The last financial crisis made many financial corporations cut their dividends, but Cincinnati Financial (CINF) managed to keep its dividend growth streak alive. The company has raised its payout for 57 years in a row, which makes the insurance company one of the Dividend Kings.Â

Cincinnati Financial’s dividend yield is substantially higher than that of the broad market, but shares are not very cheap right here. The growth outlook is compelling and investors will likely see solid total returns going forward.

Business Overview

Cincinnati Financial isn’t the biggest insurance company by far: Others like Chubb (CB), Prudential (PRU), ING (ING) or AIG (AIG) are substantially bigger. Cincinnati Financial has nevertheless managed to perform extremely well over the decades, providing an 11,800% total return since going public.

Dividends, which have been rising over the last 57 years, and which include stock dividends and special dividends, have played a major role in the company’s great returns in the past.

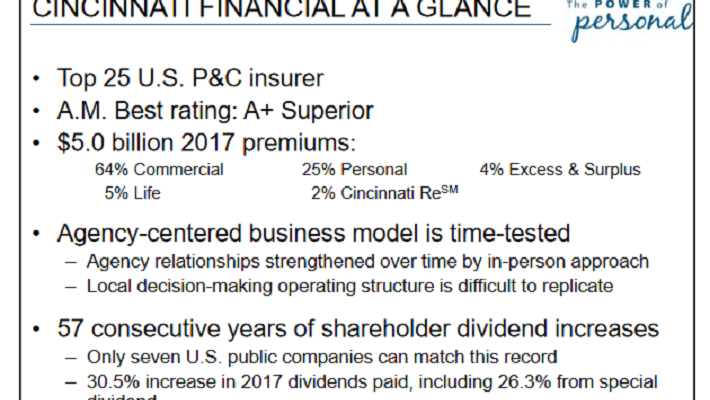

(Click on image to enlarge)

Source: Cincinnati Financial presentation

Cincinnati Financial’s insurance business is focused on the commercial sector, where the company generates about two thirds of its premiums. One quarter of Cincinnati Financial’s revenues are derived from personal insurance, whereas life insurance and reinsurance make up just a small amount of premiums.

Cincinnati Financial is focused on growing the business in the long run, through book value growth and rising investment income. Shareholders are participating via rising dividends, and since insurance companies oftentimes trade based on their book value, share prices are rising as well.

Growth Prospects

When it comes to the company’s earnings, Cincinnati Financial has several avenues for growth. The first one is premium growth, which is primarily achieved through a rising number of agencies. Cincinnati Financial has increased the number of agencies it cooperates with by more than 40% since 2009, spanning 42 states. This means that there is still some potential for geographic expansion in the US, and once the company is active in all markets it can increase its market share.