It was never going to look pretty, with indices effectively back inside prior trading ranges, with some wedged between 50-day and 200-day MAs too. Narrow range days, with a net bullish bias, is likely to be the order of the day, at least until 50-day MAs are recovered. Â The two indices best positioned to take advantage of bullish strength are the Dow Industrials and S&P.

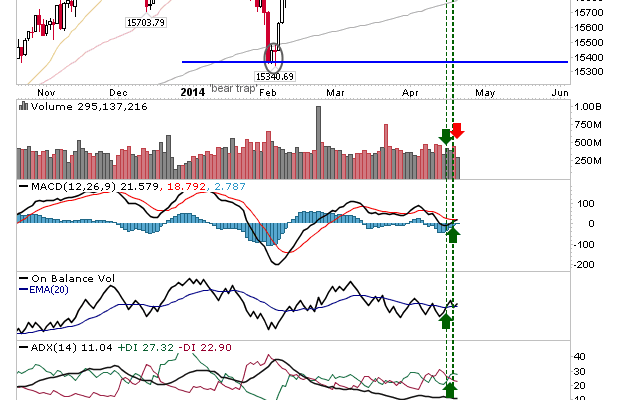

The Dow has morphed into a market leader, with strength in Transports lending weight to a long term bullish setup as per Dow Theory, although neither has cracked new highs – yet. The Dow does look like it will, and possibly soon. Technicals are all net bullish, and Monday’s narrow range day suggests few sellers willing to cash out. A break of 16,600 is looking good.

The S&P is not far behind and 1,814 is looking like it will be a more important swing low to defend (and a place for stops). The dip below 1,840 has effectively turned into what was then looking an unlikely ‘bear trap’.

Tech and Small Cap Indices have much work to do. Their sharp declines have evolved into a mini-breakouts, but there is much overhead resistance to consume. Â Technicals are also net bearish for Nasdaq and Russell 2000.

More risk averse traders and position traders may be best to focus on Large Cap Indices. Day Traders may get more joy from the Nasdaq and Russell 2000 as Large Cap indices inch closer to the breakout and value buyers look to take advantage in the spread of ‘good will’.