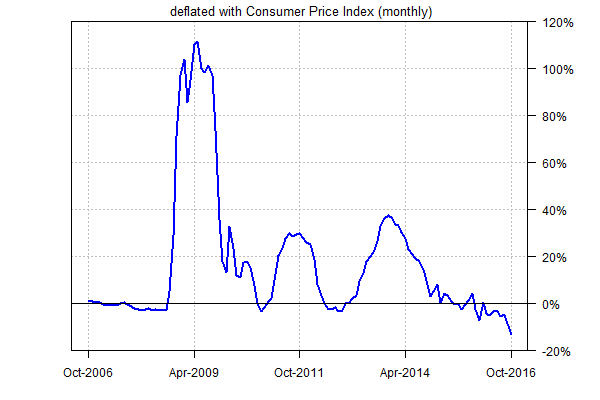

In another sign that the Federal Reserve is preparing to raise interest rates, the real (inflation-adjusted) M0 money supply’s decline picked up speed in October. The 13.4% year-over-year decrease is the steepest on record (dating to 1948) and marks a sharp drop from September’s 8.8% slide.

M0, which is also known as the monetary base and high-powered money, has declined for ten straight months through October (in year-over-year terms), the longest non-stop run of red ink in eight years. The difference this time: the contraction is significantly deeper than previous declines.

The current slide follows years of extraordinarily high rates of growth. But it’s clear that the monetary tide has turned and the Fed looks poised to announce another rate hike at its monetary policy meeting that’s scheduled for Dec. 13-14.

Market sentiment is expecting no less at the moment. Fed fund futures are pricing in a 94% probability that the central bank will lift its policy rate (currently at a 0.25%-to-0.50% range) at the FOMC meeting next month, based on CME data (as of Nov. 22).

Treasury yields have shot higher too. The policy sensitive 2-year yield settled at 1.07% yesterday (Nov. 22), fractionally below the highest level so far this year, according to Treasury.gov data.

Meanwhile, the Treasury yield curve has steepened substantially in recent weeks. In particular, the short end of the curve is at or near the highest levels in recent years through 3-year maturities (see chart below). Overall, there’s been a clear shift higher in the curve compared with yields from 90 trading days earlier (shown in blue).

“After the Trump Shock, it’s easy for the Fed to hike, because inflation expectations have gone up,â€Â advises Hideaki Kuriki at Sumitomo Mitsui Trust Asset Management in Tokyo. He tells Bloomberg that he’s “100 percent†certain that the Fed will raise rates next month.