The crude oil markets exhibited significant volatility in early Thursday trading, with market participants adjusting their positions ahead of the holiday season.

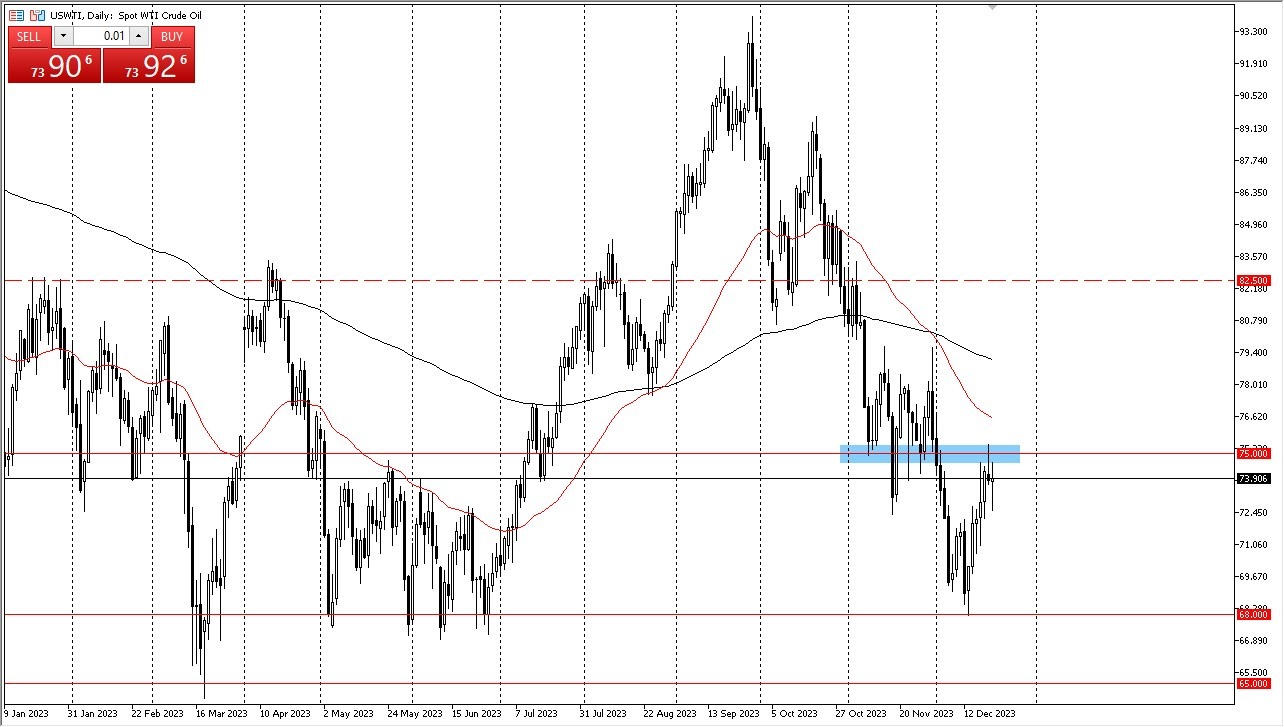

WTI Crude OilThe West Texas Crude Oil market experienced considerable fluctuations during Thursday’s trading session as traders continued to navigate their positions in anticipation of the holidays. We recently tested the $75 level but have seen a decline in that area, which is logical as it previously served as support, and market participants tend to remember these levels. These levels will be the key to determining what happens next.An intriguing aspect is that this area also represents an options barrier, adding to its significance. Additionally, the 50-Day Exponential Moving Average has dropped and appears to be heading toward the $75 level. Below that, the $68 level could become a target. Currently, it seems we are in a situation where retesting that area is possible, and some recent movements may be attributed to short covering as traders aim to secure profits for the holidays.(Click on image to enlarge) More By This Author:USD/CHF Forecast: Struggles Against the Swiss FrancUSD/JPY Forecast: Fights Against the YenUSD/CAD Forecast: Sees Overhead Pressure

More By This Author:USD/CHF Forecast: Struggles Against the Swiss FrancUSD/JPY Forecast: Fights Against the YenUSD/CAD Forecast: Sees Overhead Pressure

Crude Oil Forecast: Markets Show Hesitation