Although the market didn’t go anywhere during the latter half of last week, Tuesday’s surge – fueled by the lack of military action in Ukraine – was big enough to more than offset Monday’s loss and the inaction seen after Tuesday.  Better still, there was a subtle clue given last week that says the bigger undertow is still bullish.

We’ll look at that clue in a second. Â First, let’s dissect last week’s economic numbers.Â

Economic Calendar

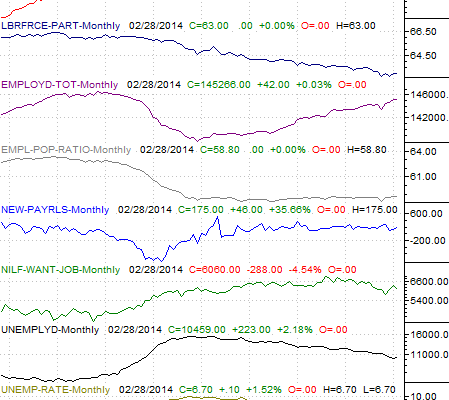

The big data last week was February’s employment information.  Last month, the nation added 175,000 new jobs, though the unemployment rate was ratcheted up from 6.6% to 6.7%.  How’s that happen?  Because more than 175,000 people put themselves back into the labor force, and there weren’t enough jobs for all them.  Still, though not red hot, the jobs situation once again got a tad better.Â

Employment Snapshot Chart

Underscoring that modest improvement in the job market is the fact that incomes were up a little in January, higher by 0.3% (per hour income was up 0.4%).  And in true American-consumer fashion, spending was up by a little more, growing by 0.4% last month. It shows that consumers are still feeling relatively confident, even if they say they’re not.

It wasn’t all sunshine and roses last week, however. January’s factory orders fell 0.7%, following December’s 2.0% plunge.Â

Although there was plenty more data spewed out last week, much of it wasn’t particularly important. It’s all on the following grid.Â

Economic Calendar

The coming week won’t be as busy, and even lass of that data will be worth worrying about. Â In fact, the only economic item of real consequence this week is Thursday’s retail sales numbers for February. Â The pros say they should by up 0.2%, with or without cars. It’ll be a nice turnaround from January’s tepid sales.