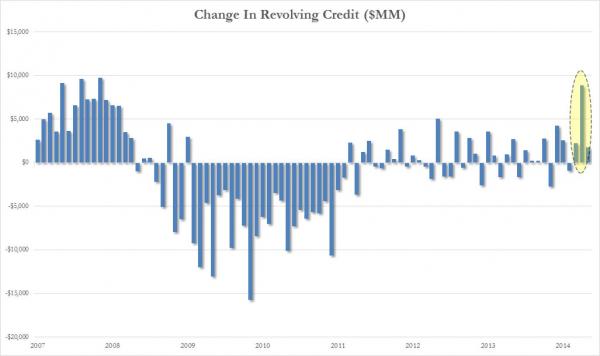

Remember that epic spending spree that took place in March when consumers cleaned out their savings account and which resulted in a surge in March retail spending in consumer outlays? Now we know that in addition to borrowing from their savings, consumers also “charged” it, because as we reported last month, the April consumer credit soared by an unprecedented $8.8 billion, the most since 2007, and a clear outlier in recent years. April, incidentally is precisely when the credit card statements for March purchases would come due so while impressive, the surge in revolving credit wasn’t quite surprising.

However, what is perhaps more notable now that the Fed just released the May consumer credit numbers, is that the month after the March spending spree, funding largely on credit, consumers hunkered down once more, and the May increase in revolving credit was a paltry $1.8 billion, much lower than the April surge, and the lowest since February. In other words, after the spending binge, came the credit card bills, and with them, the spending hangover.

And yet, while the combined May consumer credit number missed expectations of a $20 billion increase (down from $26 billion a month ago), the total number was still an impressive $19.6 billion.

Why? Because the relentless spending spree on government funded cars and student loans continues, and in the month of May some $17.8 billion in non-revolving debt was issued: as shown on the chart below, this was the single highest monthly non-revolving (cars and student loans) debt amount issued since February 2013, and the third highest ever!

Putting the spread between the revolving and non-revolving debt issued in the past year in context, here it is, in one chart:

Â