After a quiet Easter week, things got a little hot under the collar for both bulls and bears. Â Bulls were able to throw the last punch, but the fight is not over.

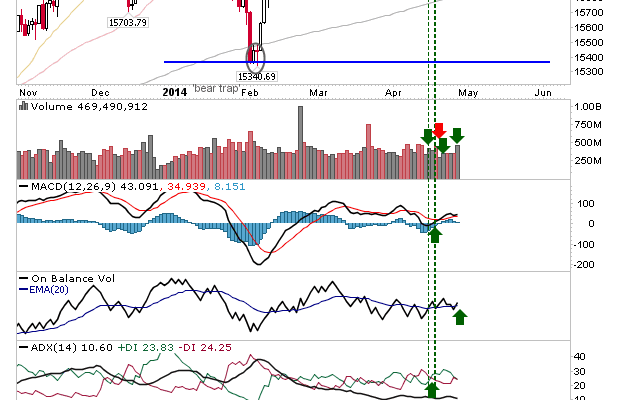

Yesterday saw wide range days, higher volume accumulation in Large Caps, and important defenses of moving averages. Starting with the Large Caps, the S&P and Dow both did well. The Dow edged it with a rebound from its 50-day MA and is angling for a break to new all-time highs. Technicals are net bullish.

The S&P had cut through both its 20-day and 50-day MA intraday, but finished above these moving averages. Â However, there was another sharp jump in relative performance against the Russell 2000, which will be a clarion call for bulls looking for somewhere to put their money to work. Â What mutes the celebration somewhat, is this action is within the trading range, meaning it’s probably noise until one or the other of the two solid blue lines on my chart break. Technicals are net bullish, which does confirm a bullish bias.

The Nasdaq wasn’t able to recover into a net positive close. Â However, it did recover the bulk of its intraday losses as it made it’s fourth pass towards support defined by December, February and April swing lows. Â Technicals are mixed, and intermediate stochastics [39,1] are suggesting the April recovery bounce is one of the ‘dead cat’ variety, so we may yet see another pass at the 4,000 level.

The worry for tech is the failure of the semiconductor index to recover its 50-day MA. The spike low suggests buyers were prepared to bid this up, but they may lose the desire to defend the moving average should bears manage to deliver another hit today – instead waiting for a better opportunity at trendline support connection November and February swing lows (hashed blue line).

The Russell 2000 had the weakest finish and is starting to sharply diverge away from the Nasdaq in a flight from speculative issues. the 200-day MA was defended, but the 20-day MA above may be seen as a point of attack for shorts should further gains develop here.