Corporate insider trading activity has never been more bearish than it is right now.

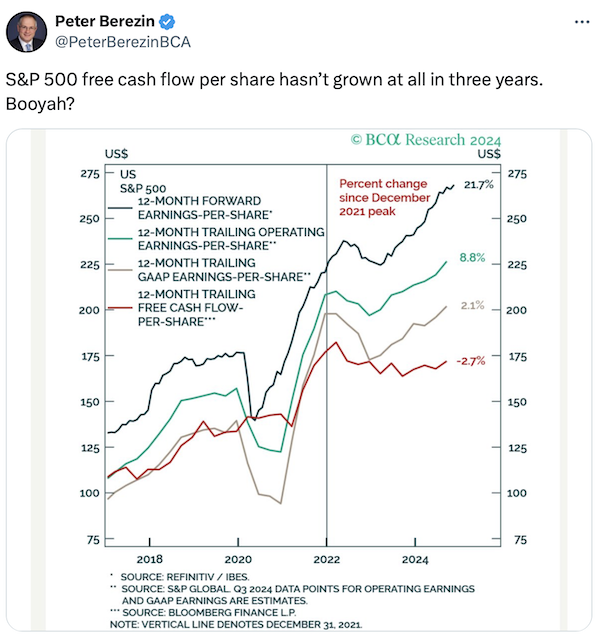

This should be especially concerning given the fact that aggregate insider activity is one of the best predictors of future earnings trends and earnings quality has deteriorated significantly of late.

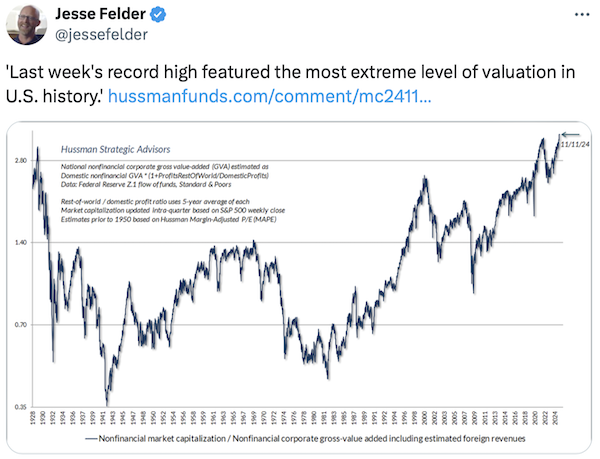

With equity valuations at record extremes…

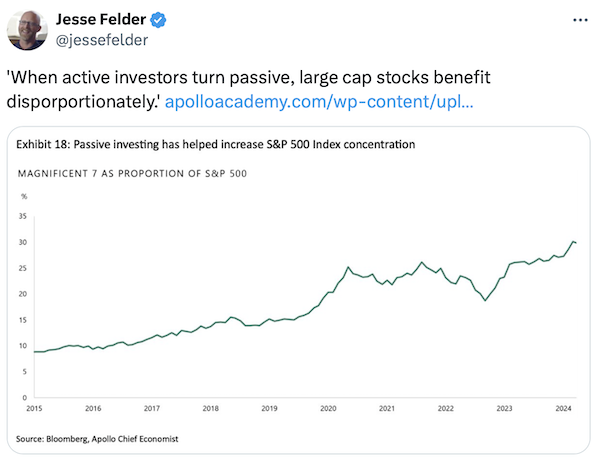

…driven at least in part by the incredible growth of price-insensitive buying…

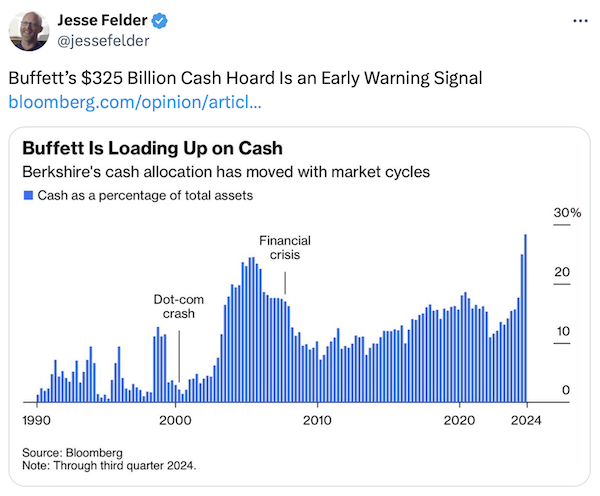

…a prudent investor may find plenty of reasons to be inordinately price-sensitive at present. More By This Author:What Could Possibly Go Wrong?Why The Long Face, Uncle Warren?Equity Investors: ‘This Is Fine’

More By This Author:What Could Possibly Go Wrong?Why The Long Face, Uncle Warren?Equity Investors: ‘This Is Fine’

Corporate Insiders Are Jumping Ship