Cincinnati Financial (CINF) has increased its dividend for 56 consecutive years, an impressive streak that only seven other U.S. public companies can match.

Perhaps more impressively, a shareholder who purchased one share of this well-run insurer before 1957 would own more than 2,146 shares today, assuming all shares from stock dividends and splits were held.

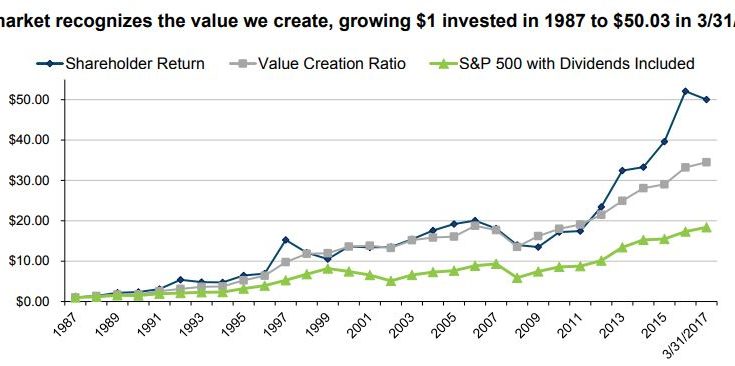

Few companies have created this level of wealth for their shareholders over the decades, and you can see that Cincinnati Financial’s stock has significantly outpaced the S&P 500 over the last 30 years as well.

(Click on image to enlarge)

Source: Cincinnati Financial Investor Presentation

Let’s take a closer look at this dividend king, which enjoys a large base of recurring revenue, generates excellent free cash flow, and has a bright long-term outlook, to see if it might be an appropriate stock for investors living off dividends in retirement.

Business Overview

Cincinnati Financial was formed in 1950 and is among the top 25 U.S. property casualty insurers today, offering business, home, and auto insurance.

Insurance companies make money by writing and selling insurance policies (which typically breaks even or loses money for most insurers), and investing policy proceeds for income until claims need to be paid out (this is where the money is really made). Local independent insurance agencies market Cincinnati Financial’s policies within their communities, which span across more than 40 states.

The company’s mix by premiums written in 2016 was 64% commercial, 25% personal, 6% life, 4% excess & surplus and 1% other. By state, 15% of Cincinnati Financial’s premiums came from Ohio, 7% from Illinois, 6% from Indiana, 6% from Pennsylvania, 5% from North Carolina, 5% from Georgia, and 5% from Michigan.

In other words, Cincinnati Financial is nicely diversified by insurance line, premium mix, and geography.

Business Analysis

Insurance companies live and die by managing risk. If insurers fail to price risk accordingly in their policies, they won’t be around for long.

Compared to some insurers, Cincinnati Financial’s underwriting process is somewhat more aggressive because the company targets a combined ratio between 95% and 100%, which means that it expects its policies to be slightly profitable at best (when a combined ratio is below 100%, the company achieves an underwriting profit).

The company ended full-year 2016 with a combined ratio of 94.8%, which is better than its target and the estimated property casualty industry aggregate of 100.7%, as per A.M. Best. As seen below, Cincinnati Financial’s combined ratio has outperformed the industry in the past five years.

(Click on image to enlarge)

Source: Cincinnati Financial Investor Presentation

The company has also produced 28 years of favorable loss reserve developments, which means it has conservatively booked more losses than it has actually realized each year. This is yet another sign of management’s conservatism.

Cincinnati Financial’s reinsurance program also limits its losses beyond certain thresholds in the event of catastrophes such as earthquakes, and its pristine balance sheet provides additional comfort.

In addition to Cincinnati Financial’s proven risk management track record, the company has several other competitive advantages.

First, its large size (Cincinnati Financial is one of the 25 biggest U.S. P&C insurers) provides economies of scale in marketing, administrative operations, and support staff. Cincinnati Financial is able to spread these costs over a sizable pool of insurance policies to keep its prices very competitive.

Cincinnati Financial is also able to price its premiums lower than smaller competitors because its risk is reduced with a larger pool of policies.

Furthermore, the company’s long operating history, range of insurance products, and size provide branding benefits and trust with the agencies that market Cincinnati Financial’s policies.

Establishing and supporting relationships with agencies takes significant time and cost but provides Cincinnati Financial with relatively low-cost distribution advantages as it expands geographically.