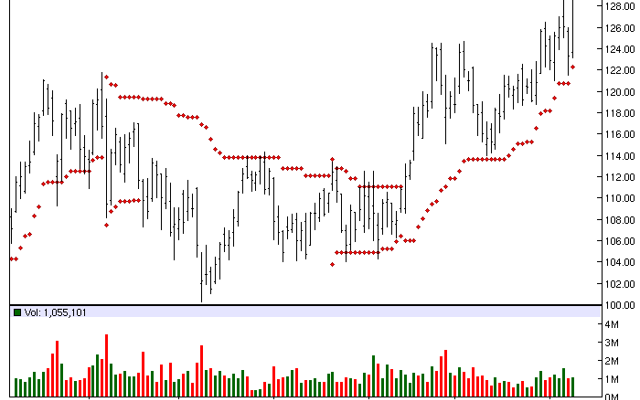

The Chart of the Day is Continental Resources (CLR). I found the stock by sorting the very small list of stocks that hit an All Time High today, then sorted then for the highest technical indicators. Last I used the Flipchart feature to review the charts. since the Trend Spotter signaled a buy on 1/22 the stock gained 14.64%.

CLR is a crude-oil concentrated, independent oil and natural gas exploration and production company with operations in the Rocky Mountain, Mid-Continent and Gulf Coast regions of the United States. The Company focuses its operations in large new and developing plays where horizontal drilling, advanced fracture stimulation and enhanced recovery technologies provide the means to economically develop and produce oil and natural gas reserves from unconventional formations.

(click to enlarge)

Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 13.17% in the last month

- Relative Strength Index 64.98%

- Barchart computes a technical support level at 119.11

- Recently traded at 129.18 with a 50 day moving average of 117.49

Fundamental factors:

- Market Cap $24.00 billion

- P/E 23.60

- Revenue predicted to grow 25.80% this year and another 19.60% next year

- Earnings estimated to increase 30.20% this year, an additional 18.70% next year and continue to increase at an annual rate of 26.86% for the next 5 years

- Wall Street analysts issued 7 strong buy, 14 buy and 9 hold recommendations on the stock

Great revenue and earnings projections. Use the 50 day moving averages for signs of weakness and the 100 day moving averages to protect profits.