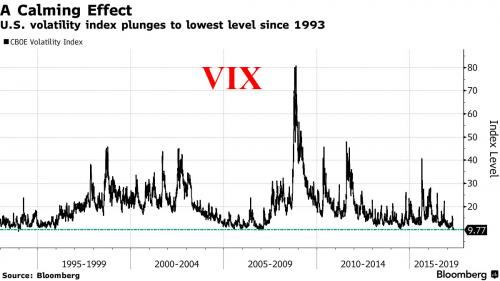

Asian stocks declined, while European stocks rose to the highest since 2015, led by a rebound in commodities and basic resource stocks. U.S. stock-index futures were little changed at 2,395 – just shy of all time highs – as investors focused on corporate earnings after the French election, while the VIX hovered near its lowest level since 1993.

In another mostly quiet overnight session, the Bloomberg Dollar Spot Index rose a second day as the greenback hit multi-week highs versus the Australian dollar, with the USD//JPY reaching 103.83, the strongest since March 15, and the EUR/USD sliding below 1.09, the lowest since March 30, as the aftermath of the French vote saw no further catalyst and the common currency consolidates near the 1.09 handle. A drop in Treasuries supported the dollar amid speculation that a hawkish speech by the Federal Reserve Bank of Cleveland President Loretta Mester on Monday may have been the opener of a series of hawkish commentary by Fed officials this week. The Fed official said that the Fed needed to be vigilant against “falling behind the curveâ€, while Mester also said with regards to the balance sheet that “we could probably end re-investments and not see a big impact, as long we articulate it wellâ€.

The odds of a move in June have already risen to 80 percent from 68 percent last week, based on overnight indexed swaps and the Fed funds effective rate, and speeches by Fed’s Neel Kashkari and James Bullard among others could cement expectations of a 25-basis-point increase by policy makers in nearly a month’s time. However according to Bloomberg’s FX team, further dollar gains aren’t that straightforward as strong resistance lies ahead, while a robust labor market isn’t coupled with relatively strong wage growth. The market is looking for two more increases by the Fed this year and the repricing of such expectations could be pivotal for the greenback to revert its downward trajectory since January.

Crude reversed an earlier decline ahead of government data which is expected to show inventories fell for a fifth week, while natural gas futures rebounded from the biggest loss in eight weeks. Copper for delivery in three months also bounced after the lowest close since December. That helped ensure basic resources shares were the biggest winners as the Stoxx Europe 600 Index advanced.

The big story, however, remains the near record low volatility, with the VIX dropping to a level not seen since 1993 and shares are trading at record levels.

Looking around global market, European stocks and bond yields rose on Tuesday, boosted by higher commodity prices and basid industries stocks, as well as record low volatility, continuing relief from this weekend’s French presidential election and solid corporate earnings. The Stoxx Europe 600 rose 0.4 percent, Germany’s DAX Germany’s DAX rose 0.3 percent, France’s CAC 40 and Britain’s FTSE 100 added 0.4 percent.

Asian stocks did not perform as well, with MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.1 percent and Japan’s Nikkei fell 0.26 percent. China’s Shanghai Composite narrowly avoiding a seventh consecutive loss, the longest losing streak for four years,weighing on the region more broadly.

U.S. futures pointed to a slightly higher opening on Wall Street, which would see the S&P 500 moving even higher than Monday’s record 2,401 points.

“It’s calm sailing today for stock markets after the VIX had its lowest close since 1993,” ETX Capital senior markets analyst, Neil Wilson, said. Victory for business-friendly centrist Emmanuel Macron in France and earnings were also supportive for equities, he said. “So far, there is precious little to halt the rotation from bonds to stocks,” he said.

The FTSEuroFirst hit its highest for nearly two years, and the index of top 50 euro zone stocks its highest for 18 months. Germany’s DAX hugged close to Monday’s record high. Shares in Germany’s Commerzbank rose more than 2% after the bank posted forecast-beating profits in the first quarter, and mining companies were among the leading gainers.Â

The MSCI World index, which touched a record high overnight, dropped about 0.1 percent.

In bond markets the 10-year U.S. Treasury yield rose to 2.394 percent, its highest in a month. The two-year yield held steady at 1.33 percent, meaning the yield curve rose to its steepest for more than two weeks. The yield curve had flattened last week to its lowest since the U.S. presidential election in November as investors fretted over the impact higher interest rates will have on the economy.

In commodities, oil market sentiment swung between optimism over statements from major oil-producing countries that supply cuts could be extended into 2018 and lingering concerns over slowing demand and a rise in U.S. crude output. U.S. crude rose 0.5 percent to $46.66 a barrel, and global benchmark Brent also rose 0.5 percent to $49.57. Copper bounced from the four-month low touched on Monday after data showed a sharp drop on imports into China, the world’s biggest consumer. London copper rose 0.5 percent to $5,515 a ton on Tuesday, after falling to as low as $5,462.50 on Monday. Gold recovered from a seven-week trough touched on Monday. Spot gold rose about 0.1 percent to $1,226.60 an ounce.