Image Source:

Image Source:

Asian stocks were lackluster on Thursday, and the dollar was under pressure after U.S. data indicated that the progress in curbing inflation had stagnated, despite the economy showing resilience. This has created uncertainty regarding the Federal Reserve’s potential actions in the coming year. With the U.S. Thanksgiving holiday expected to result in thin trading for the remainder of the week, traders were cautious about making significant moves. China’s stock market lagged behind the rest of the region as traders anticipated potential additional stimulus from Beijing ahead of an important economic summit next month. Stock indices in Hong Kong and mainland China fell. Japanese semiconductor stocks gained after reports indicated that the United States might consider easing restrictions on chip equipment and AI memory semiconductor sales to China The Central Economic Work Conference in China, typically held in December, outlines the monetary, fiscal, and industrial policies for the upcoming year. The possibility of sanctions has underscored the already fragile trade relations between the United States and China. Following the recent strength of the dollar and rising concerns over trade tensions, Asian markets are set for their first consecutive monthly declines this year. Despite the looming threat of U.S. tariffs, investors will be preoccupied with concerns regarding the economic and political stability of key European nations, including Germany’s inflation figures and France’s budget woes. French stocks will be the subject of attention following the country’s primary stock index’s descent to its lowest level since early August as a result of budget disputes that have the potential to undermine the effectiveness of the new government. French bonds also experienced a substantial decline, which resulted in the government’s long-term borrowing costs reaching their greatest level since the eurozone debt crisis in 2012. Marine Le Pen, the far-right leader, has threatened to depose France’s coalition government through a no-confidence motion due to her disagreements with Prime Minister Michel Barnier regarding the proposed budget, which includes tax increases and spending cuts. On the other hand, the recent collapse of the ruling coalition in Germany has paved the way for snap elections in February. The preliminary inflation data for November is being intently monitored. In October, consumer prices increased by 2.4% year over year, which is consistent with the data adjusted for comparison with other EU nations. Therefore, inflation is expected to remain elevated at 2.6%. A survey released on Wednesday suggested that Germany’s economy may face additional obstacles in December, as consumer sentiment is anticipated to decrease. In response to reports of job losses, households are expected to become more pessimistic. In 2024, the German government anticipates a 0.2% economic contraction, which would confirm Germany’s status as a laggard among its larger eurozone counterparts and signal the second consecutive year of decline. Because of the political and economic instability in these two main economies, investors may continue to shun the core of Europe instead favouring the periphery of Greece and Spain. The ever-present concerns regarding the lack of a unifed debt market for the single currency maintain fragility in the region.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/11/24

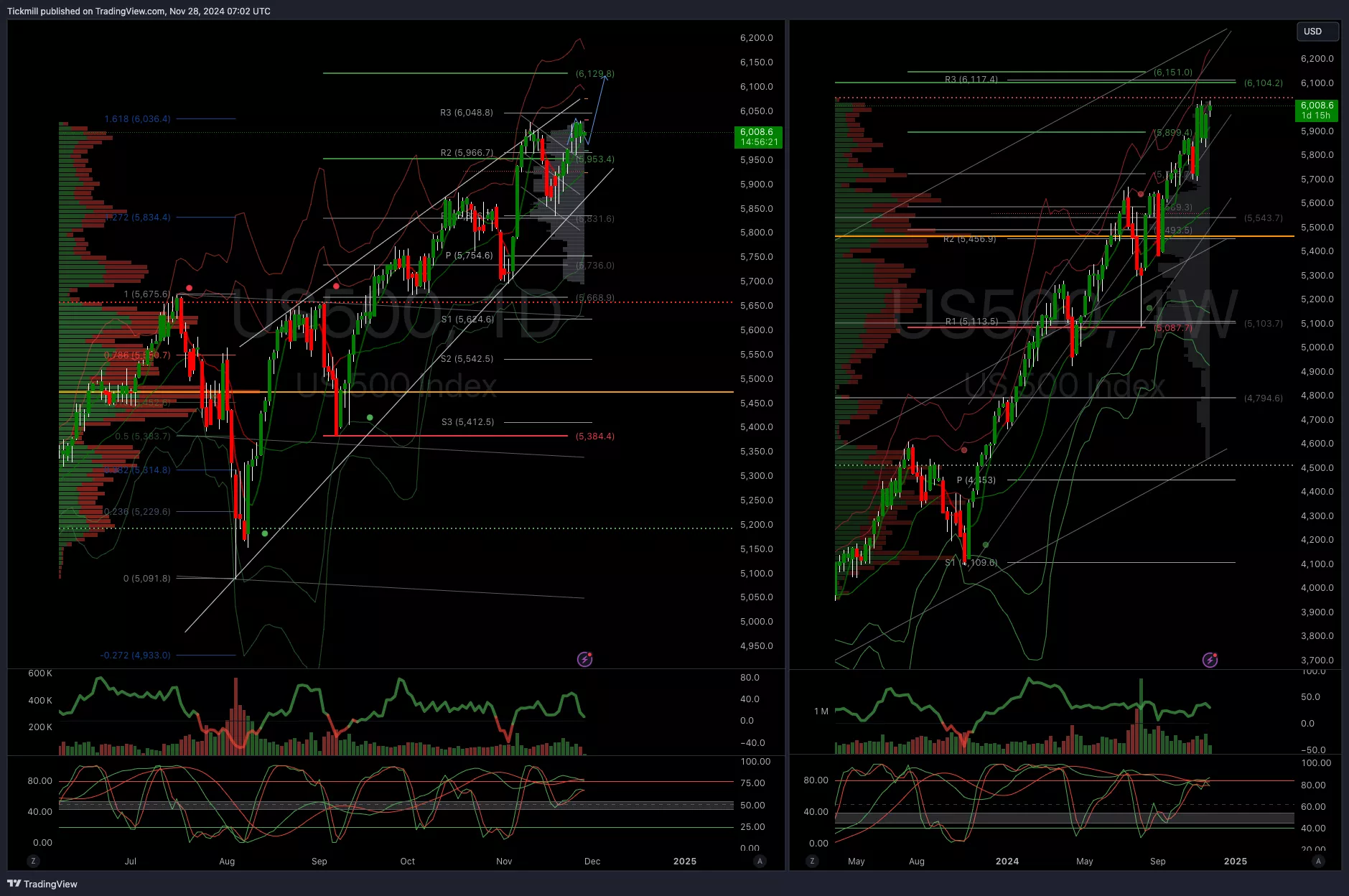

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5990

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.05

EURUSD Bullish Above Bearish Below 1.05

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

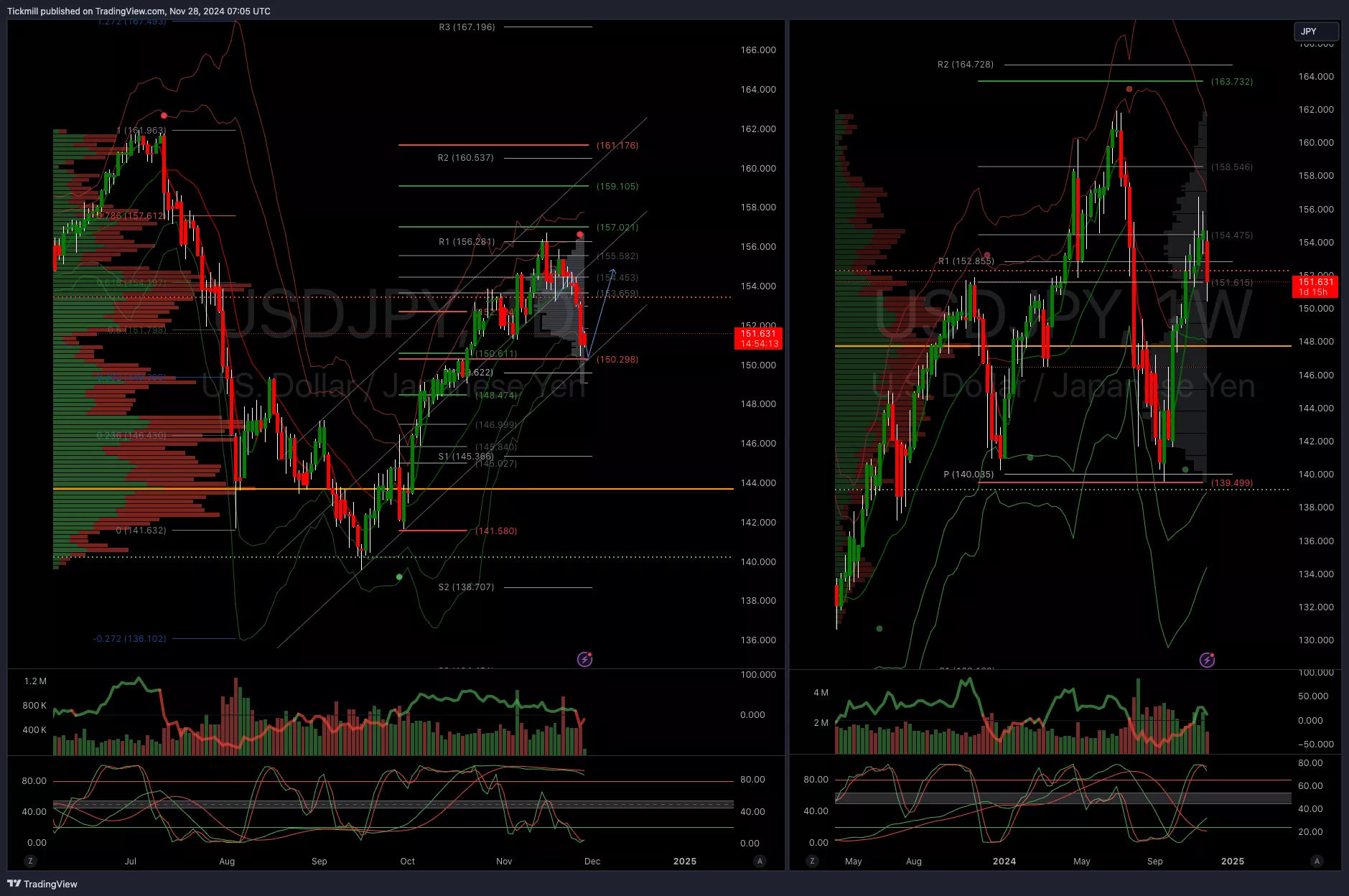

(Click on image to enlarge).webp) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

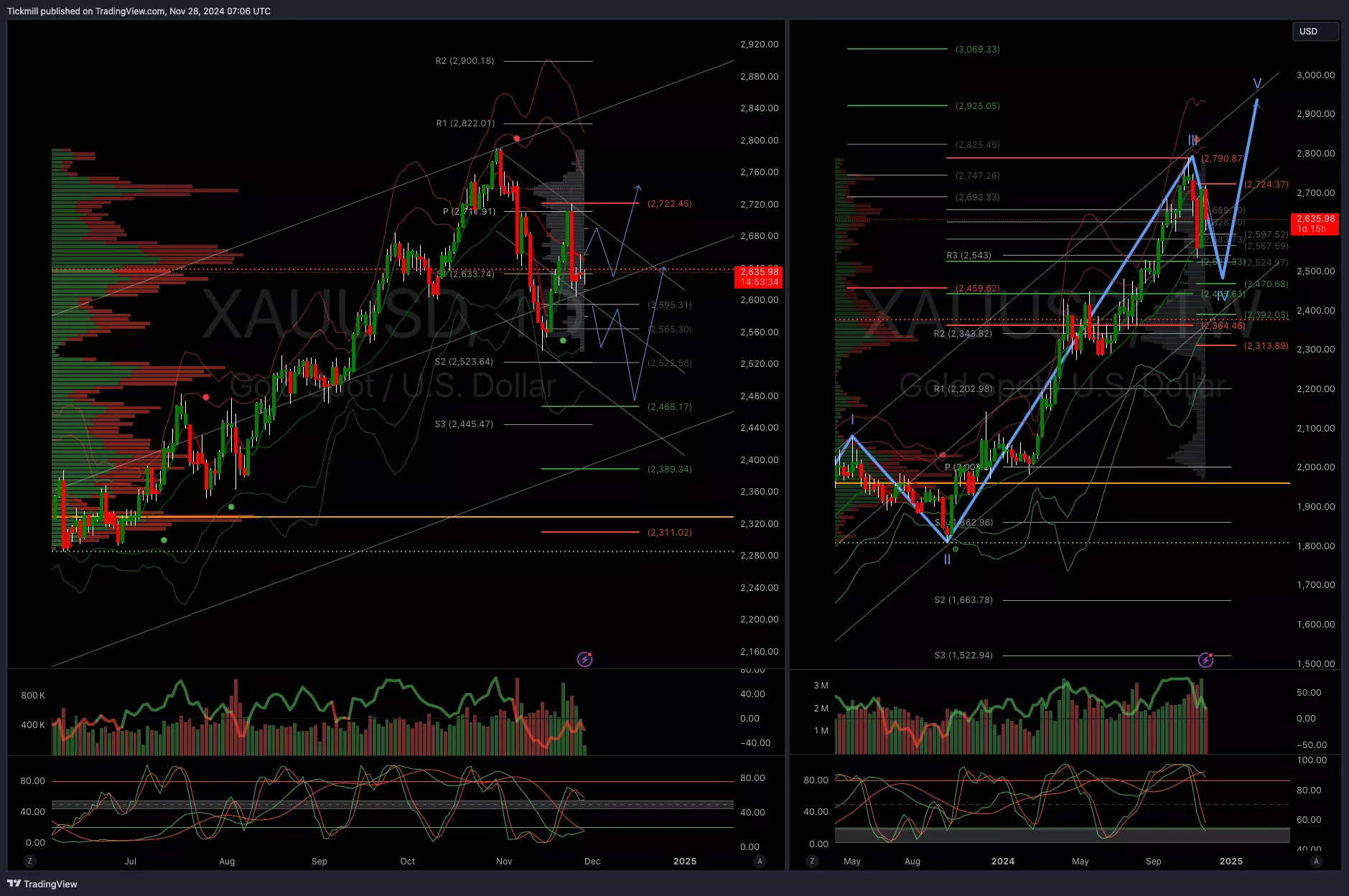

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

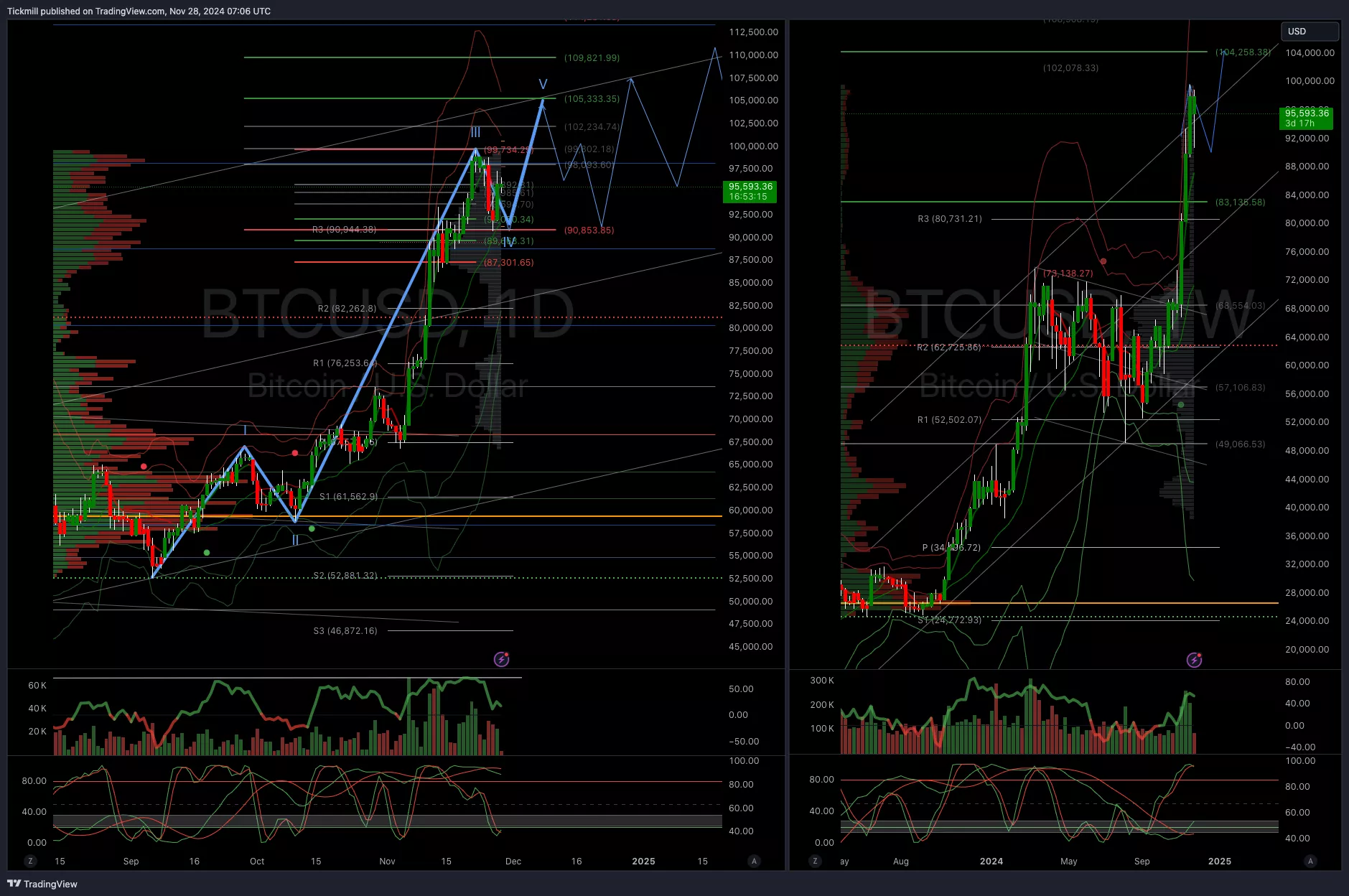

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 92000

BTCUSD Bullish Above Bearish Below 92000

More By This Author:

More By This Author: