Asian stock markets are trading with mixed results on Monday, following the generally positive performance on Wall Street on Friday, as traders have reduced their expectations for US Federal Reserve interest rate cuts this year in response to the largely upbeat set of US economic data released last week. A series of Chinese economic data released last week has reinforced calls for more stimulus measures to support the Chinese economy. Ongoing concerns about geopolitical tensions continue to weigh on the markets. Last week, US retail sales increased slightly more than anticipated in September, and jobless claims unexpectedly declined, while industrial production decreased in September, reversing the growth seen in August.The focus on China’s stimulus program continues to overshadow data flow, but the picture these releases paint is still very real and will impact the efficacy of Beijing’s belated push. GDP data was never expected to track at the official 5% growth target in Q3, but the +4.8% ytd reported in the release (and 4.6% y/y) shows what needs to be done in the final three months of the year to hit that level. Most will come from investment rather than consumption, which ought to be a mix of efforts to complete unfinished property projects (Sep real estate investment -10.1% y/y) while continuing to pump capacity (Sep manufacturing investment +9.2% y/y). But while that might meet the immediately prescribed target, it will do little to address the root causes of slowing growth and weak confidence. While we might see an uptick in retail too, consumers are unlikely to view government solutions centered around borrowing as completely reassuring. House price declines remain rapid and reductions to mortgage rates are unlikely to move that dial. The propensity to save will stay high and increasing domestic capacity will remain a deflationary force. At the same time, the export model remains vulnerable to increasing trade and geopolitical hostilities. Ideology needs to change to reshape macro direction, liquidity Kool-aid won’t.The relatively quiet U.S. data schedule is led by S&P Global flash PMIs, existing and new home sales, durable goods, the Federal Reserve’s Beige Book, weekly jobless claims, and University of Michigan sentiment. The BoC is expected to lower its policy rate from 4.25% on Wednesday, with 19 of 29 economists in a Reuters poll expecting a chunky 50 basis-point cut. Japan has a low-key week for event risk, with flash PMIs, Tokyo October CPI and services PPI the main releases, ahead of the general election on Sunday. European Central Bank President Christine Lagarde will discuss Europe’s economic outlook on Wednesday. The UK has flash PMIs on Thursday, while Bank of England Governor Andrew Bailey has three speaking engagements in the U.S.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)As the US elections draw near, the financial markets are bracing for potential volatility, presenting both opportunities and challenges for traders. To help navigate this crucial period, we have launched the a comprehensive resource tailored to meet the needs of traders at every level.

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 18/10/24

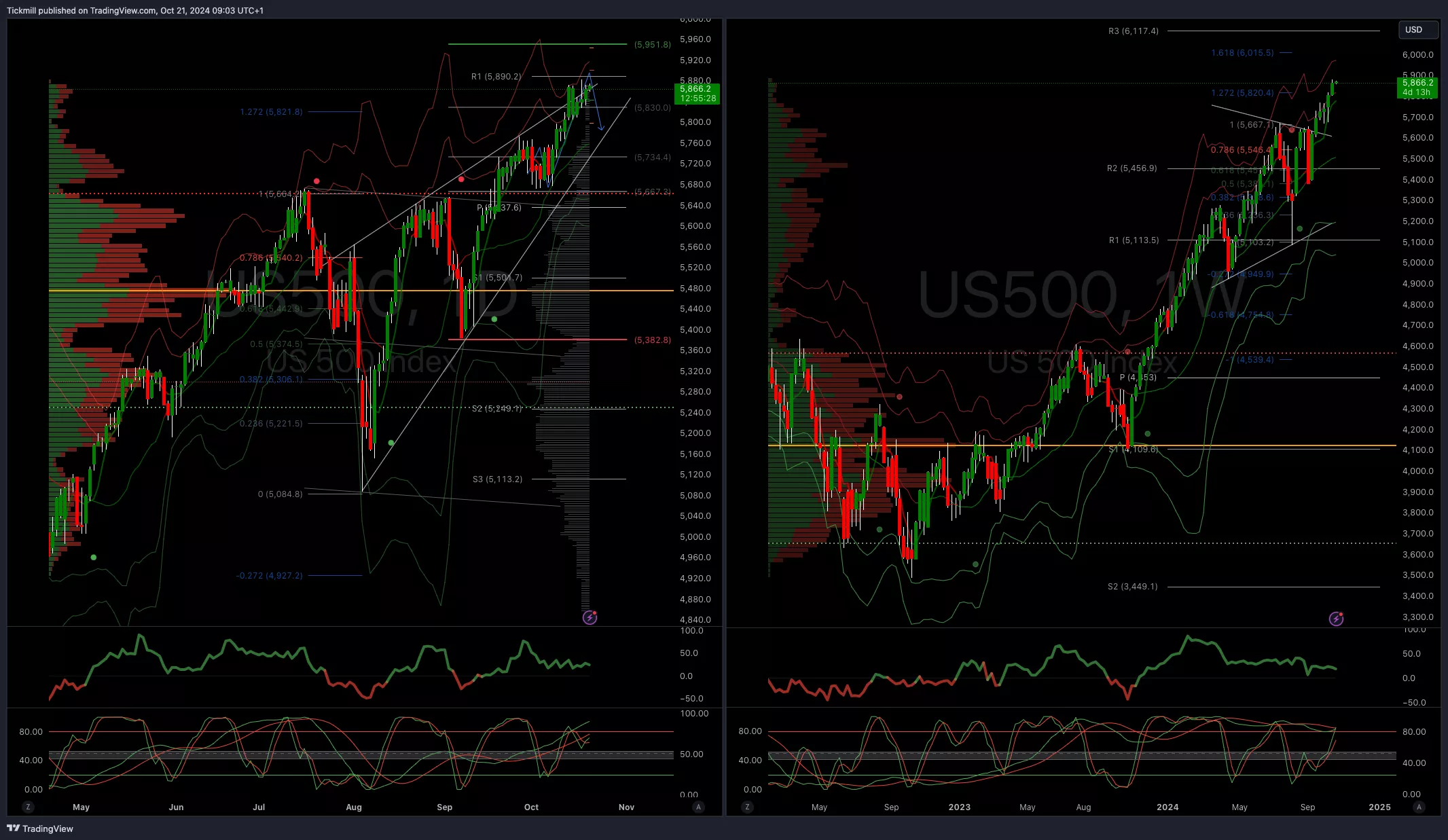

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5750

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.11

EURUSD Bullish Above Bearish Below 1.11

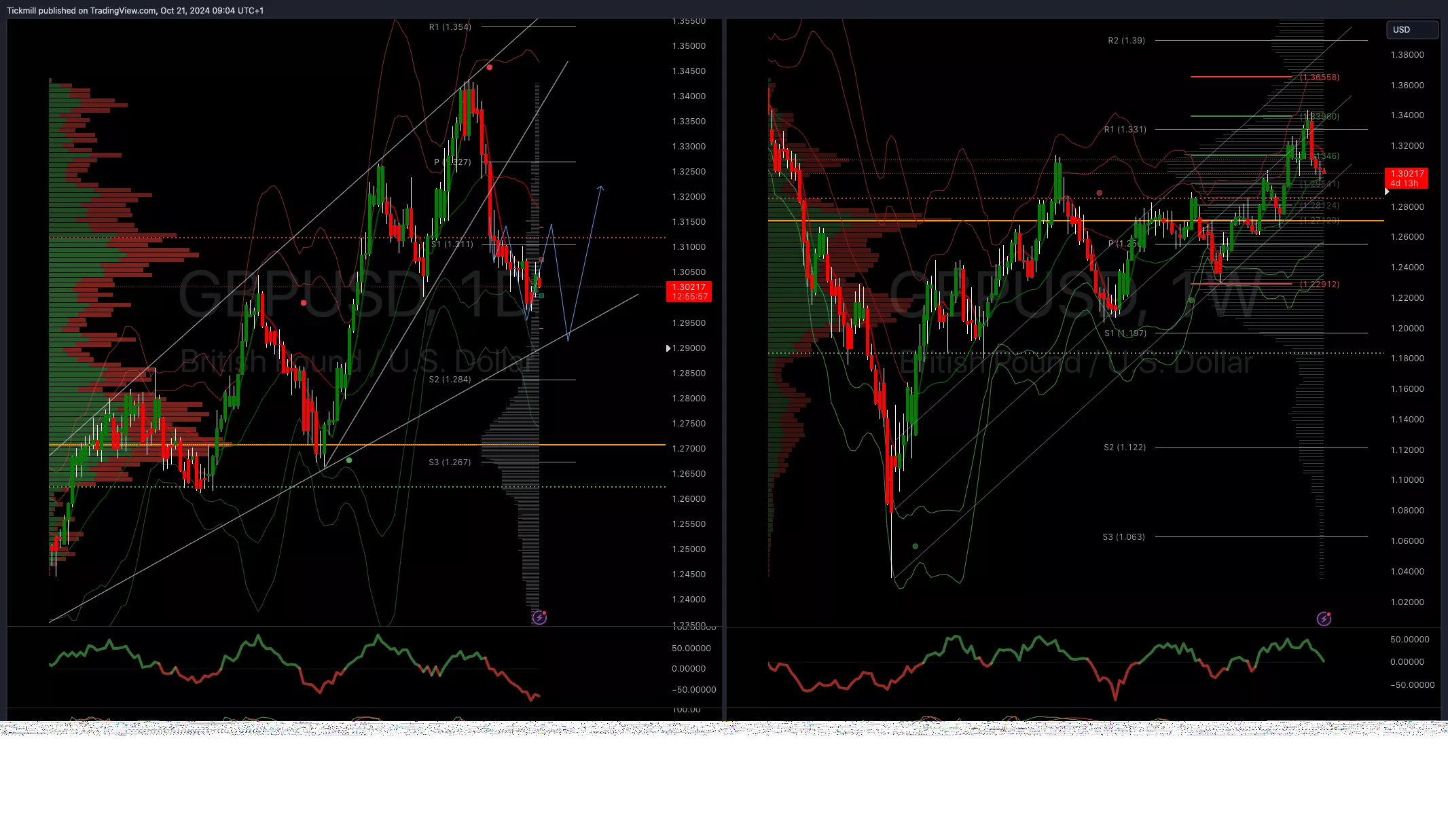

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.32

GBPUSD Bullish Above Bearish Below 1.32

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 144

USDJPY Bullish Above Bearish Below 144

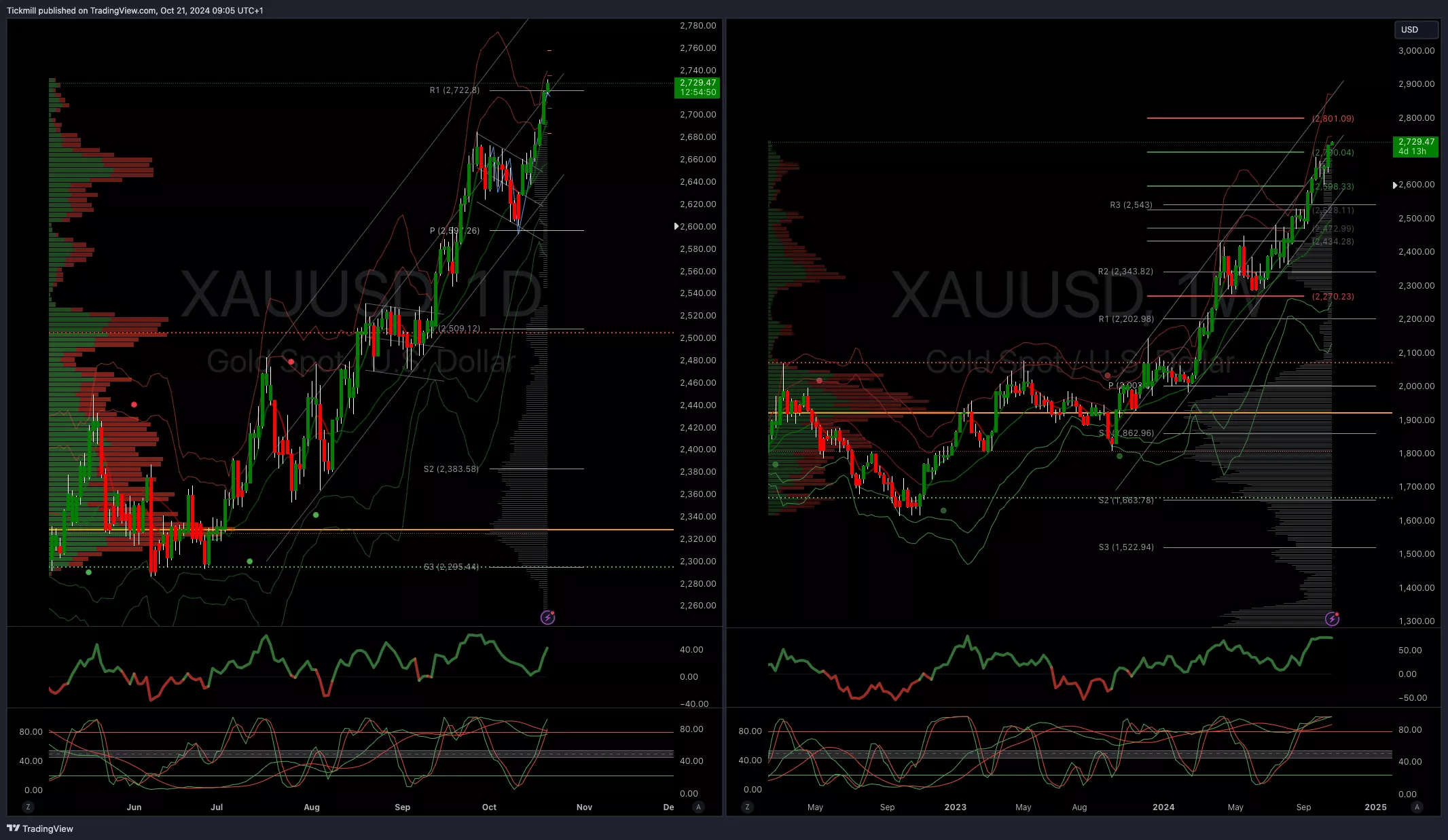

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2645

XAUUSD Bullish Above Bearish Below 2645

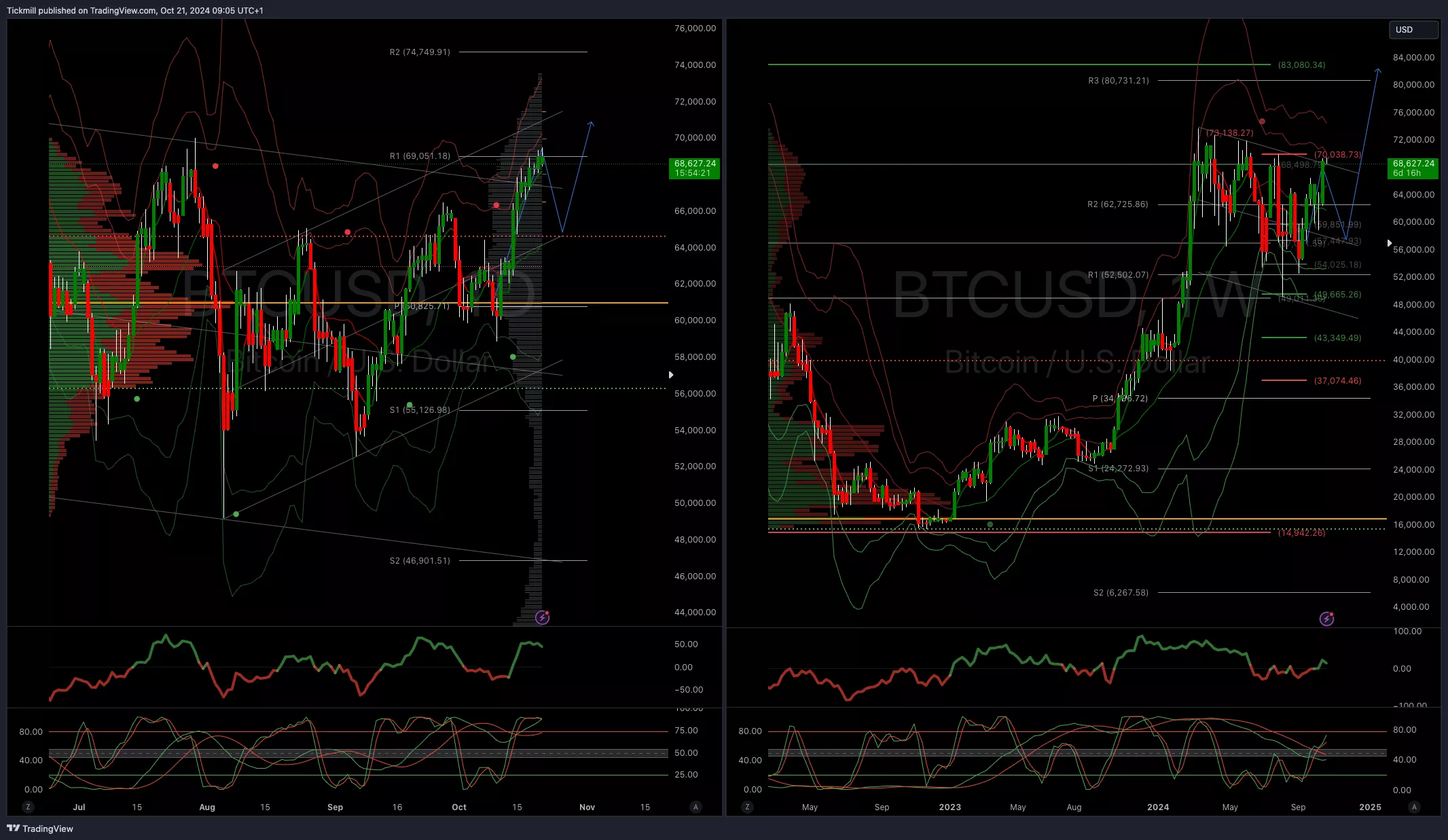

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 57000

BTCUSD Bullish Above Bearish Below 57000

(Click on image to enlarge) More By This Author:

More By This Author: