The S&P experienced a small loss on lighter volume. After a long series of gains, today’s loss was welcome, and doesn’t change the larger bullish picture. Â Technicals remain bullish, and with the 20-day and 50-day MAs converging, the chance for a retreat and bounce at these MAs remains compelling.

Â

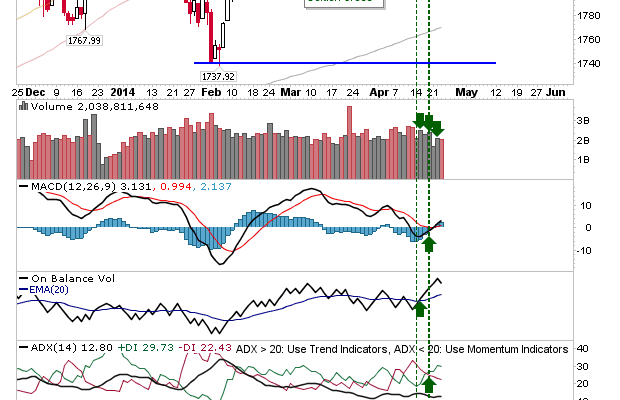

The Nasdaq experienced a larger loss than the S&P, finishing a few points below its 20-day MA. The triple swing low dating back to December 2012 remains the most likely place to find support, although the MACD and On-Balance-Volume ‘buy’ triggers remain in play.

Â

The Russell 2000 experienced a similar loss as the Nasdaq, finishing just below the 20-day MA too. It too has a MACD trigger ‘buy’ along with a relative ‘buy’ trigger against the Nasdaq.

Â

The short term setup remains bearish, but not enough to suggest a broader sell off is about to develop. This is likely to be a buyers retreat, unless there is a break of the February swing low.

—