Image Source:

Image Source:

The rebound in sentiment from Wall Street on Friday has helped Asian stock markets trade mostly higher on Monday. However, traders are still cautious because of the ongoing geopolitical tensions in the Middle East, the uncertainty surrounding the outcome of the US election, and the impending monetary policy announcement from the US Federal Reserve. Along with the Federal Reserve, the Bank of England (BoE), the Reserve Bank of Australia (RBA), Riksbank, and Norges Bank will all make rate decisions this week, giving investors global monetary policy catalysts. The Federal Reserve is expected to cut interest rates on Thursday regardless of the election result, with further cuts anticipated in December, though this may change depending on the president-elect. The Bank of England and Riksbank are also expected to cut rates, while other central banks are likely to hold steady. Oil prices have risen after OPEC+ delayed a planned production increase, indicating concerns about global demand. The standing committee of China’s National People’s Congress (NPC) will meet from November 4 to November 8, and it will be eagerly monitored for more information on a number of previously announced stimulus measures. Asia’s trading was thinner on Monday since Japan was on vacation.The euro and the yen nudged up against the dollar. A poll that showed Democratic candidate Kamala Harris with an unexpected 3-point lead in Iowa, primarily because of her appeal with female voters, may have contributed to the dollar’s decline. Prior to the election, Harris and Republican nominee Donald Trump were still essentially tied in opinion polls, and the outcome may not be known for days after the votes close. With the Democrats catching up, the likelihood of a Republican sweep has dropped considerably. The outcome of the vote may not be known immediately, and there could be legal challenges that prolong the process. European investors will have to stay up late on Tuesday night to see the first results since polls in Kentucky and Indiana close at 10pm GMT. Different news sites say that the final answer will be given anywhere from as soon as London gets to work on Wednesday to days or weeks from now. Given how close the polls were, the uncertainty about when the final result will come in reflects the larger question about the outcome itself.Ahead of the US Election focus Important things that might affect markets on Monday ECB Board Member Piero Cipollone and ECB President Christine Lagarde attended the Eurogroup meeting. ECB members Claudia Buch, Christodoulos Patsalides, Frank Elderson, and Elizabeth McCaul’s appearances U.S. durable goods and factory orders data for September; final Eurozone manufacturing PMIs for October.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 1/11/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5775

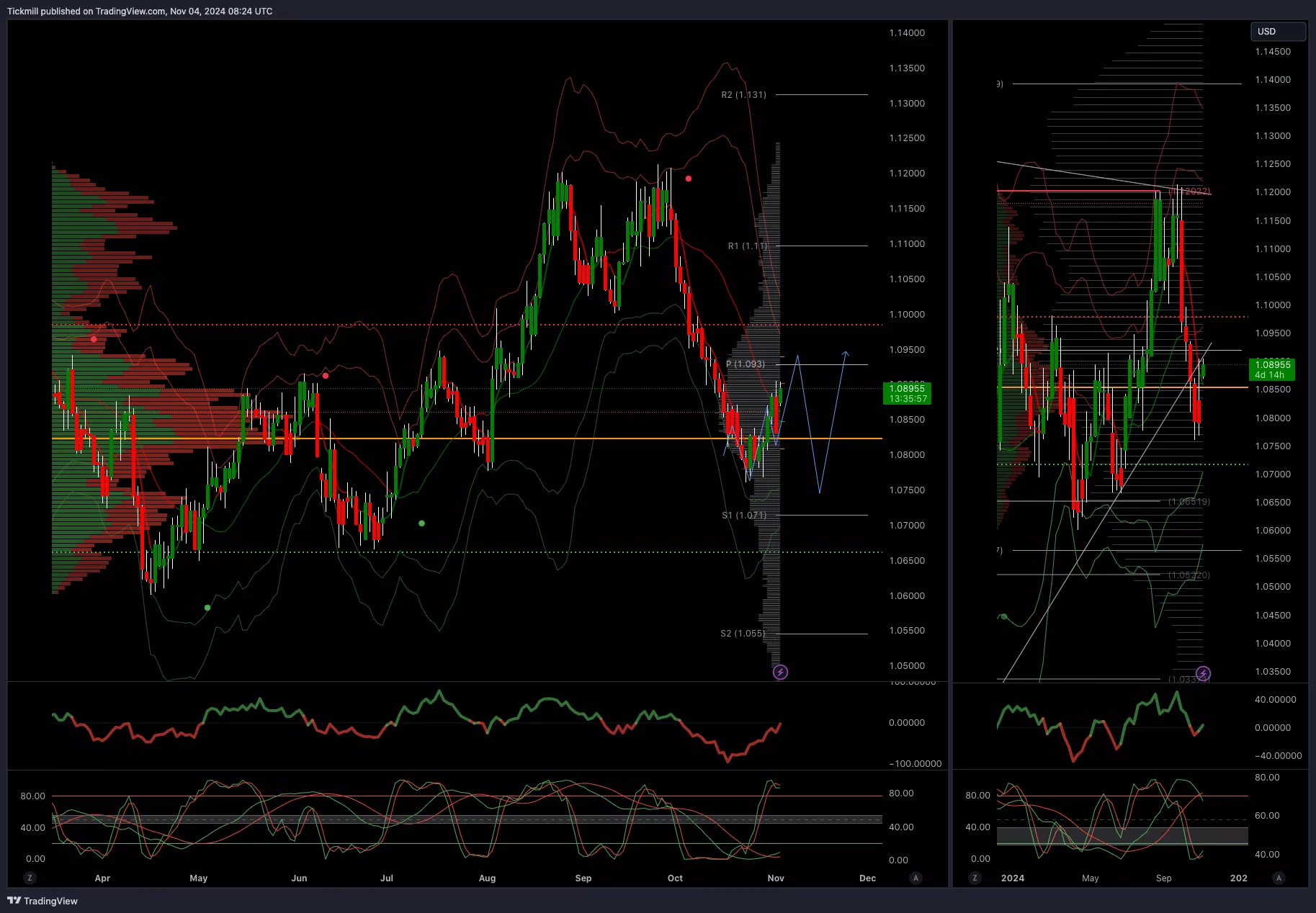

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.09

EURUSD Bullish Above Bearish Below 1.09

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.3050

GBPUSD Bullish Above Bearish Below 1.3050

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 148

USDJPY Bullish Above Bearish Below 148

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2680

XAUUSD Bullish Above Bearish Below 2680

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 69500

BTCUSD Bullish Above Bearish Below 69500

(Click on image to enlarge) More By This Author:

More By This Author: