Morning action left the Russell 2000 staring at a new swing low, and the S&P at a channel break. However, buyers returned in the afternoon to return the S&P to support and the Russell 2000 scrambling back to its 200-day MA. Â Meanwhile, the Semiconductor index finished with a bullish doji on the 50-day MA. Given bears failure, bulls have an opportunity to press their advantage in the Semiconductor Index and S&P.

The 608 low in the Semiconductor Index may see a test and perhaps an intraday violation, but there is a fairly decent long side opportunity available, if the 50-day MA can hold.

Â

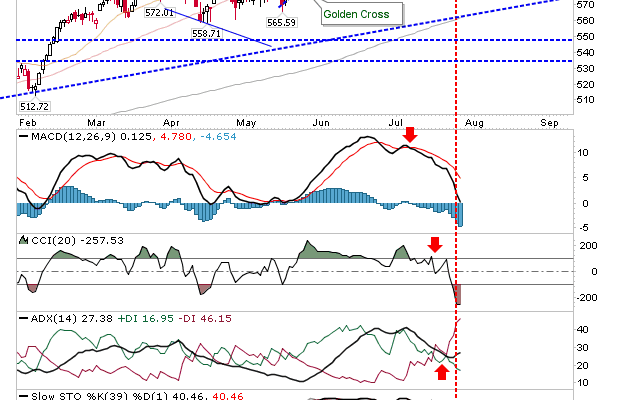

The S&P has the least risky longside opportunity to work with. The intraday violation of the channel isn’t ideal, but it does offer a place for stop; the second doji low from early July at 1,952 is another.

Â

The Russell 2000 had the most bearish action on the day, but there is a chance for a mini-double bottom (‘Eve-and-Adam’) with the 200-day MA available for bulls.

Â

Meanwhile, the Nasdaq finished at the 20-day MA (and neckline support). Again, an opportunity for bulls, particularly with the Semiconductor index looking well placed for a bounce.

Â

For tomorrow, look for afternoon strength to continue into the morning. Important will be tomorrow afternoons’ action as bulls will need to resist any attempt by bears to return markets below Monday’s close prices: a higher close tomorrow will confirm ‘buy’ signals from the various doji in the market.