Bulls made a stab at forming a swing low with a gap open, but were unable to push on with further gains. Sellers returned in the afternoon, but the gap remained in play by the close of play.

The Nasdaq remains the index best positioned to build on bullish momentum given it still holds breakout support. I have redrawn the line in the sand for this index at 4,245; a failure of which would see this morph into a broader trading range with support down at the December and February swing lows.

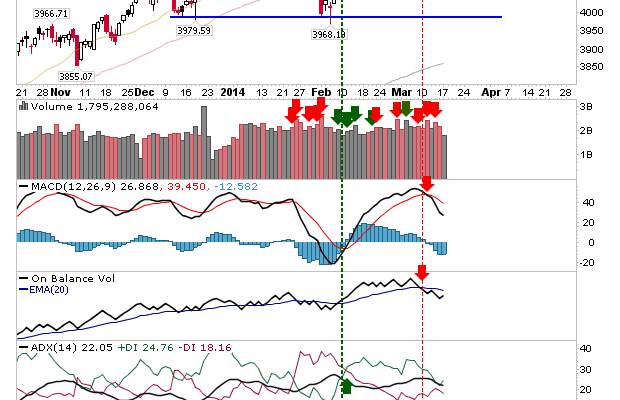

The selling didn’t look so drastic in the S&P (given gaps don’t show for this index) and ‘buy’ signals for ADX and On-Balance-Volume does suggest bulls will try and make a stand here. However, intermediate stochastics [14,3] are not oversold, which suggests the bounce may not last long.

The Russell 2000 looks to be evolving into a trading range too. Like the S&P its stochastics are not oversold: the 50-day MA would be a more attractive level to look for a tradable bounce.

The Nasdaq is perhaps the ‘cleanest’ of the indices to trade with a clear support level available to set risk. Â However, given the scrappier action of the S&P and Russell 2000, which already undercut (and regained) comparable support it may end up been nothing more than a whipsaw trade. Â Also note, Nasdaq Breadth is in rollover mode (from a top) and is a long way from oversold conditions typical of strong buying opportunities. The bearish divergences aren’t helping either.