Asian stocks declined while the dollar remained at four-month highs on Tuesday, but the focus was on bitcoin, which reached a record high driven by investor bets on assets expected to benefit from Donald Trump’s election win. Investors anticipate Trump’s second term will bring tax cuts and looser regulations, boosting the world’s largest cryptocurrency, bitcoin, to an all-time high of $89,657. However, the threat of potential tariffs from the new White House administration has put pressure on the euro, which touched near seven-month lows overnight. The dollar is expected to benefit from policies that will likely keep U.S. interest rates relatively higher for longer. The Republican Party’s decisive win removes the uncertainty of a contested U.S. election outcome, but the medium-term outlook could become more complex if Trump pursues aggressive tariff hikes, which could fuel inflation and impact the Federal Reserve’s rate-cutting plans. Asian stocks, including Taiwan and South Korean shares, declined, with chip stocks in the region also reeling after the U.S. ordered Taiwan Semiconductor Manufacturing Company to stop supplying certain chips to China. In the commodities market, oil prices have declined as China’s stimulus plan and concerns over oversupply have dampened market sentiment in recent sessions.On the macro side, investors will be closely watching the U.S. consumer price inflation data on Wednesday, and a series of Federal Reserve speakers, including Fed Chair Jerome Powell, are scheduled to speak this week. Markets are currently pricing in an 87% chance of the Fed cutting rates by 25 basis points in December.The performance of short-dated government bond yields in the UK and Germany shows a significant disparity in market rate expectations since the US election. Schatz yields are 111 basis points lower than the ECB depo rate, suggesting more rate cuts are likely. The incoming US administration may impose tariffs on European industrial exports, and the fall of the German coalition government has negatively impacted public opinion. The impact of tariffs is likely less severe in the UK due to its smaller manufacturing industry. The BoE’s latest meeting did not reverse post-Budget market expectations for a more gradual path of rate decreases, with the 2-year gilt yield only about 50 basis points below the bank rate. This discrepancy between the BoE and ECB’s short-term expectations and the actual policy rate is unprecedented, and there will probably be some reconvergence over time.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 8/11/24

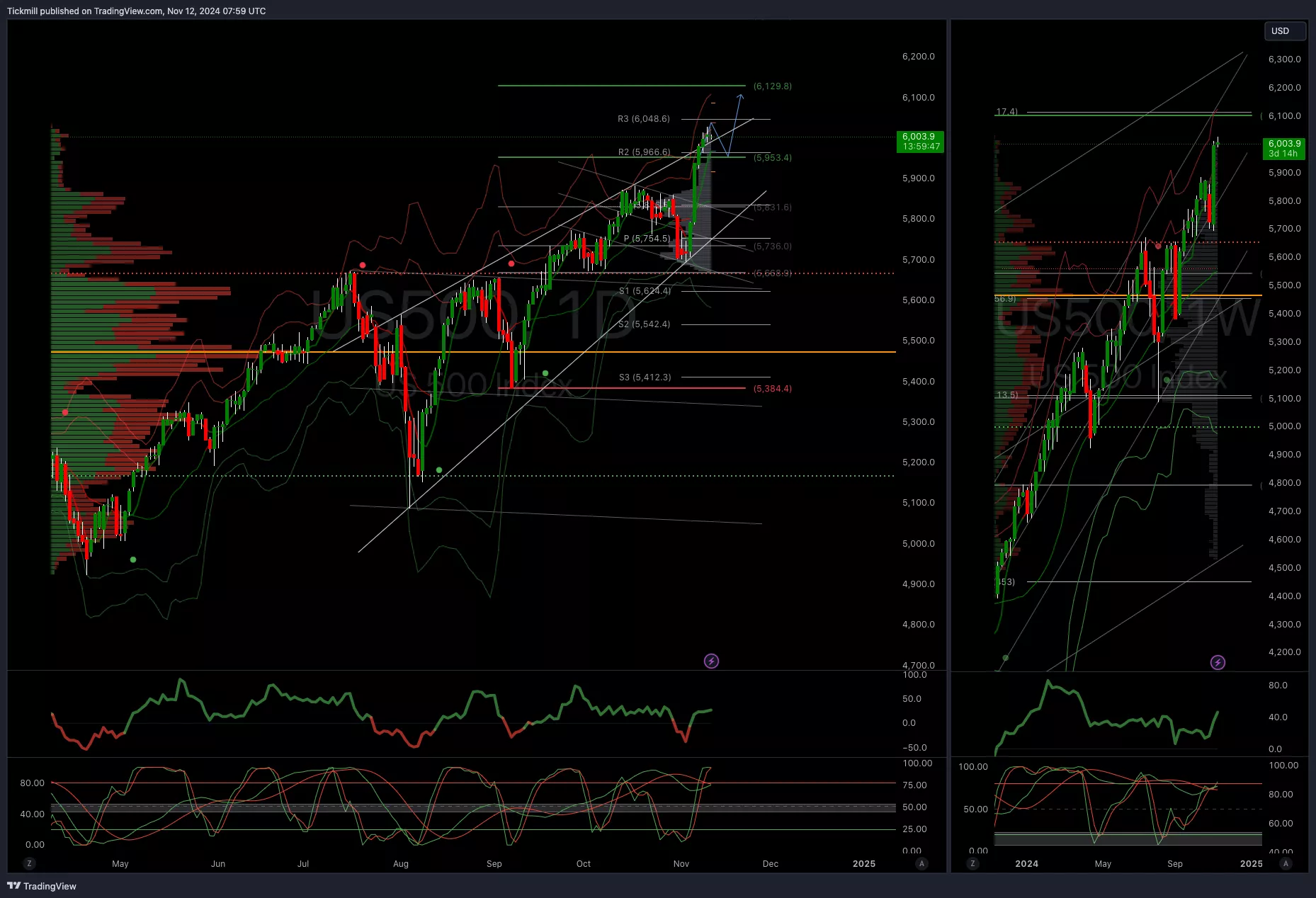

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0810

EURUSD Bullish Above Bearish Below 1.0810

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.3050

GBPUSD Bullish Above Bearish Below 1.3050

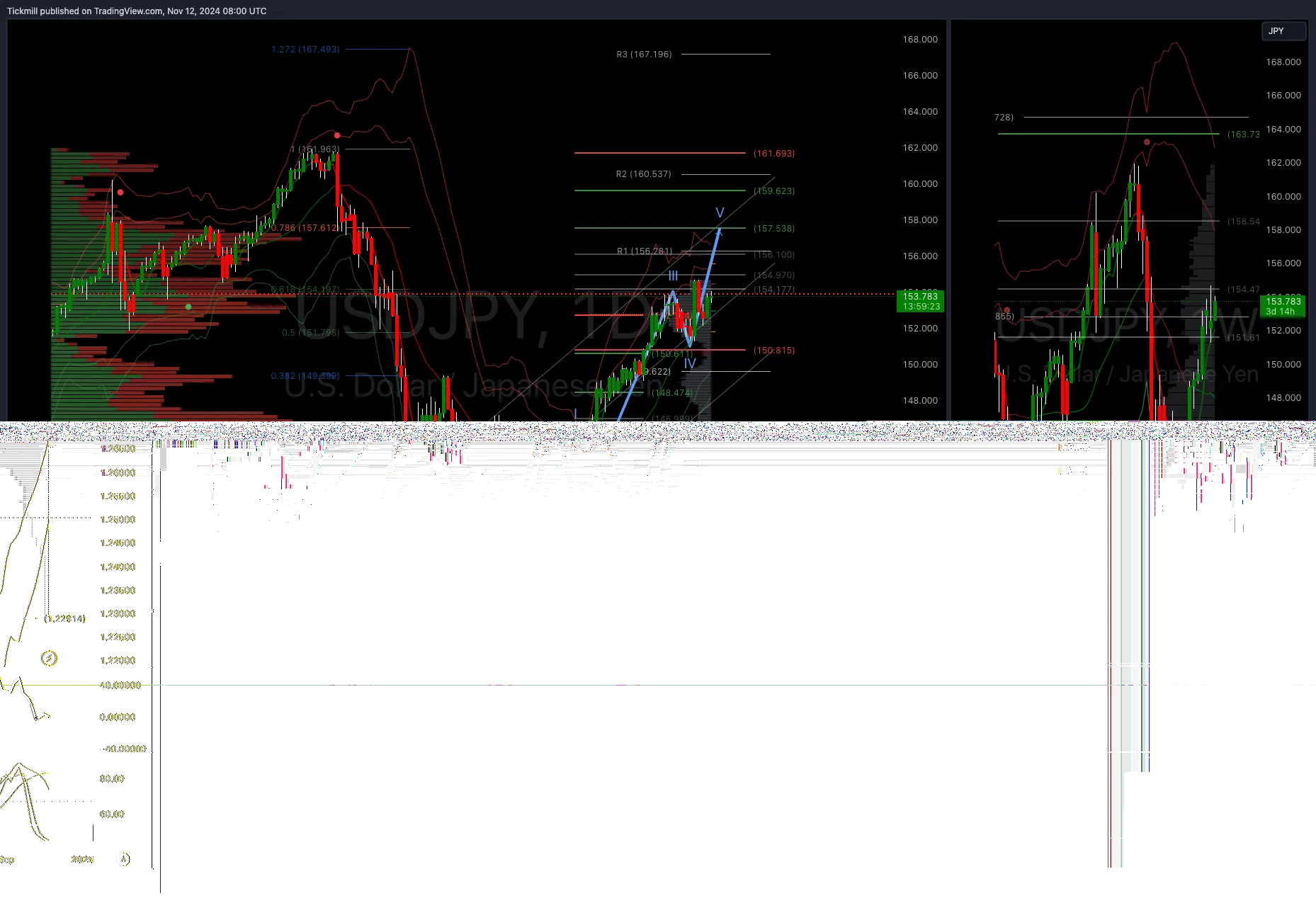

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 151

USDJPY Bullish Above Bearish Below 151

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 84500

BTCUSD Bullish Above Bearish Below 84500

(Click on image to enlarge) More By This Author:

More By This Author: