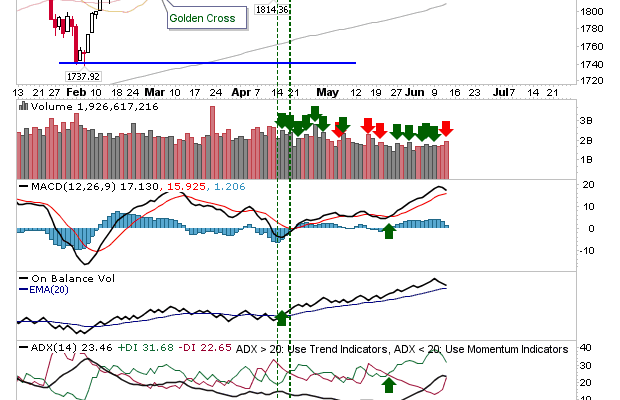

The 2nd/3rd day of declines has been relatively orderly so far. Volume picked up in distribution as many traders took easy profits from either the May breakout, or from positions taken during the earlier dip in January/February. A move back to 20-day MAs would be substantial enough to attract buyers back, and yet maintain the strong bullish momentum which has been a characteristic of the summer breakout.

Even if there was a loss of the 20-day MA in the S&P there would be additional support to be found from the May breakout level.

Â

Critics may argue the Nasdaq remains under its March high, but the index handily breezed past what could have been a picture perfect head-and-shoulder reversal. A more complex dual-head pattern could yet emerge, but the advance has yet to reach the resistance level which would define this.

Â

The Russell 2000 has been sharply higher, and consequently, has reversed a little more relative to other indices. Action still favors a bullish ‘flag’, but this may yet evolve into a larger channel down given where the index reversed. Shorts could get aggressive with a stop on a move above resistance.

Â

Meanwhile, the semiconductor index has barely reacted to the selling.

Â

Sellers may be able to squeeze a little more out of this, but shorts will be reluctant to participate until they see the reaction to the next rally (level of volume buying).