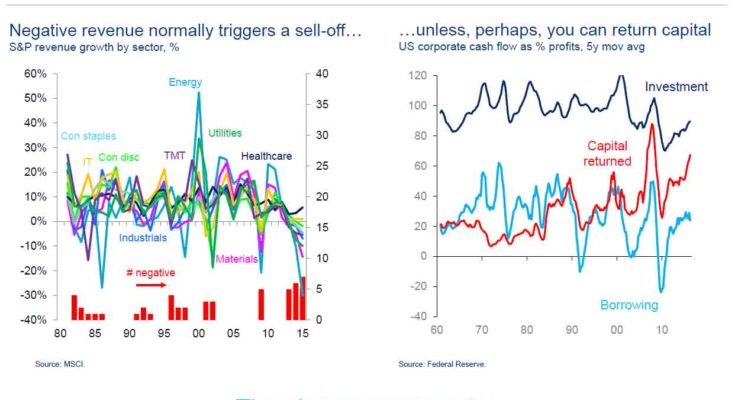

While Q3 earnings season has been better than expected, and the 5-consecutive quarter earnings recession is set to end, the bigger picture reveals something troubling: a secular corporate decline as revenue growth continues to be absent, and sales decline quarter after quarter. This is what shown in the following Citi chart, which also points out that while revenue declines normally trigger a sell-off, this can be avoided if companies return capital to shareholders by increasing payouts, which is precisely what they have been doing.Â

(Click on image to enlarge)

As we reported recently, traditionally increased payouts are financed with credit, and this time – as Barclays showed recently – the amount of new credit going to fund payouts has been higher than ever.Â

(Click on image to enlarge)

And yet, one look at the following chart shows why, at least according to Citi’s Matt King, alarm bells should be going off: net leverage has never been higher. In fact, this is the first time we have ever seen a Citi chart which has a frowning fact on it.

(Click on image to enlarge)

Which brings us to Citi’s punchline: the bank admits that while the leverage clock is working, even at this very late hour, the market just doesn’t seem to care, and asks “why are neither credit nor equity investors bothered by poor fundamentals?”Â

(Click on image to enlarge)

What explains this unprecedented indifference to fundamentals? The answer is a well-known one: everyone has to scramble for yield, as both foreigners, and in fact “just about everyone”, are being crowded into credit…Â

(Click on image to enlarge)

…. which in turn is encouraging corporate releveraging to new all time highs: it is the new debt that is driving valuations, as well as outright indexes, but almost entirely in the US, where every company is doing it (elsewhere not so much). The conclusion: the releveraging is propping up equities…Â