I recently wrote an article for Sure Dividend entitled “Consider Equity REITs for Your Next Investment“. In that article, I listed nine equity REITs (eREITs) for dividend investors to consider in light of the drubbing that eREIT valuations have recently taken due to fear of rising interest rates and to capitalize on the pass-through provision for REIT income included in the new tax legislation. Both of these topics are covered in some detail in the previous article. This article provides a more complete investment thesis for Chatham Lodging Trust (CLDT) one of the nine eREITs highlighted in the previous article.

Chatham Lodging Trust

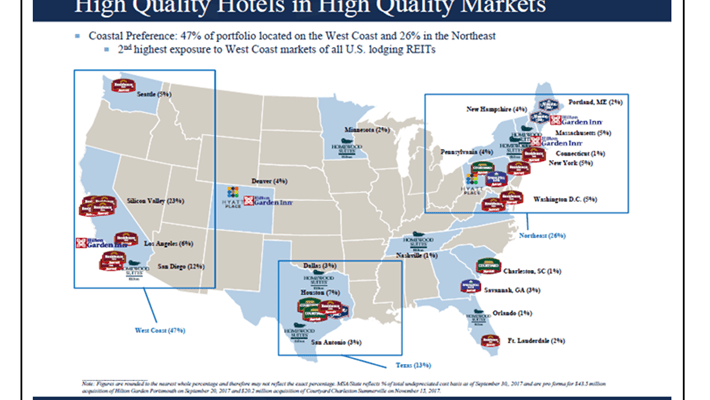

Chatham Lodging Trust is a select service and extended stay hotel eREIT with an enterprise value of roughly $1.6B. Chatham Lodging Trust owns 41 hotel properties primarily on the West (47%) and East (26%) coasts and in Texas (13%). The chart below shows the mapped locations of CLDT’s US properties.

Source:Â Chatham Lodging Trust Website

CLDT’s hotels are concentrated in prime business locations serving large metropolitan centers. The chart below shows a breakdown of CLDT’s hotel property types and the major markets served.

Source:Â Chatham Lodging Trust Website

One of the key metrics (maybe THE key metric) that measures a hotel’s ability to generate revenue and potential earnings is known as RevPAR or revenue per available room. Compared with CLTD’s select service hotel REIT peers, CLDT consistently has the highest RevPAR by a significant margin. The chart below shows CLDT’s RevPAR compared to its select service hotel peers.

Source:Â Chatham Lodging Trust Website

Chatham’s high RevPAR along with being a pure select service (i.e. limited service) with lower costs than full-service hotels, allows CLDT to generate high EBITDA margins, the highest in the hotel REIT sector. The chart below shows CLDT’s EBITDA margins compared to its peers in select service hotels and compared to full-service hotels.