Although a quiet post-Thanksgiving day was anticipated in Asia, investors were prompted to chase the yen, which is poised for its strongest week in four months, by Tokyo’s surprisingly high CPI data. As traders strengthened their bets on a rate hike by the Bank of Japan next month, the yen surged as much as 1.1%, hitting its highest level in six weeks and dropping below the 150-per-dollar line. According to current swaps, there is a 60% chance that the rate will rise by one quarter point to 0.5%, the highest level since 2008. The BOJ has a chance to get closer to normalising rates now that concerns about deflation have mostly been replaced by concerns about a weakening yen. Investors are better ready this time around, despite the fact that the central bank’s previous rate hike created a slight market disturbance. Chinese stocks excelled in Asia, with blue-chip shares rising by 2% before the upcoming release of official surveys regarding the manufacturing and services sectors on Saturday. There is an anticipation that the large factory sector probably continued to grow in November, though at a slow rate.The yuan in China rose slightly on Friday against a weakening dollar, positioning itself for its first weekly increase in two months, which is partly due to Beijing’s efforts to mitigate the currency’s decline amid tariff threats from Donald Trump. However, the yuan is still on track for its largest monthly decline in almost a year and a half, and analysts predict that volatility is likely to remain high with a trade war between the U.S. and China on the horizon under Trump’s administration. While the yuan has shown some stabilisation, aided by the central bank’s daily fixing guidance, “traders continue to be concerned about geopolitical issues and are particularly uneasy about Trump’s policies.The Eurozone inflation data series, which is scheduled for release later today, is the primary risk factor. Headline inflation is anticipated to rise from 2.0% in October to 2.3%, according to economists. Nevertheless, the inflation figures from Germany were unexpectedly low, which suggests that the outlook is skewed to the downside. A 25-basis point rate reduction by the European Central Bank in December has been fully anticipated by traders. A mild inflation report could result in a more substantial 50-basis point cut, which is currently only viewed as a 19% probability. There are increased concerns among investors in French bonds as a result of the uncertainties surrounding the stability of the current government. The far-right National Rally has suggested that the French Prime Minister Michel Barnier’s decision to abandon plans to increase electricity taxes may not be sufficient to avert a no-confidence vote as soon as next week, which could conceivably topple the government. Consequently, the spreads of French bonds have nearly equalled those of Greece, indicating investor apprehension regarding France’s debt problems, which appear to be unresolvable.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/11/24

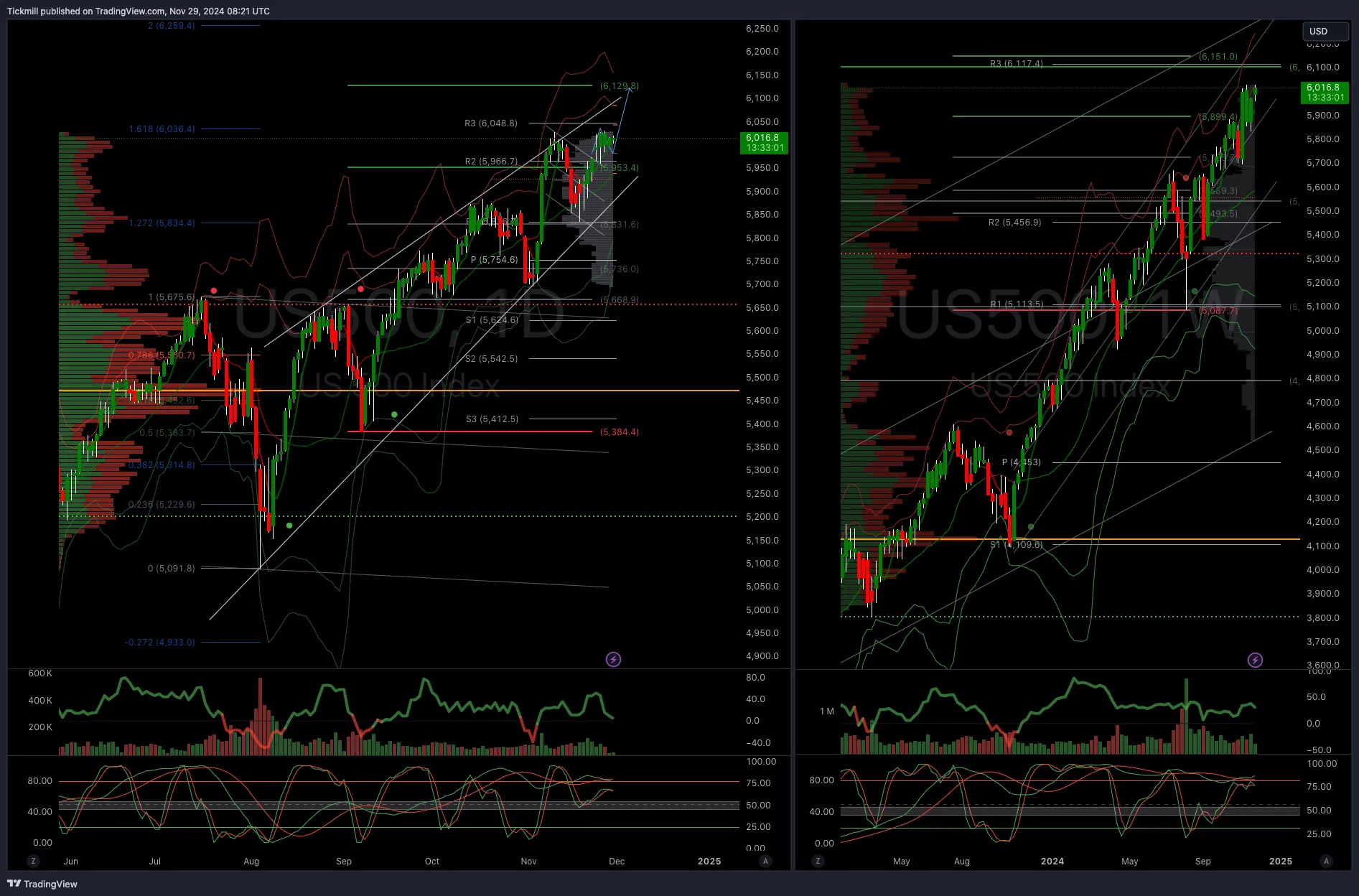

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5990

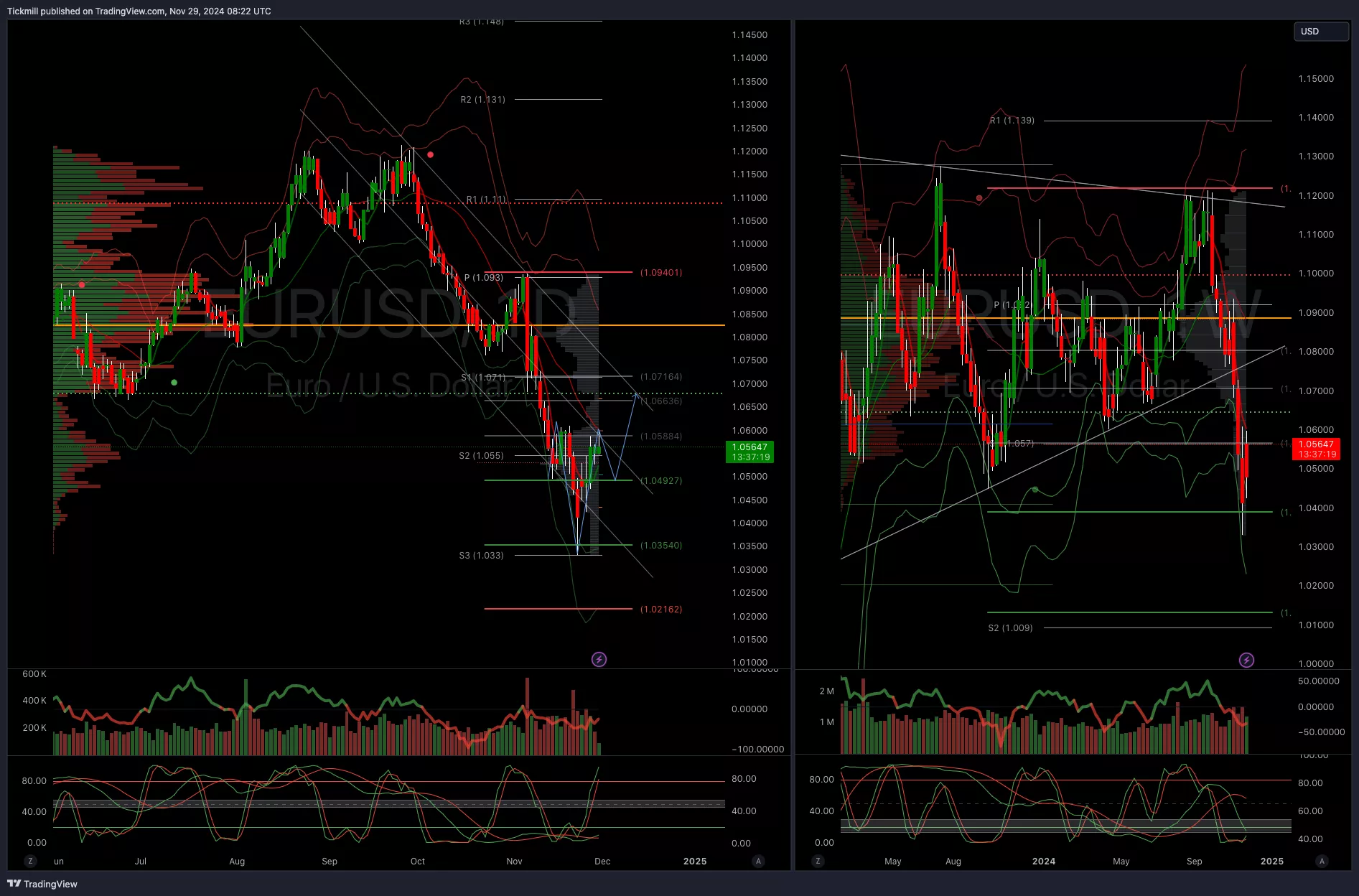

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.05

EURUSD Bullish Above Bearish Below 1.05

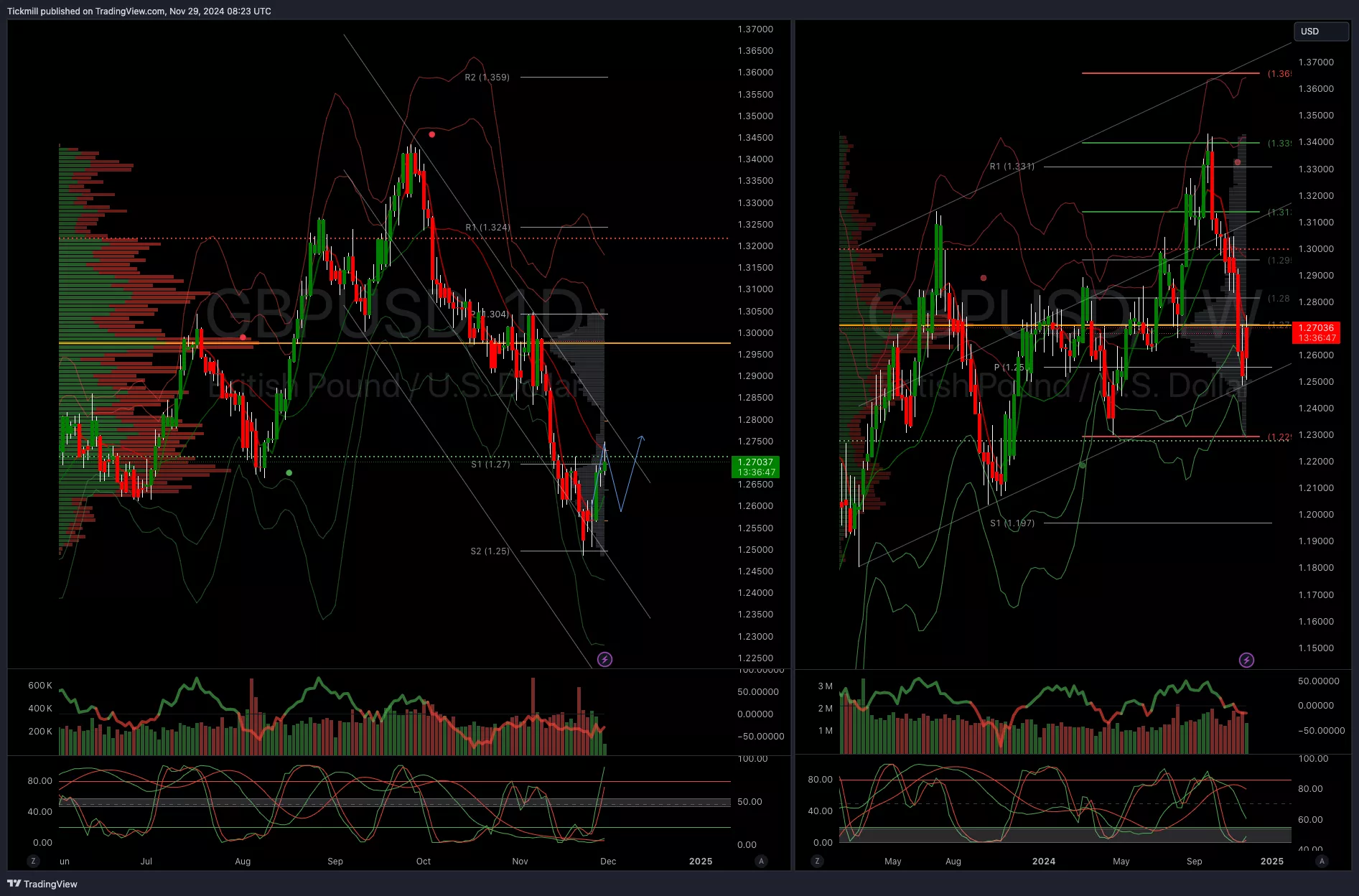

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

(Click on image to enlarge).webp) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

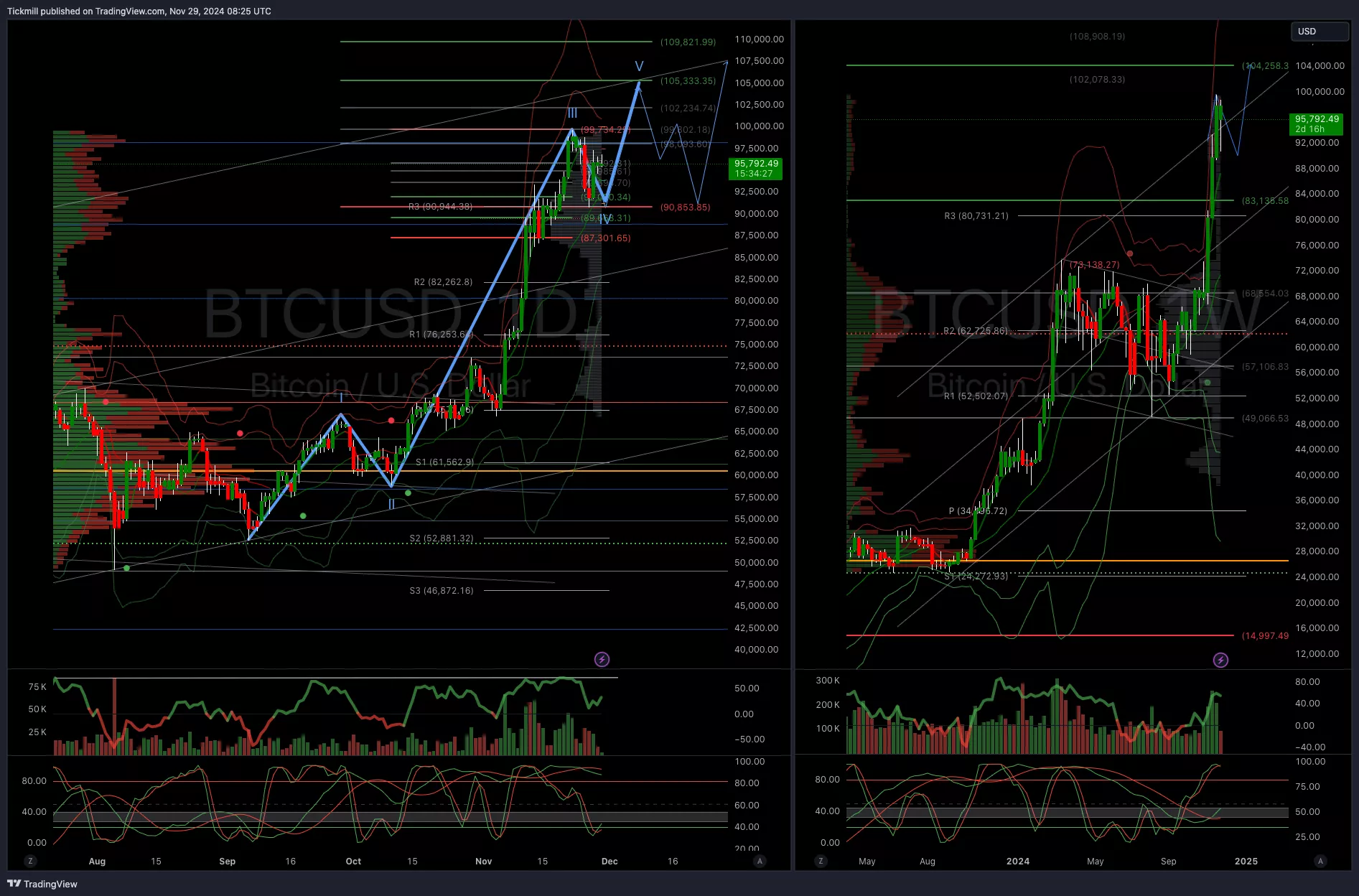

BTCUSD Bullish Above Bearish Below 92000

More By This Author:

More By This Author: