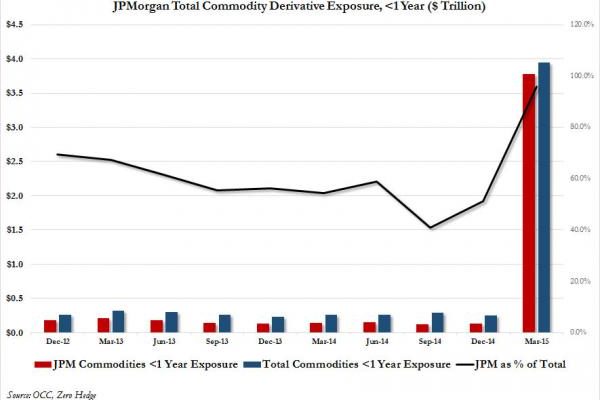

One week ago, when we scoured through the latest OCC quarterly derivative report (in which we find that the top FDIC insured 4 US banks continue to account for over 90%, or $185.5 trillion of all outstanding derivatives which as of March 31 amounted to $203 trillion; nothing new here), we found something fascinating: based on the OCC’s derivative update, JP Morgan Chase (JPM) had literally cornered the commodity derivatives complex, when from “just” $226 billion in total Commodity exposure, JPM’s notions soared by 1,690% in one quarter to $4 trillion, or about 96% of total.

Â

Â

Some, without even bothering to read the article, did what they always do when reacting to Zero Hedge articles: accused it of “writing a post first and asking questions later“, and coming up with some utterly incorrect response to show just how wrong Zero Hedge was because, guess what, the Office of the US Currency Comptroller had clearly “fat fingered” trillions in critical data.

As usually happens in these situations, Zero Hedge was right (there was some tongue in cheek apology but hey, at least someone got to boost their traffic briefly by namedropping this web site), which could have been checked simply just by looking at bank call reports, in this case the quarterly Regulatory Capital report, schedule RC-R, which made it very clear that indeed JPM’s OTC commodity derivatives had exploded to $4 trillion.

For those too lazy to check before tweeting, here is the number of OTC cleared “Other” commodity derivatives for JPM before, as of December 31:

Â

Â

And after, as of March 31:

Â

Furthermore, while we await the OCC to respond to our inquiry (we aren’t holding our breath), nobody has disputed our claim (because it is purely factual) that as of Q1 the OCC decided to exclude Gold as a separate commodity category (see call reports above) and lump it in with Foreign Exchange for some still unexplained reason. It would appear that gold is money after all…