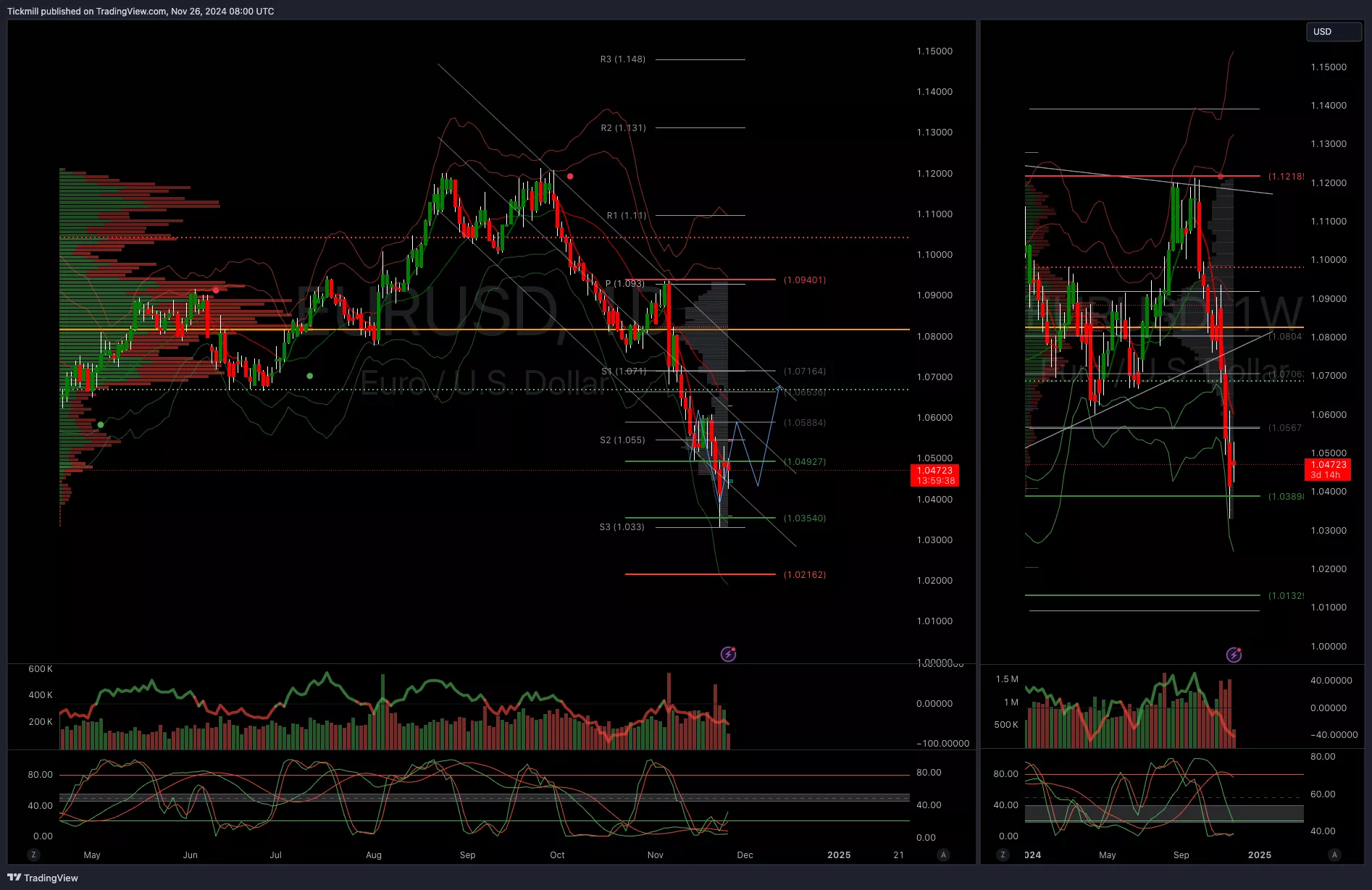

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.05

EURUSD Bullish Above Bearish Below 1.05

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

(Click on image to enlarge).webp) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

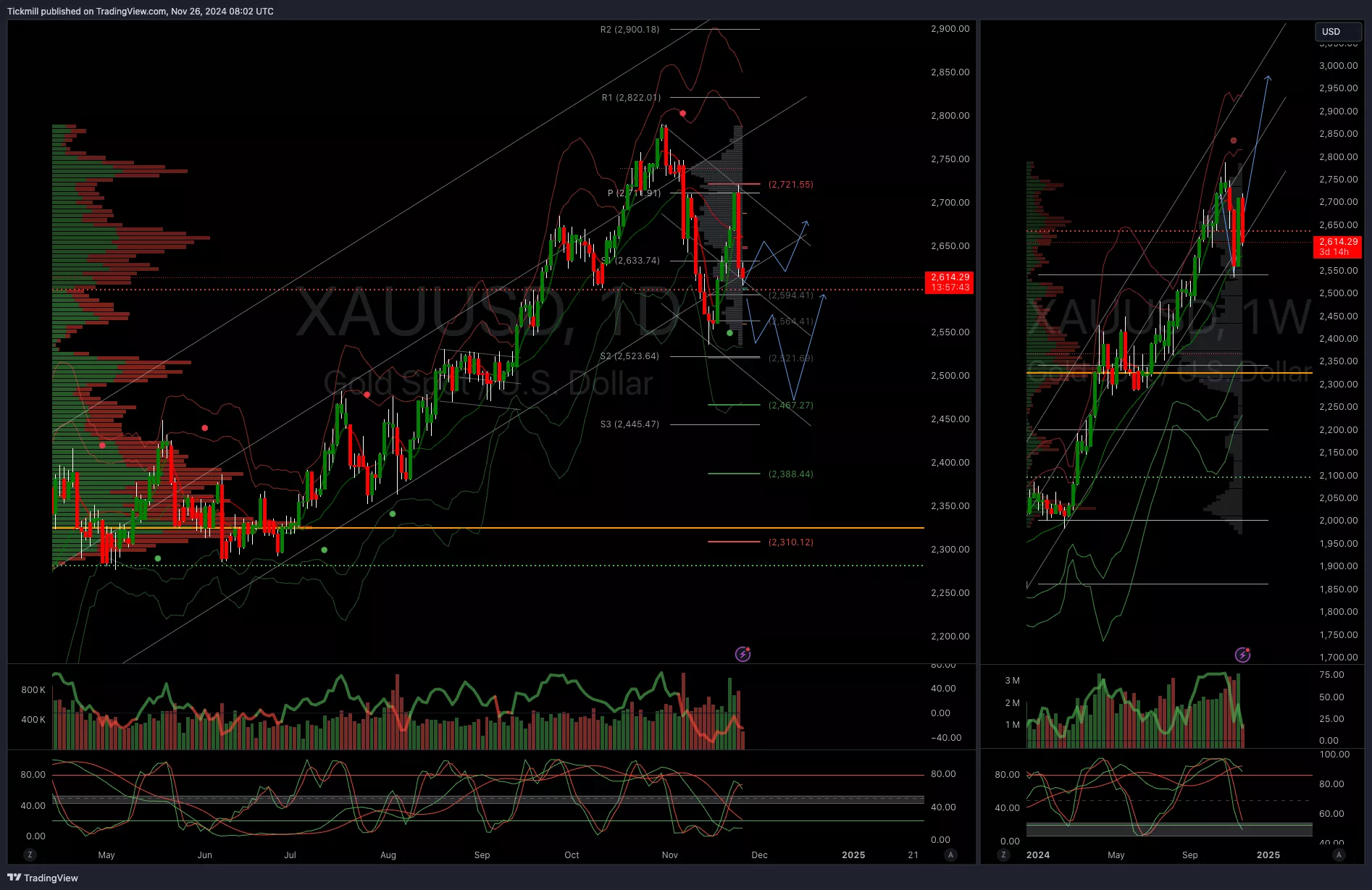

(Click on image to enlarge).webp) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

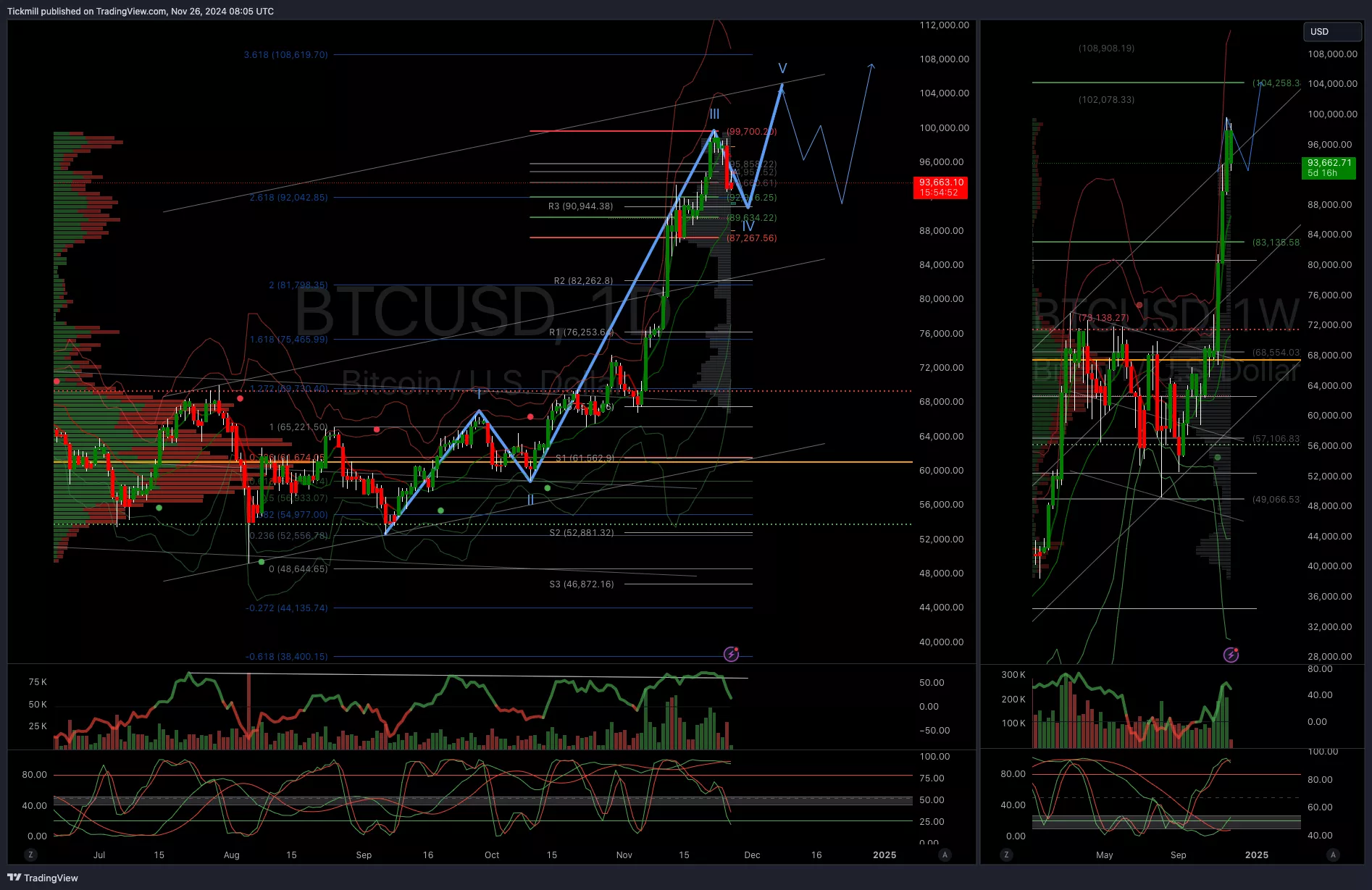

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 93000

BTCUSD Bullish Above Bearish Below 93000

(Click on image to enlarge) More By This Author:

More By This Author: