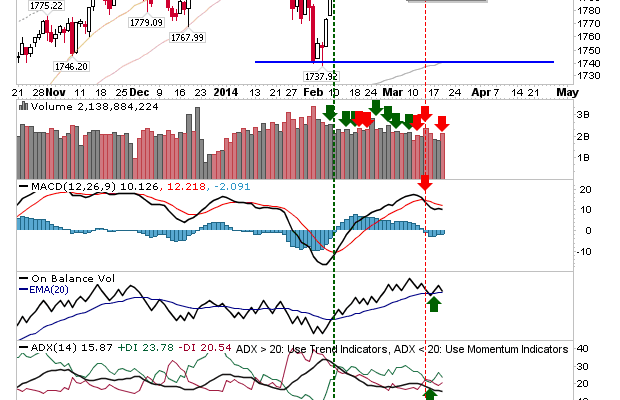

Wide range days made appearances across the board. Volume climbed to register distribution, but the day was not significantly bearish to suggest either bulls or bears have control. Tomorrow could result in an inside day as it would be hard to see three wide days follow with a fourth within a broader area of congestion.

The S&P finished at its 20-day MA without managing a challenge on resistance.

Best positioned of the indices are still the Nasdaq and Nasdaq 100. While bears may get another shot at challenging breakout support tomorrow, the longer term picture for each index still sides with bulls.

The Russell 2000 came back towards its 20-day MA but it will only hold for so long. A move back to its 50-day MA would offer a more attractive place to build an advance given the extent of the February rally.

Buyers might get another crack at entering positions at breakout support for the Nasdaq and Nasdaq 100. Things are a little more difficult for the S&P and Russell 2000, with no clear advantage for either side.