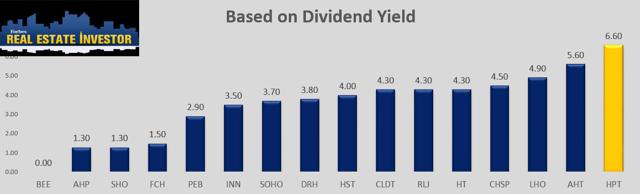

As I glanced across the long list of Lodging REITs today one name jumped out in front of me like a deer in headlights: Hospitality Properties Trust (NYSE:HPT), better known for its externally-managed hotel platform, pays out a whopping 6.6% dividend yield – higher than any of the other Lodging REIT peers.

When I see such a disproportional dividend yield (compared to the peers) I always ask myself, “is this a sucker yield”?

By my very nature, I have trained myself to sniff out the ugly ducks and it’s become a common part of my research to always ask myself, “is the yield too good to be true”?

That was exactly my thought pattern when I decided to step off the gas pedal with American Realty Capital Properties (NASDAQ:ARCP), Campus Crest (NYSE:CCG), and Wheeler Real Estate (NASDAQ:WHLR). The words “sucker yield” kept popping up into my brain, and of course that means I don’t ever want to be a sucker (and lose hard earned capital).

So I started thinking about HPT and the other REITs that I just referenced – pondering whether there were any similar characteristics that would make HPT the beneficiary of the sucker yield club. Here’s how I defined the term (sucker yield) on Investopedia:

A “sucker-yield” is based on quantifiable high yields, seemingly ridiculous, when the underlying security has a flawed or vulnerable business model. Companies that fall under the “sucker-yield” definition typically have unpredictable and unreliable earnings histories with unsafe dividend payouts.

I also added some examples and suggested that,

In the business of investing, as well as real life, the words “too good to be true” means that “all the glitters is not gold”. If a stock seems to pay a dividend yield that is exceptionally high, investors should look harder at the sources of payment behind the dividend. That is, how profitable is the company? Can the sources of income cover the dividend payment? How sustainable is the dividend? Are there threats to the underlying business model?

Let’s Begin with the Basics

As I mentioned above, HPT is externally managed. That does not mean the security is a sucker yield simply because of the management platform; however, it does tell me that there could be conflicts that could possibly impact the sustainability of the dividend.