Credit Suisse Group AG (ADR) (NYSE:CS) has laid out the case for further M&A activity this week. The bank points out that ‘dry-powder’ at private equity companies and corporate cash levels still sit at record levels. While in many sectors it has now become cheap to buy capacity, rather than build it.

The bank makes the case that:

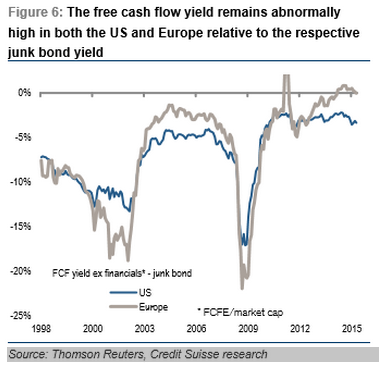

- 73% of European companies and 63% of US companies have a FCF yield above their respective corporate bond yield.

- The combined firepower from corporate cash, re-leveraging and private equity ‘dry powder’ is $4.2 trn, or 10% of global market cap

- M&A activity is only in line with 10-year norms and 40% below its long-run average

- In many cases, it is cheaper to buy than build: 56%, 29% and 19% of Japanese, GEM and European corporates trade below replacement value

- Private equity for the first time appears willing to pay higher multiples than strategic buyers

All of these factors support the case that another wave of M&A activity is just around the corner.

Â

Â

Â

Â

M&A – Awash with cash

According to data from Worldscope, there is $4.2trn of cash on corporate balance sheets globally. Of this, $1.4trn sits with US corporates. A significant amount of this cash is parked overseas, $690bn according to Credit Suisse’s estimates. Nonetheless, US corporates repatriated $301bn last year, the highest since the repatriation holiday of 2005.

High cash balances are also supported by low levels of gearing, leaving room for levered acquisitions. Moreover, a third of the companies in the US universe now have a net cash balance.

Â

Â

In total, including leverage available and cash on corporate balance sheets, Credit Suisse believes that there is a staggering $4.3 trillion of cash available for M&A activity.To put that in perspective, AOL, Inc. (NYSE:AOL) and Time Warner Inc (NYSE:TWX) was the largest merger ever at $186 billion – $4.3 trillion would mean approximately 23 mergers that size.