Image Source:

Image Source:

As the week comes to an end, yields are thankfully lower, relieving some of the tension that has been plaguing stocks and enabling the battered yen and euro to restore some stability in relation to the dollar. However, with risk events swirling over the horizon next week—including mega-cap results from five of the “Magnificent 7”; a highly crucial U.S. payrolls data on Friday; and the final lap leading up to a potential photo-finish U.S. presidential election on November 5—this relative quiet feels like the eye of the storm. Despite polls showing a close race, the “Trump trade” has gained traction as the odds of Donald Trump winning a second term as president have increased significantly on several betting sites. As a result of Trump’s platform of higher tariffs and taxes, which many in the market view as inflationary, the dollar is expected to gain for a fourth week and Treasury rates are expected to rise for a sixth week. Bets on Fed easing have quickly decreased in response to a wave of strong U.S. economic data, which is also helping to boost the currency and rates. Although stocks are taking a brief break to end the week, a recovery is still a long way off. The majority of Wall Street’s modest overnight gains were driven by optimism over Tesla’s earnings, and the Dow actually declined. Now, investors are anticipating Alphabet, Amazon, Apple, Meta, and Microsoft’s three-day profits from Tuesday.Amid a currency recovery and concerns over a general election on Sunday that would deny the coalition government its lower house majority, Asian stocks are mixed, with Japan’s Nikkei falling 0.5%. The MSCI World Equity Index continues to stutter towards a weekly loss of 1.2%, which would end a two-week winning run.October survey data shows a divide between British and European activity, with UK manufacturing and services indices remaining in expansionary territory, while the Eurozone manufacturing sector shrank for the 28th consecutive month. Demand was sufficient for UK businesses to continue to raise output prices, while input costs declined. In contrast, the Eurozone saw a decline in new orders, leading to increased spare capacity and job cuts, with services also under pressure.

Overnight Newswire Updates of Note

Capital One Tops Profit Estimates On Loan Growth

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 18/10/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5750

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0950

EURUSD Bullish Above Bearish Below 1.0950

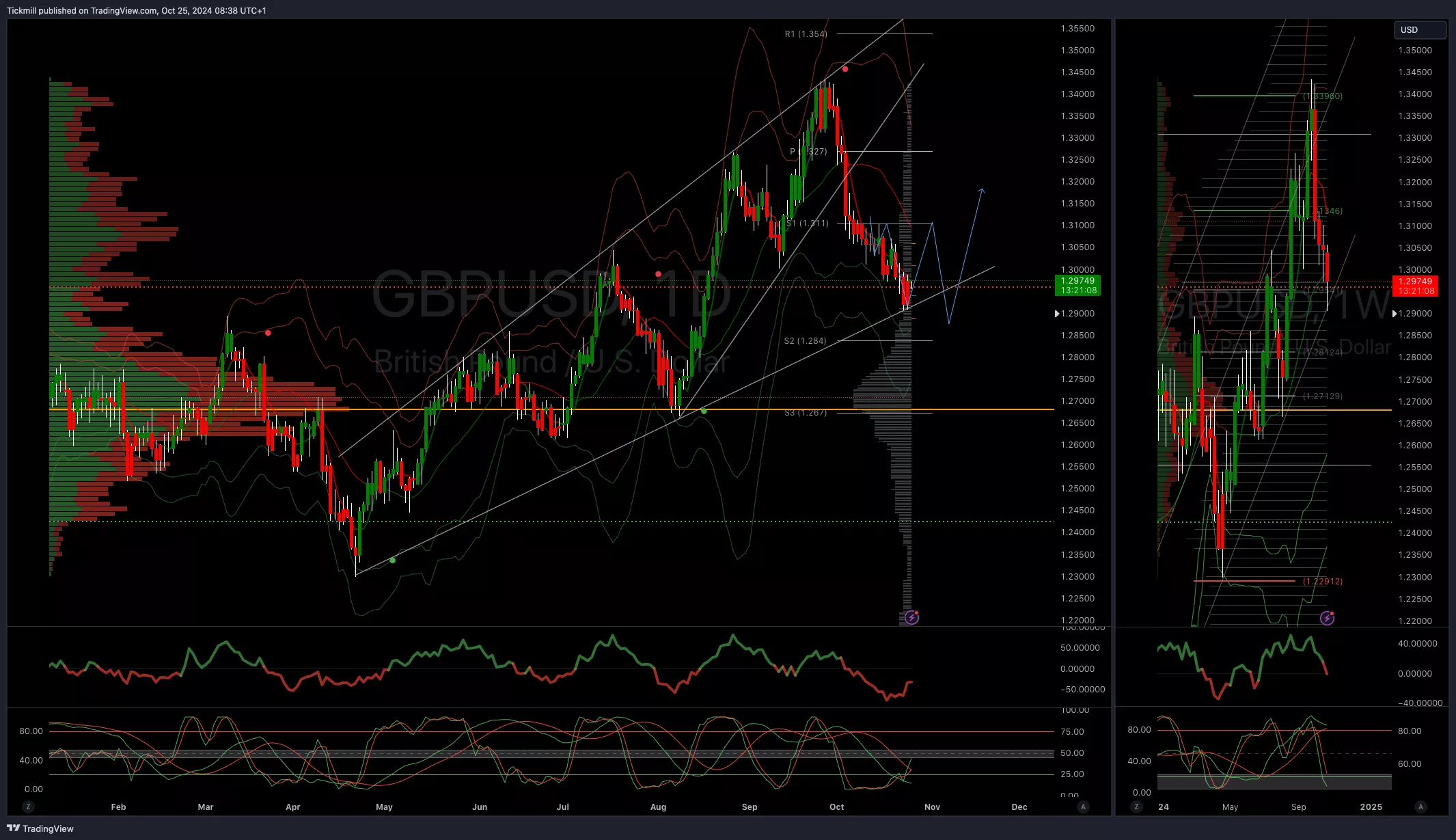

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.31

GBPUSD Bullish Above Bearish Below 1.31

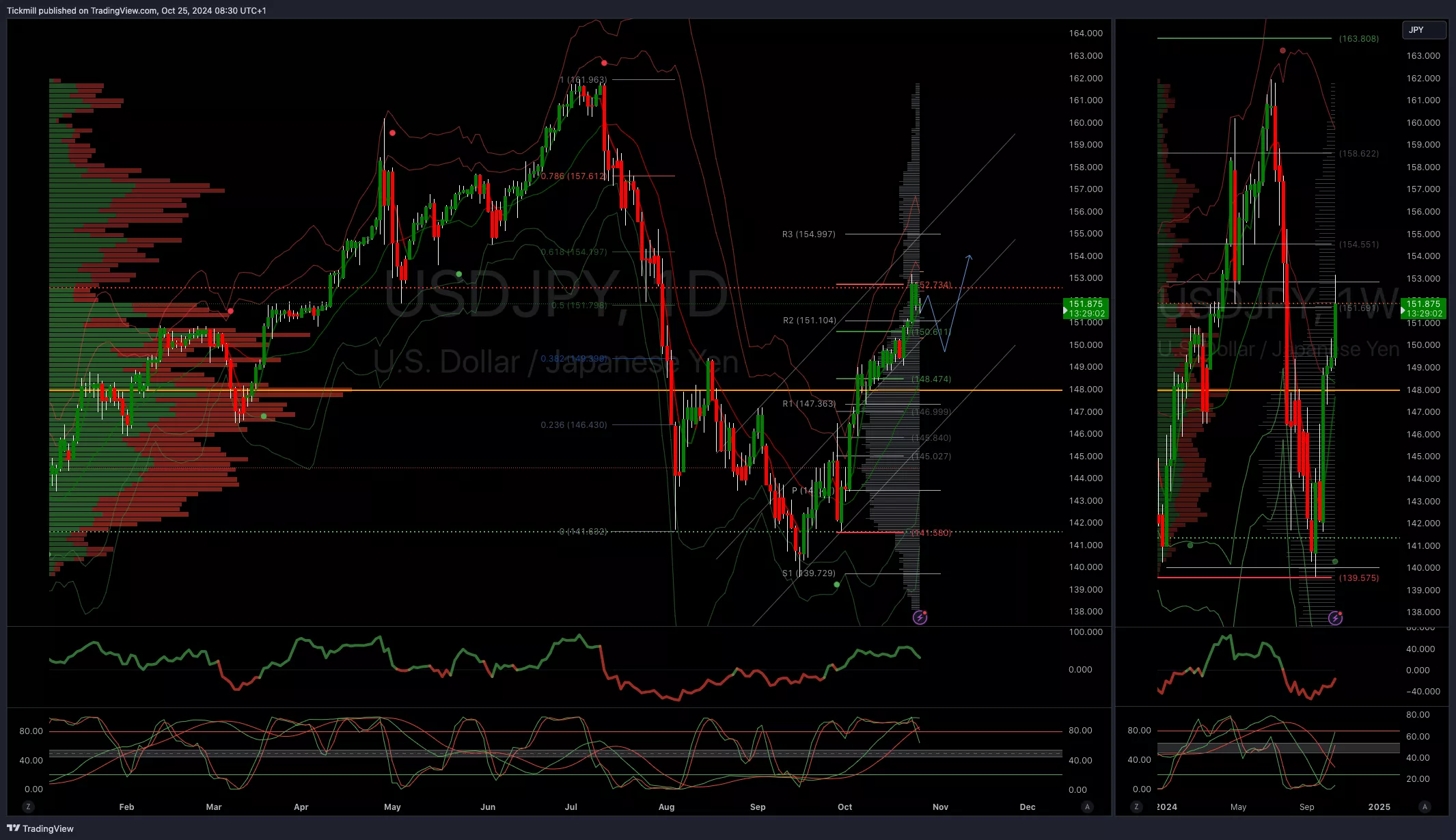

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 148

USDJPY Bullish Above Bearish Below 148

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2680

XAUUSD Bullish Above Bearish Below 2680

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 63000

BTCUSD Bullish Above Bearish Below 63000

(Click on image to enlarge) More By This Author:

More By This Author: