Russia lowered its threshold for using nuclear weapons and fired a hypersonic ballistic missile at Ukraine, sending gold on its way to its biggest weekly gain in almost eight months and the euro hovering at a 13-month low. In addition to driving investors to safe havens and pushing European gas prices to a one-year high, the risk of escalation also supported German debt and put the Swiss currency on track for its first weekly increase in two months. Stocks in China and Hong Kong fell on Friday as investors continued to express caution owing to the potential of tariffs from the U.S. President-elect Donald Trump. Chinese government advisers are recommending that Beijing should maintain an economic growth target of around 5.0% for next year, pushing for stronger fiscal stimulus to mitigate the impact of expected U.S. tariff hikes on the country’s exports, according to sources. Disappointing corporate results also contributed to the losses, while shares in Taiwan and South Korea were up more than 1% and the Nikkei was up 0.8%, chipmakers led equities in Asia slightly higher on Friday after Nvidia reached a record high in U.S. trade on strong earnings. Bitcoin was on the verge of surpassing $100,000 for the first time, while gold bulls target a test of $2700 an ounce as the yellow metal looks set to post a 5%+ gain on the week. Assets associated with Adani Group companies remained under pressure, with dollar bonds suffering losses after U.S. prosecutors indicted chairman Gautam Adani for fraud. Core inflation in Japan stayed above the central bank’s 2% target in October, according to data, which kept pressure on the central bank to raise interest rates. There is a 57% chance that the Bank of Japan will raise interest rates by 25 basis points in December, according to market pricing.Over the course of the day, monthly PMIs will be revealed globally, assisting investors in determining the state of the various economies, the direction of global rates, and the potential length of time that the dollar’s recent advance may last.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 15/11/24

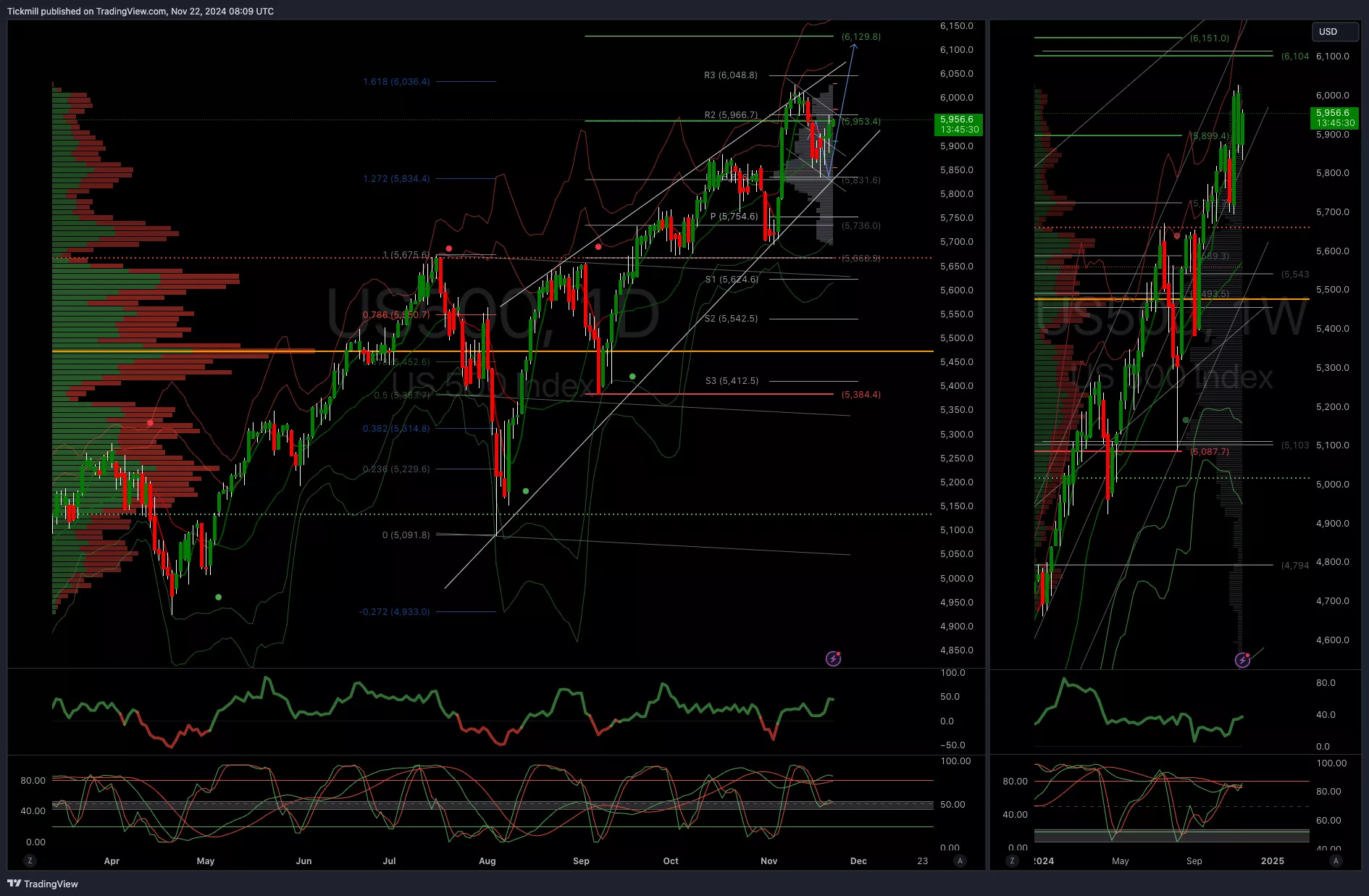

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0650

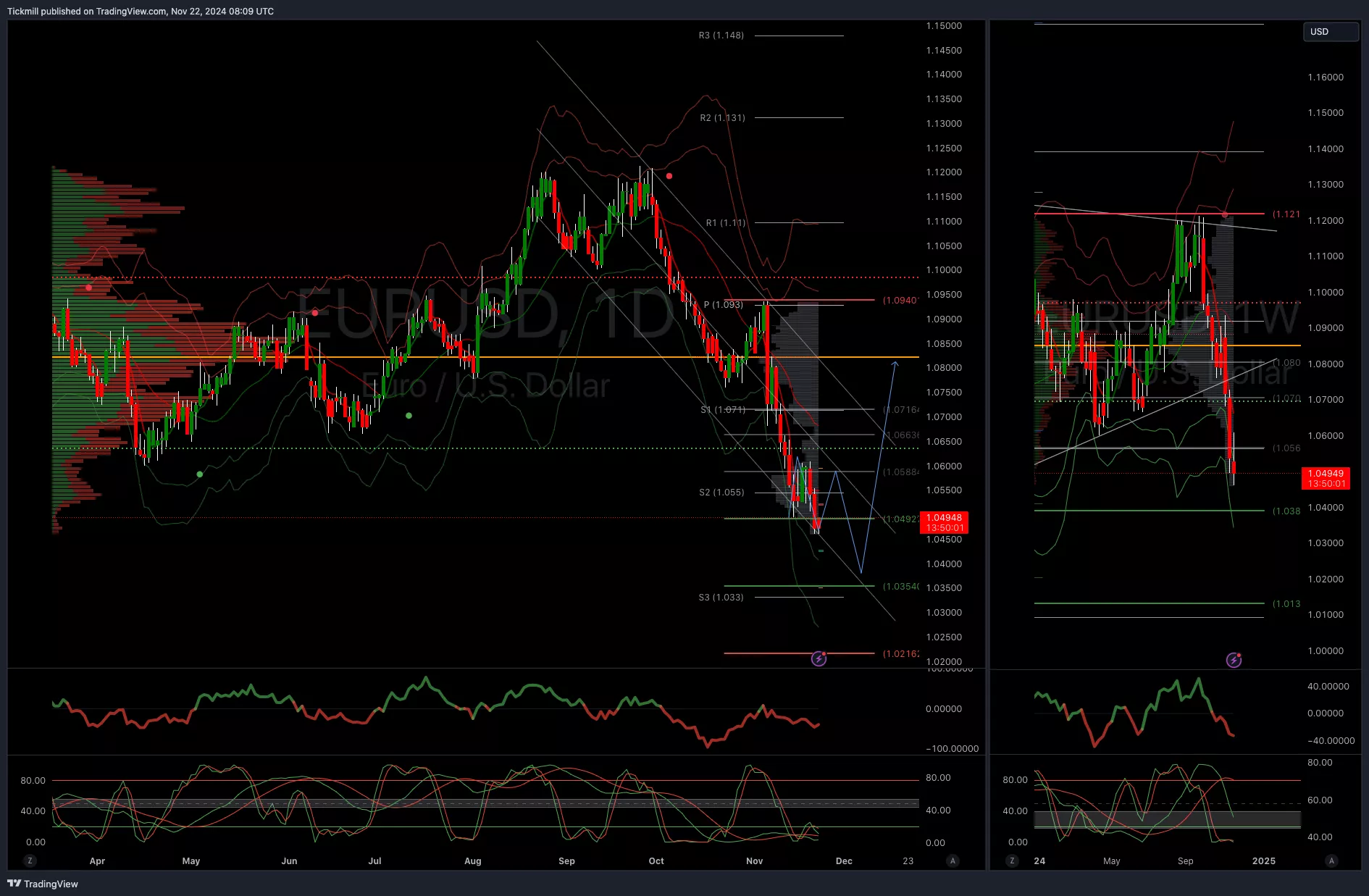

EURUSD Bullish Above Bearish Below 1.0650

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

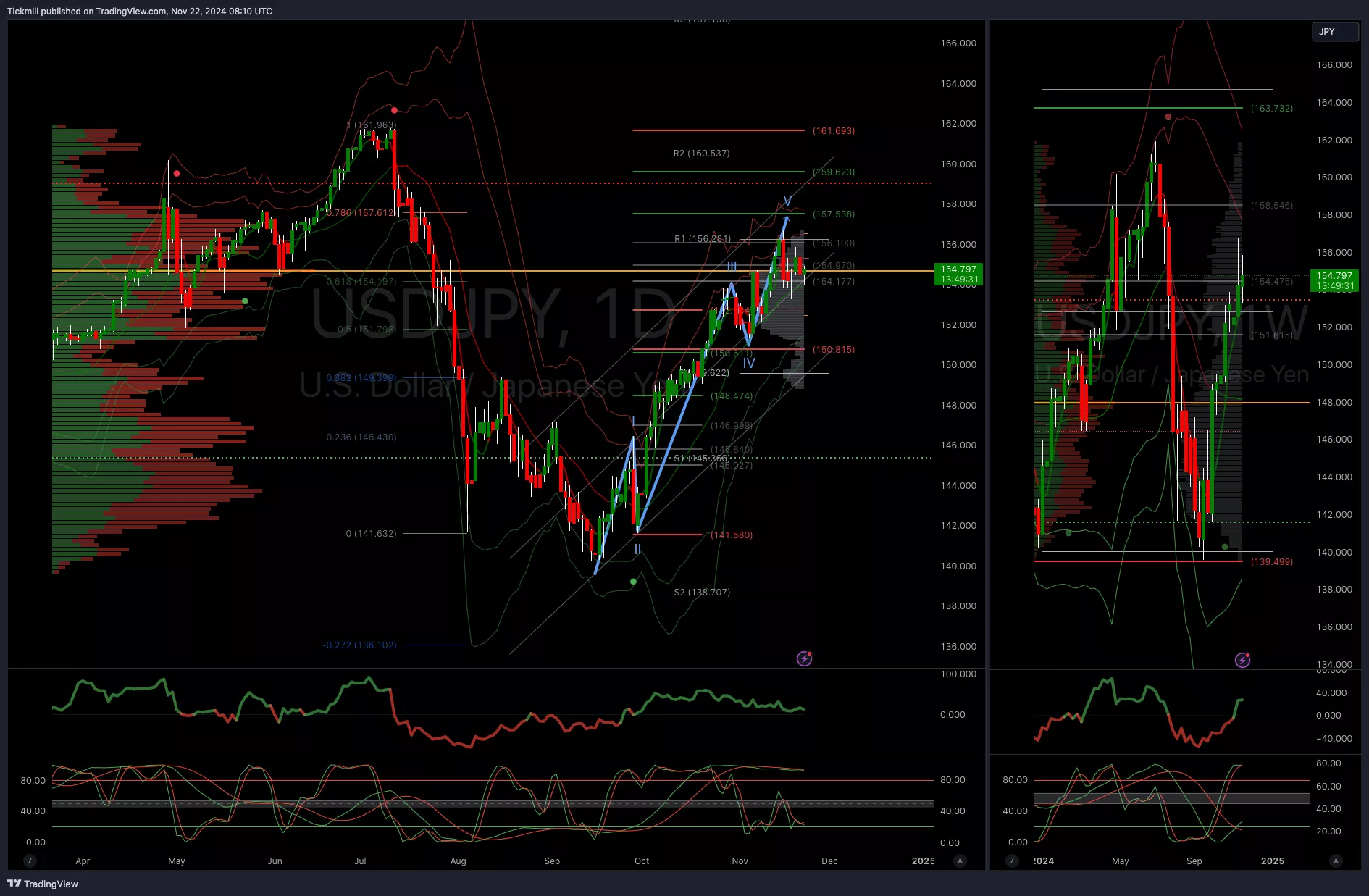

USDJPY Bullish Above Bearish Below 154

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

(Click on image to enlarge).webp) BTCUSD Bullish Above Bearish Below 93000

BTCUSD Bullish Above Bearish Below 93000

(Click on image to enlarge).webp) More By This Author:

More By This Author: