It is only fitting that the next business day following a headline that “Global Futures Slide China Tumbles On Short Selling Boost” we would see China, in an apparent panic, not only cut its RRR by 100 bps to 18.5% – far more than expected and the most since 2008 – but, more importantly, hinted that the Friday regulatory decision to encourage short sales and tighter margin rules on “umbrella trusts” was in no way meant to pop that the Chinese stock bubble, ridiculous as it may be.

As we reported over the weekend, “in a statement published on Saturday evening, the China Securities Regulatory Commission said measures rolled out on Friday, including tightening rules on margin lending and promoting the use of short selling, aren’t aimed at clamping down on a red-hot market. The measures are about “maintaining the healthy development of the market,†the CSRC said in the statement. “They aren’t intended to encourage short selling, let alone depressing the market…the market shouldn’t over-interpret the measures,†it added.”

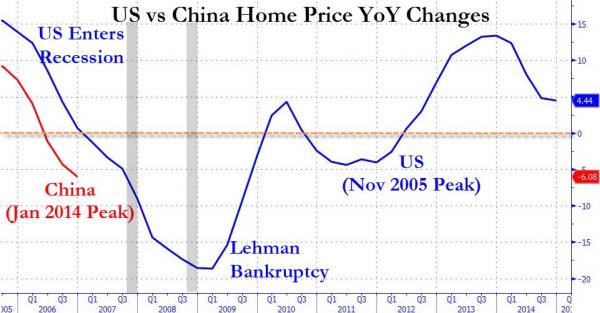

In other words, the Chinese moves were far less concerned with the economy, where as we showed if the US housing “lesson” is any indication, then the Chinese economy is already in a recession…

Â

… but all about preserving the only bubble China has left, ahead of what would be a full-blown hard landing: that of stocks.

End result: after Chinese futures crashed by up to 6% on Friday after the Shanghai close, overnight the SHCOMP was down just 1.64%, erasing the bulk of the futures loss. More importantly, US equity futures have seen a strong bid this morning in yet another attempt to defend not only the Apple Sachs Industrial Average from going red on the year but the all important 100 DMA technical levels.

Should Virtu’s momentum accelerator algos wake up on time from their post-IPO party hangover, we may well see the entire Friday loss wiped out, completely oblivious that the Greek drama may be about to end in tears for all.

For now however, European equities reside comfortably in positive territory with the weaker EUR offering support to German exporters, which is in turn aiding DAX outperformance. However, German auto-makers have since pulled of highs with Volkswagen and BMW confirming they are both facing headwinds in China. Furthermore, basic materials is the best performing sector in the session underpinned by China stimulus efforts. However, after initially trading higher by over 1%, Chinese bourses later reversed direction following a bout of profit taking as well as concerns over the comments from the CSRC stating that they will tighten margin lending rules. Furthermore, analysts suggest that the action taken by the PBoC over the weekend may not be sufficient enough to get the Chinese economy back on its feet, with further cuts to the deposit and lending rate potentially required.

Additionally, sources reported during the European session that China are to inject USD 62bln of FX reserves into Chinese banks, with USD 30bln pumped into Exim Bank and another USD 32bln into CDB. (Caixim/BBG)

UST’s are seen lower heading into the North American crossover alongside the strength seen in stocks. Separately, German paper has edged higher with uncertainty in Greece still taking centre stage, after weekend reports that Russia and Greece were to reach an energy deal which would grant the troubled economy EUR 5bln. However, these rumours were later refuted by Russian government spokesman over the weekend with GR/GE spread wider compared to its Eurozone neighbours.

In FX markets, the USD-index is seen marginally higher as EUR/USD is considerably weaker as the possibility of ‘Grexit’ lingers on. Elsewhere. Antipodean currencies briefly touched 1 month highs boosted by the surprise RRR cut in China. AUD/USD rose to a 1-month highs of 0.7840 while NZD/USD gained for a 5th consecutive day, both pairs taking out 0.7800 and 0.7700 respectively. However, the firmer greenback dragged the antipodean currencies back into negative territory.

India’s Sensex Index falls 2% to three week low while USD/INR rose by the largest amount in two months to its highest level since March 16th as a consequence of concerns of lower than expected corporate earnings.

WTI and Brent crude futures saw much of its upside erased after comments from Saudi Arabian oil minister stating that Saudi Arabia have an output of 10mln bpd in April and is not worried about demand for oil in China. Finally, spot gold has pared most of its safe haven bids underpinned by Chinese growth worries due to the modestly stronger USD.