Image Source:

Image Source:

Markets continue to express caution, with participants reluctant to take on significant risk. Asian markets are trading with a mix of gains and losses on Thursday, mirroring the mixed performance on Wall Street overnight. Traders are also keeping a close eye on the growing tensions between Russia and Ukraine, with wires reporting that Russia launched an intercontinental ballistic missile attack against Ukraine, targeting the city of Dnipro, early Thursday. The cautious market sentiment has also been influenced by the People’s Bank of China’s decision to maintain interest rates at their current level and the uncertainty surrounding the US Federal Reserve’s future interest rate moves. The Japanese market is trading lower on Thursday, continuing the losses from the previous session. The Nikkei 225 is below the 38,100 level, with advances in banking firms offsetting declines in technology and index heavyweights.Investors are also cautious due to the possibility of slower sales growth at AI powerhouse Nvidia. As investors process Nvidia’s forecast of its slowest sales increase in seven quarters, the figures disappointed investors used to the AI darling surpassing all projections. Given Nvidia’s pivotal role in the AI environment, which has fuelled the majority of the market gains in recent months, the forecast is expected to have an impact on suppliers as well as the larger markets. With the dollar index lingering around a one-year high reached last week, the dollar continues to lead the currency markets. Since Donald Trump’s resounding victory earlier this month, the dollar has been rising as investors anticipate that his proposed tariffs will cause inflation and keep U.S. interest rates higher for an extended period of time. Bitcoin, which has increased by almost 40% in the two weeks since the election, is still the market outlier, as investors anticipate that the Trump administration will enact more lenient rules for the cryptocurrency industry. During Asian hours, the largest cryptocurrency reached a record high of $97,798 with $100,000 the principal near-term objective. For the day ahead, the macro slate is once again scant; events to monitor include the US Jobless Claims, Philly Fed Index, US Existing Home Sales, speeches by the Fed, SNB, ECB, RBA Governor, and BoE’s Mann.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 15/11/24

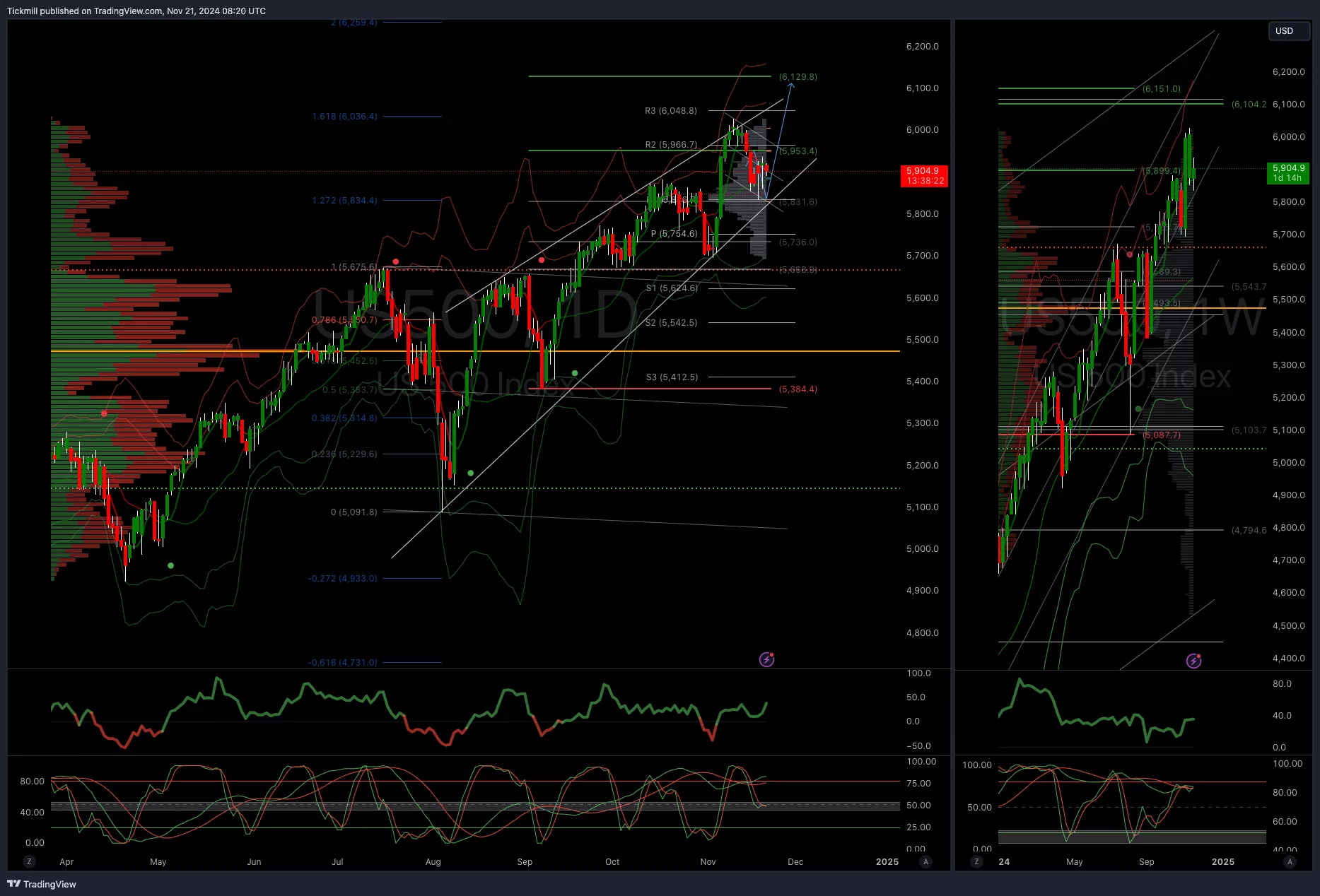

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0650

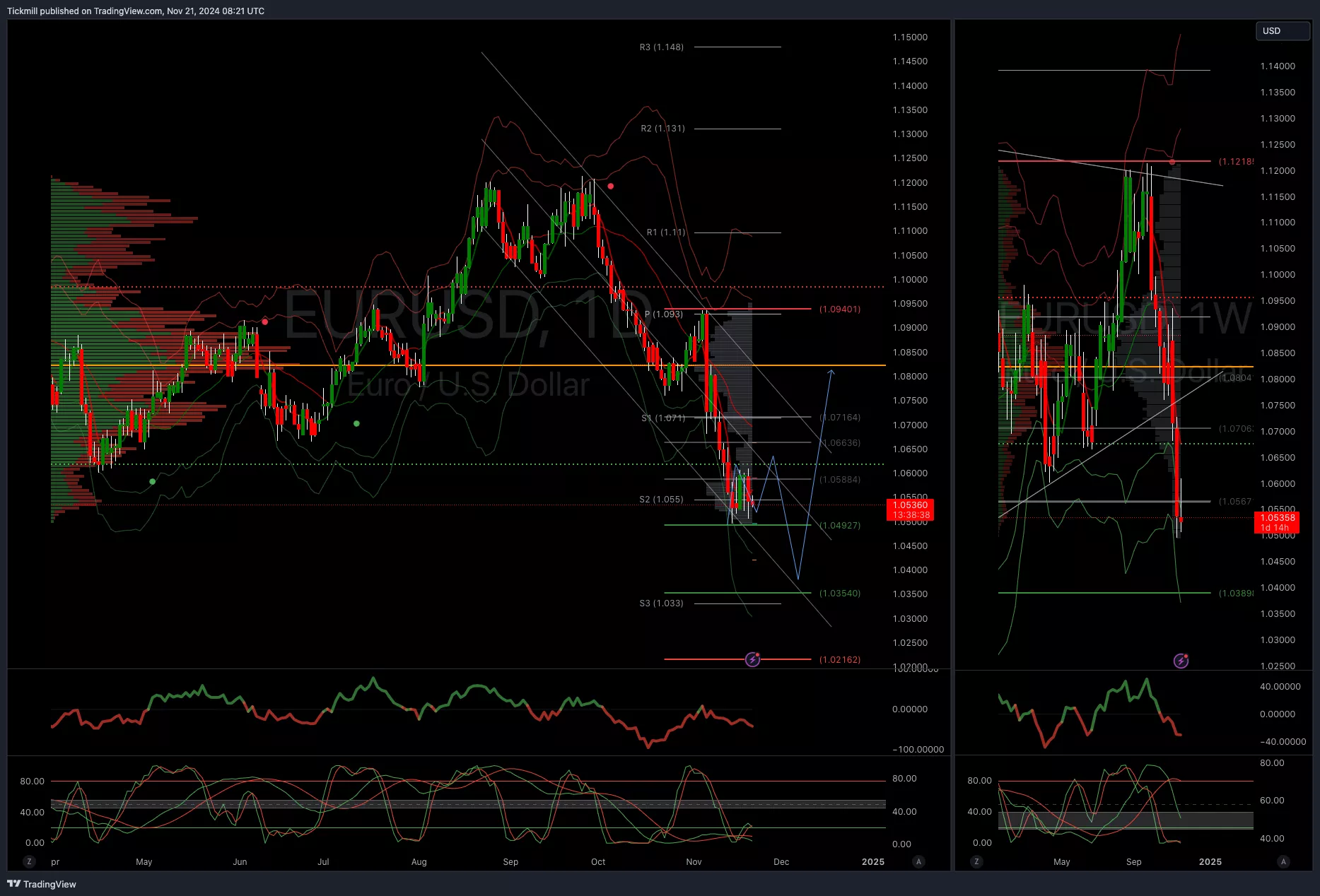

EURUSD Bullish Above Bearish Below 1.0650

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

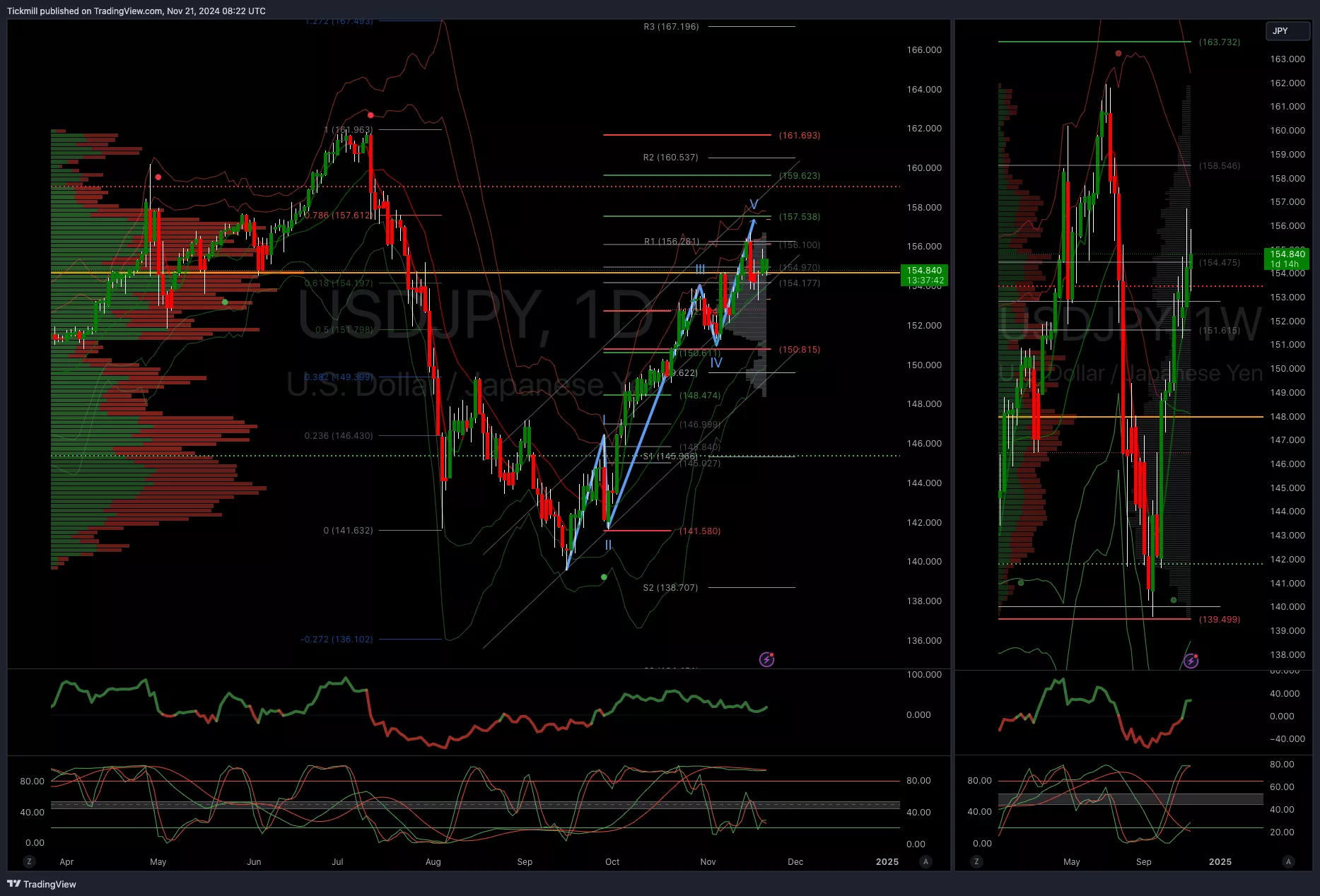

USDJPY Bullish Above Bearish Below 154

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

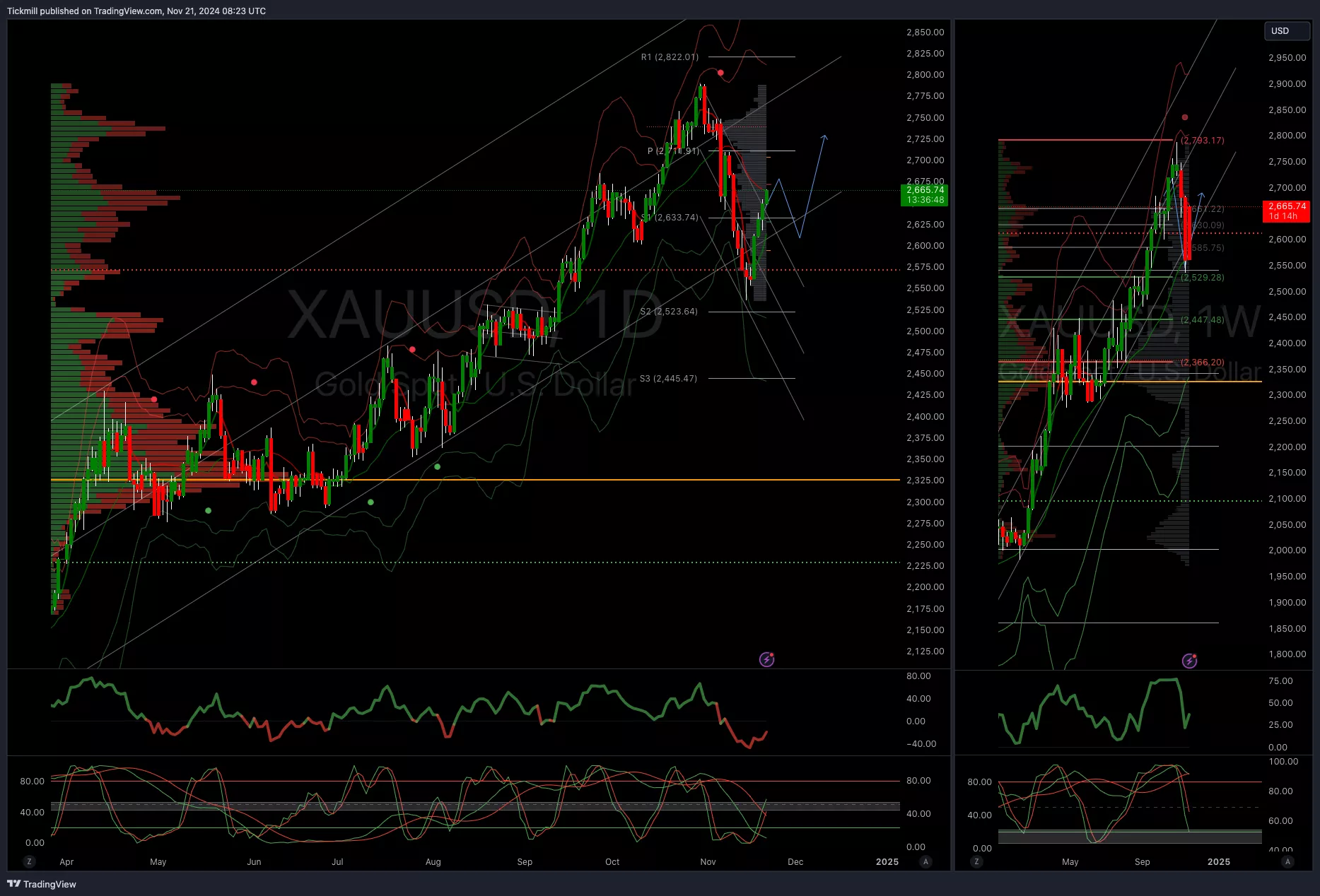

XAUUSD Bullish Above Bearish Below 2600

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 93000

BTCUSD Bullish Above Bearish Below 93000

(Click on image to enlarge).webp) More By This Author:

More By This Author: