It’s looking good for the Dow following yesterday’s breakout in the S&P. There was a uptick in technicals with a ‘buy’ signal in On-Balance-Volume following a recent ‘buy’ signal in the MACD. Support comes in around 16,450 with the 20-day MA an alternative support level.

The S&P added to yesterday’s breakout, although volume was down on prior accumulation. However, there was a new MACD trigger ‘buy’. The measured move to 1,980 is the upside target here.

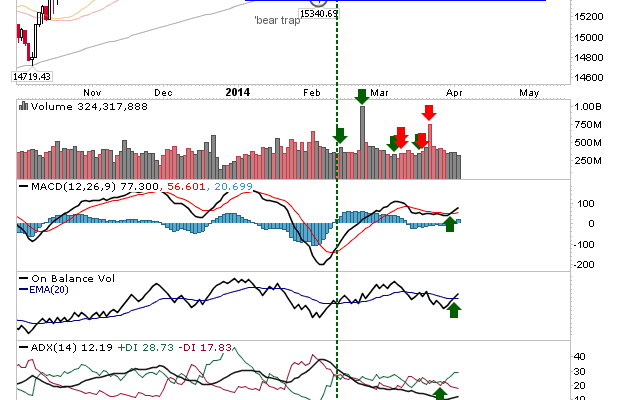

The Nasdaq popped over its 20-day MA, but hasn’t yet generated a MACD trigger ‘buy’. It’s a slow crawl for this index, but there should be enough to make it to newly defined channel resistance.

The Nasdaq 100 is interesting for shorts as the current bounce has taken it back to former channel support turned resistance. If there is a chance for shorts, tomorrow could be the day. Stops can be run relatively tight to today’s high (or avoid the play altogether if there is an opening gap higher into the channel).

I haven’t mentioned much on the semiconductor index, but it has been steadily pushing higher despite weakness in other indices. One only has to look at relative performance against the Nasdaq 100 to see how well it has done.