Image Source:

Image Source:

Asian stocks declined, counterbalancing the gains in Wall Street, amid speculation about Donald Trump’s potential running mate J.D Vance and the resulting new trade and geopolitical concerns. The MSCI AC Asia Pacific index experienced its third consecutive day of losses, dropping by 0.2%. Hong Kong witnessed the largest decline in stocks, while certain Chinese companies continued to fall due to investor anticipation of Trump’s tariffs. On the other hand, Japan’s stocks rose as exporters benefited from the weakening Yen.Jerome Powell, the Federal Reserve Chair, comments were seen as leaning towards a more cautious approach, leading to expectations of an interest rate cut in September. The possibility of Donald Trump returning to the White House has influenced trading and is on the minds of investors. Powell’s remarks, possibly his last before the Fed’s policy meeting, indicated that recent inflation data may lead to the inflation rate reaching the Fed’s target of 2%. This has caused a shift in market expectations, with traders now anticipating a significant easing of rates. The US dollar has been fluctuating in response to Powell’s comments and speculation about the impact of a potential Trump presidency on inflation and interest rates. Trump’s appearance at the Republican National Convention has further fueled expectations of his victory in the November election, leading to various market movements such as surging cryptocurrencies and gold approaching record highs. In Europe, futures suggest a quiet start to trading on Tuesday, with attention once again focused on developments involving Trump and Powell. Data wise the main macro driver today will be US retail sales, with nascent signs of the consumer pulling back markets will be attentive to any further dents in the data.

Overnight Newswire Updates of Note

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 9/7/24

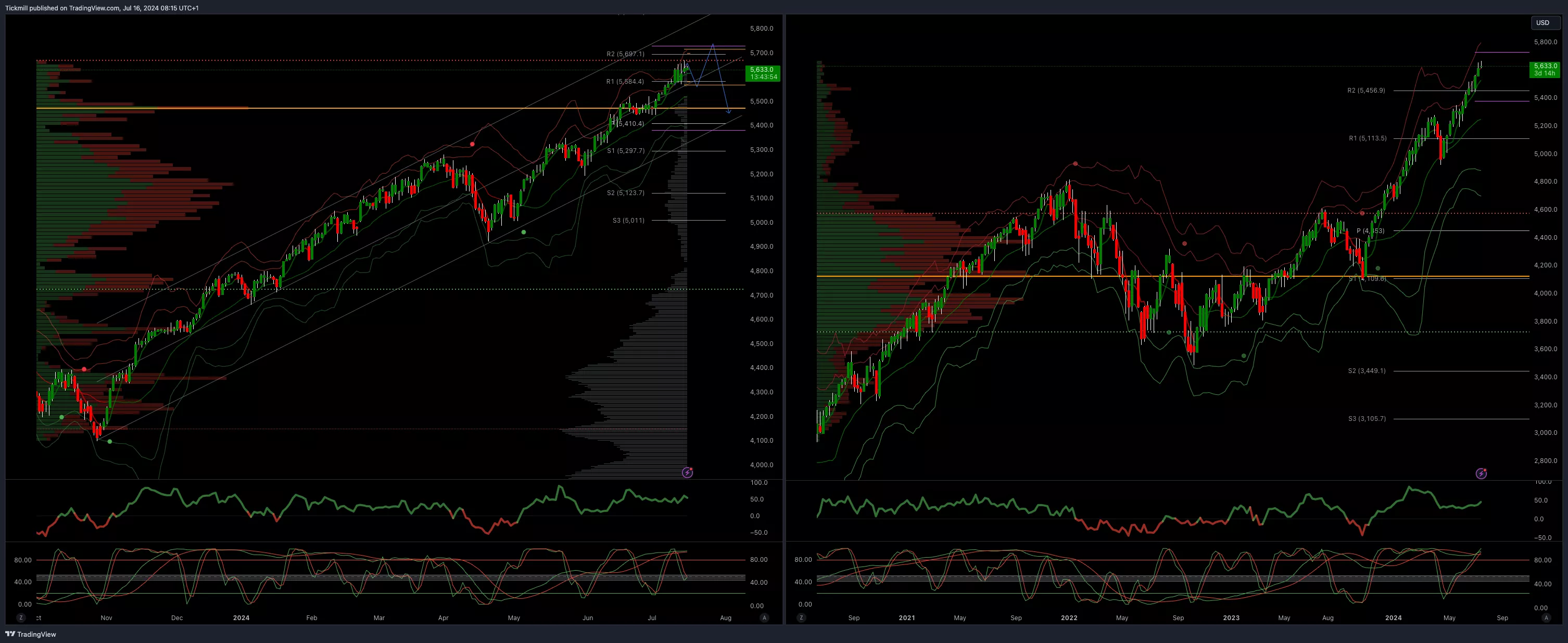

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5550

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.09

EURUSD Bullish Above Bearish Below 1.09

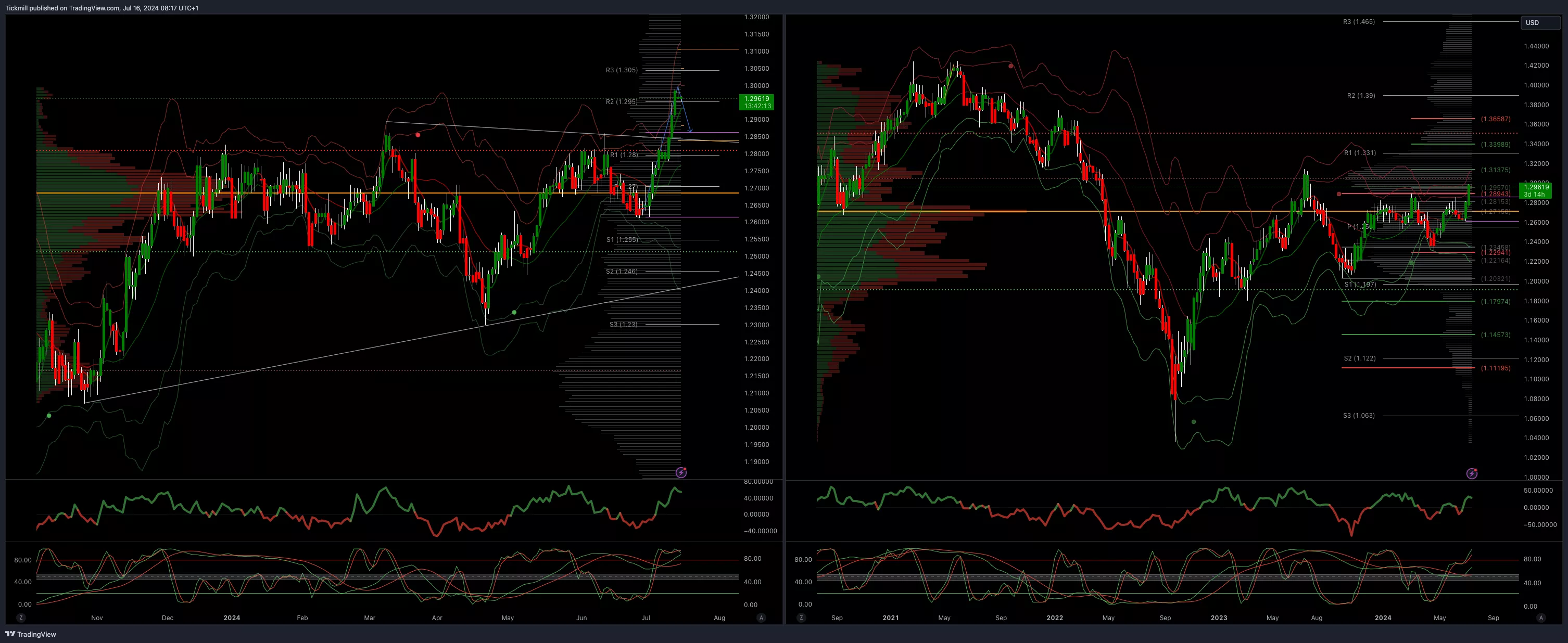

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.28

GBPUSD Bullish Above Bearish Below 1.28

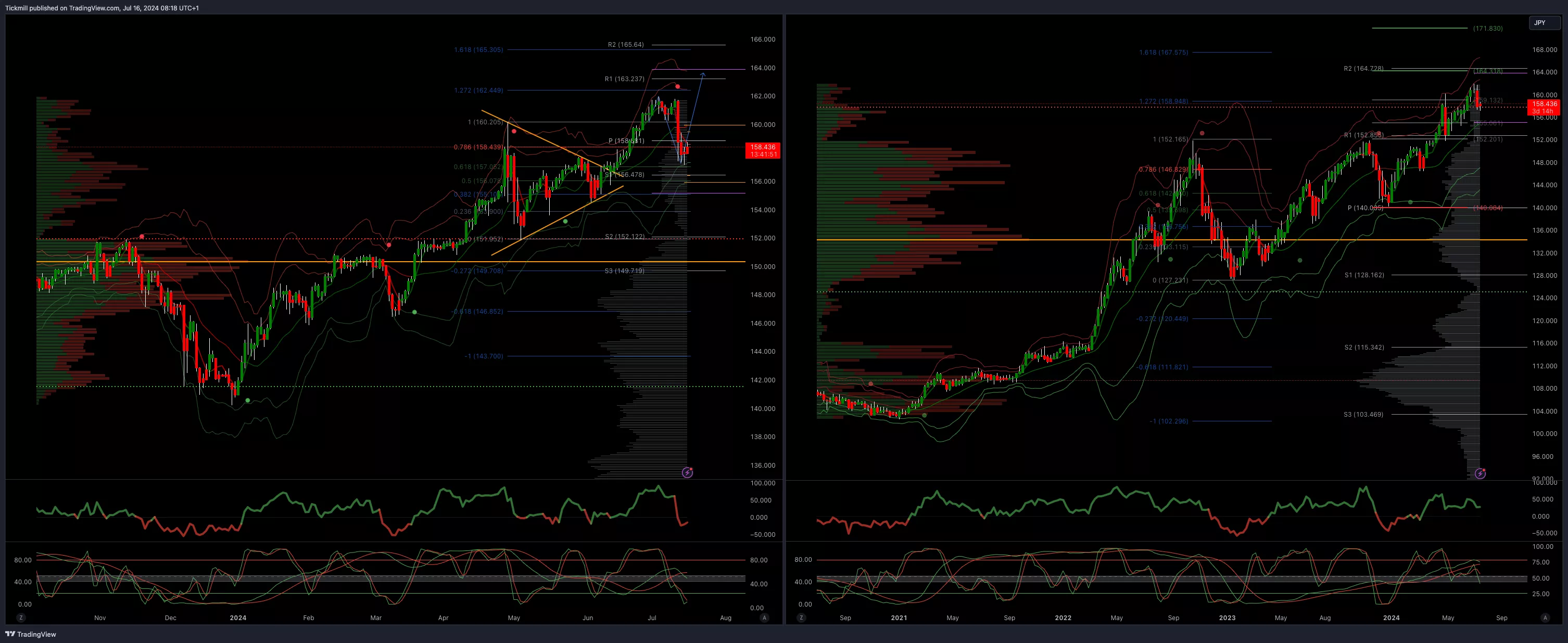

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 160

USDJPY Bullish Above Bearish Below 160

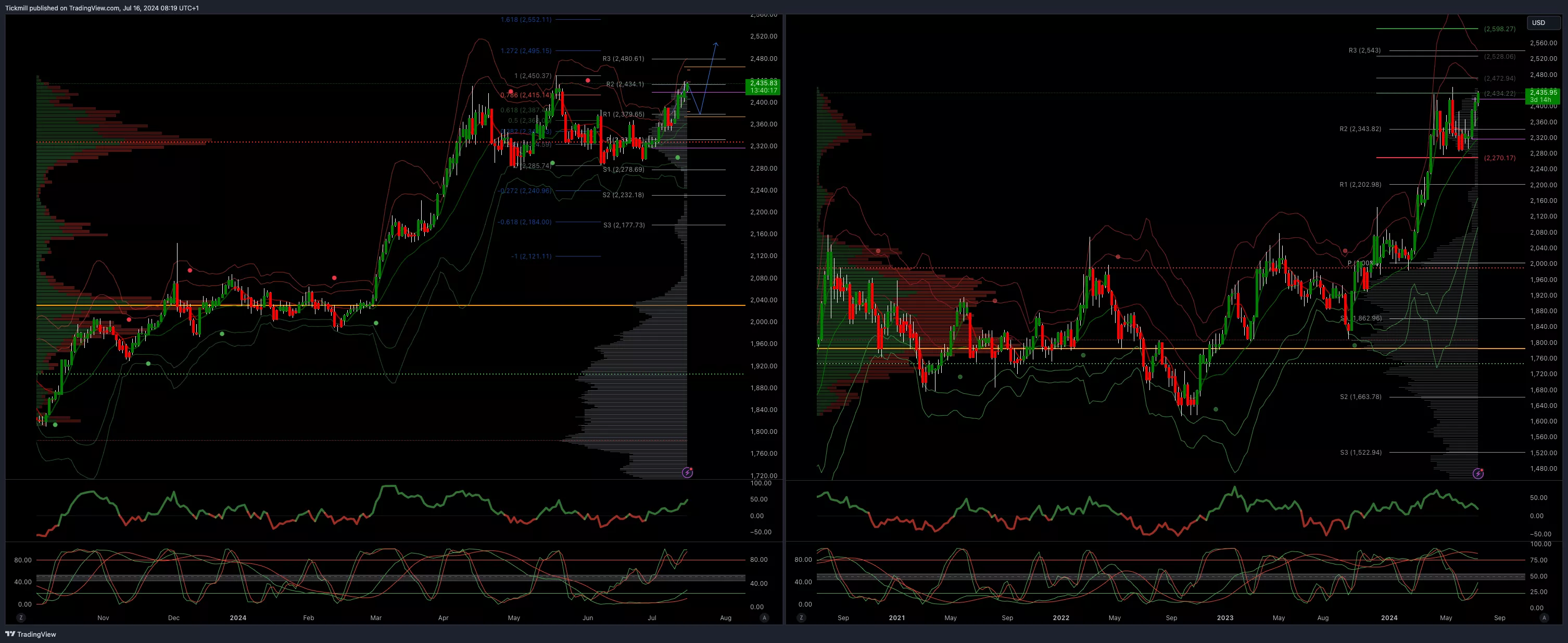

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2345

XAUUSD Bullish Above Bearish Below 2345

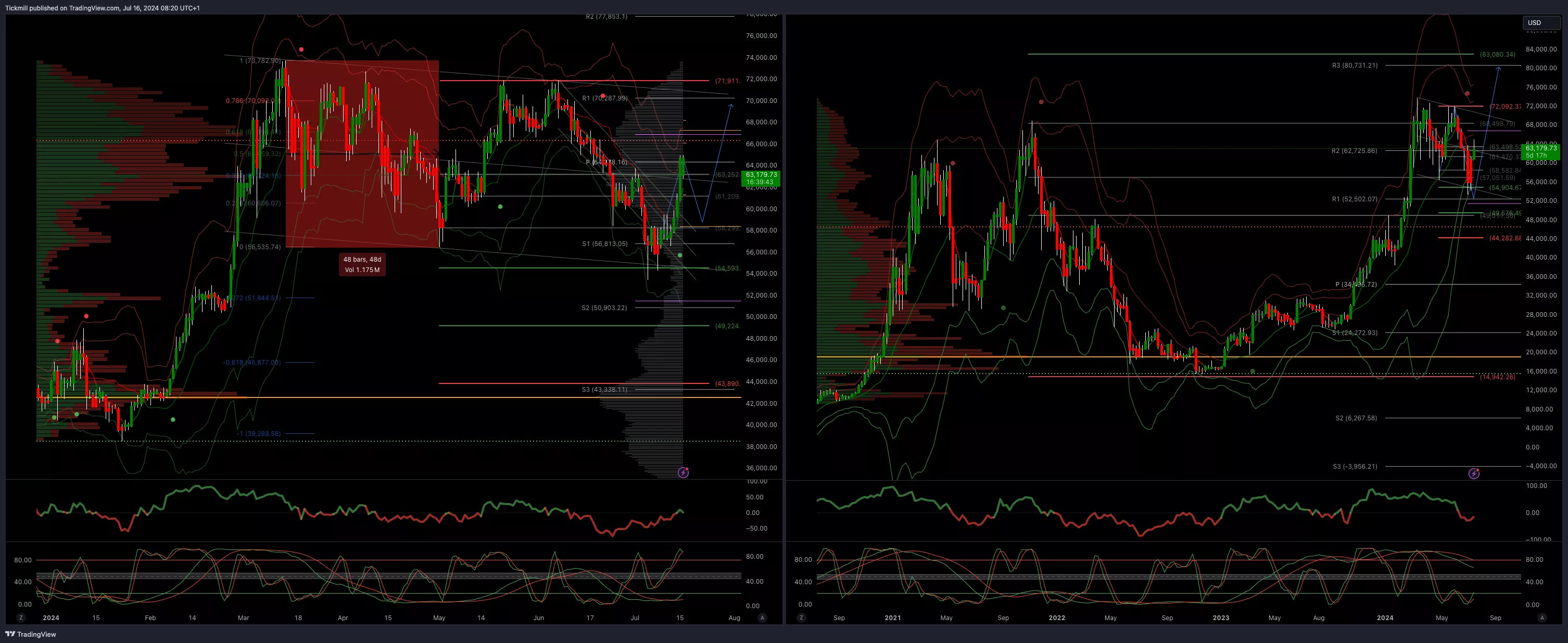

(Click on image to enlarge) BTCUSD Bullish Above Bearish below 60000

BTCUSD Bullish Above Bearish below 60000

(Click on image to enlarge) More By This Author:

More By This Author: