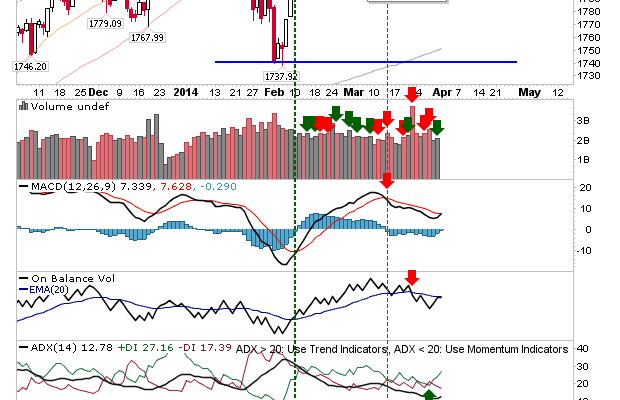

The week continued its bright start with a resistance break for the S&P. Technicals are improving, with the MACD and On-Balance-Volume on the verge of a new ‘buy’ trigger. However, there was also a snap-back relative swing against Large Caps and back to Small Caps despite the breakout. Bulls will be gearing up for a measured move; the first target is 1,920.

The Nasdaq posted a good gain on higher volume accumulation. The index blew past its 50-day MA, and in the process generated a ‘bull trap’. Today’s action complicates a bearish head-and-shoulder reversal, with bears perhaps looking at a double head-and-shoulder; in this scenario, resistance kicks in 4,371. For Wednesday, look for a break of the 20-day MA. The 20-day MA will be an important level to attack for shorts looking for a quick trade, so it may be a tight day tomorrow.

The Russell 2000 offered a point of optimism for Nasdaq traders as it finished the day above its 20-day MA. It will find it harder as it gets closer to 1,210, but the last three days have been very good for the index.

Bulls re-established themselves with little opposition from bears, despite their dominant display last week. Bears have an opportunity tomorrow to attack 20-day MAs, and this may make it a scrappy day for traders.