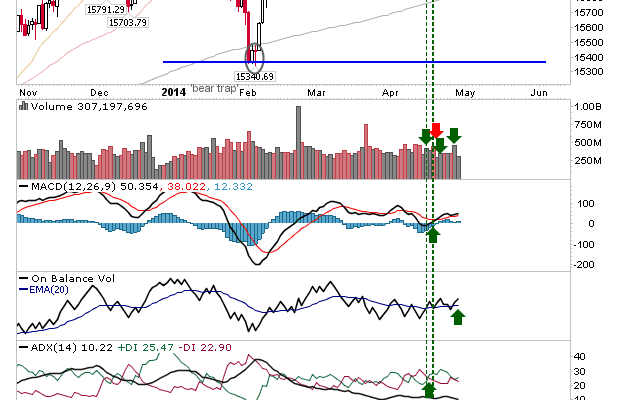

Solid action from bulls in Large Cap indices keeps the potential breakout in play. The Dow looks more likely to lead out. Volume was down on yesterday, but it will need to pick up if a breakout is to holiday. Â Look for a breakout in the coming days.

If the S&P was to complete a bearish head-and-shoulder pattern it would need to turn lower soon. There is very little room for further upside without it negating the bearish reversal. A second ‘head’ is possible, but it wouldn’t be an ideal setup.

The Nasdaq posted modest gains, but not enough to suggest bullishness increased by today’s close. The index remains penned in by the 20-day MA, and tomorrow will see this resolved tested.

The Russell 2000 finished with a bullish harami cross, one of the most reliable candlestick patterns. Will it play true tomorrow? Unfortunately, the stop is typically a break of the pattern low, which is some distance away.

Tomorrow is another opportunity for bulls to build on the advance, with Large Caps ready to break. Should these succeed it will be bullish for the other indices too.