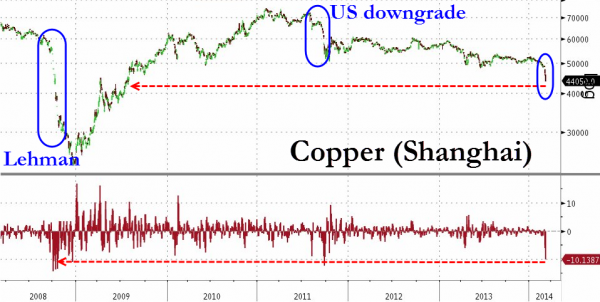

Following a triumvirate of macro misses from AsiaPac (South Korea unemployment surged, Aussie confidence plunged, and Japanese inflation tumbled), the credit concerns running riot through the collateral underlying China’s shadow banking system continue to crush Copper (and iron ore) prices. Copper is limit down in Shanghai at its lowest since July 2009 – these size moves have only occurred twice in history (Lehman and the US downgrade). Japanese stocks are ignoring any ramp efforts in USDJPY and US equity futures are fading qucikly with AUDJPY….

A sprinkling of headlines from this evening:

- South Korea unemployment jumped to 3.9% (exp 3.2%, prev 3.2%) – highest in 3 years

- Aussie Consumer Confidence dropped to 10-month lows

- Japanese Producer Price Inflation (Domestic Corporate Goods) MoM -0.2% – biggest deflation since Dec 2012 and YoY slowest since June 2013

- *JAPAN’S NIKKEI 225 DROPS BELOW 15,000

- *JAPAN’S NIKKEI 225 EXTENDS LOSSES TO 2%

- *COPPER IN SHANGHAI DROPS AS MUCH AS 5.2% TO 43,800 YUAN/MT (close to biggest drop since Dec 08)

Leaves copper echoinG Lehman and the US downgrade…

With the Nikkei unable to catch a bid from JPY ramp

and S&P futures continuing to track AUDJPY lower..

Â

Â