UPDATE:*CHINA HSBC MANUFACTURING PMI AT 48.5 FOR FEB. (as expected and marginally above the Flash print)

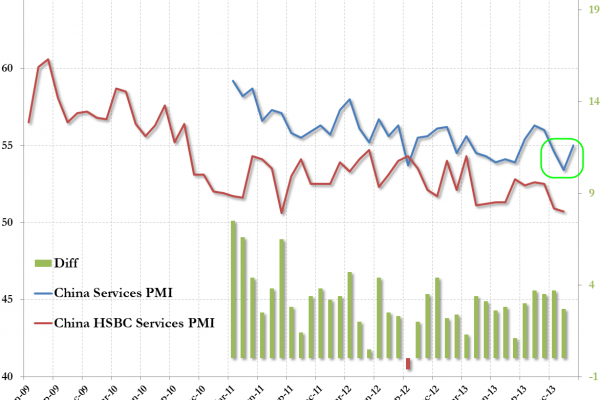

Chinese manufacturing PMI fell to an 8-month low holding barely above the crucial 50 level yesterday forcing Goldman to admit that “this signals further deceleration” in Chinese growth. All sub-indices showed signs of cyclical slowdown from January to February with perhaps the two most-critical ones - production and new orders – showing considerably larger falls than the headline index itself as we await this evening’s HSBC print to confirm an average ‘contraction’.China’s Services PMI just printed at 55, up from 53.4, to a 3-month high led by a surge in the “expectations” sub-index.

China Services PMI rose to 3-month highs… as new orders rose but the “expectations” sub-index jumped the most as hope trumps any current weakness as input prices slumped to 10 month lows.

China Manufacturing PMI fell to 8-month lows

Ahead of this evening’s HSBC-version (which printed 48.3 Flash) of Manufacturing data, Goldman’s summary is oddly (honest) pessimistic on China’s Manufacturing industry…

The latest PMI data is another piece of evidence of slowing activity growth since 4Q 2013. Data at the start of the year tends to be noisy in general, and unlike some other indicators taking the average of January and February PMI readings doesn’t necessarily override the Chinese New Year distortions (this is because survey results can be affected by the timing of the survey which covers only a short period over several days within the month). However, the consistency of the signal is such that there is little doubt that growth has been weak and probably becoming weaker since the end of the year. We see risks to our 7.7% GDP forecast for 1Q tilted more towards the downside.

We believe the combination of a tight monetary policy stance, heightened anti-corruption and anti-pollution campaign, inventory destocking and slower than expected external demand contributed to the slowdown. While over the longer term measures such as anti-corruption measures can improve the efficiency of the economy, they can often put significant downward pressures on demand growth in the short term.