As if we needed more evidence, the Chinese liquidity system is stuck. As much as authorities in China might complain about the global credit-based reserve currency system, as PBOC Governor Zhou Xiaochuan put it in March 2009, and quietly seek out its replacement, they not only allowed it to happen they quite eagerly participated in it so long as it appeared to fuel their economic “miracle.†The monetary system in China is not Chinese; it is at most translated into RMB as its basis is derived elsewhere. And in the world of the late 20th century and especially the first decade of the 21st that means primarily “dollars.â€

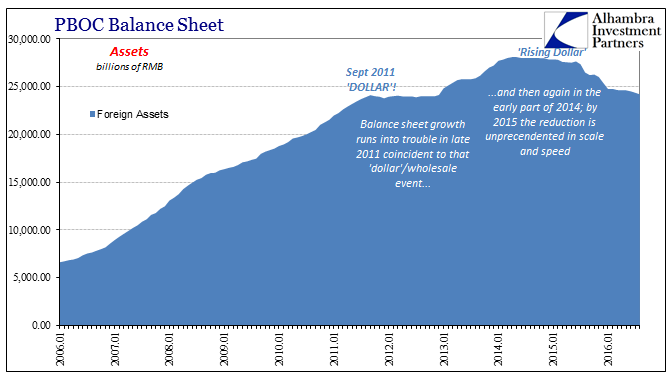

It is perhaps one of the biggest shocks to traditional thinking where you can very easily observe the eurodollar system’s decay by looking at nothing more than the People’s Bank of China’s assets. While the 2008 panic is notably absent for various reasons (only somewhat related to this specific examination), its aftermath is the most prominent feature.

(Click on image to enlarge)

By pegging the yuan to the dollar for so long, the central bank essentially obtained any free “dollars†from its exploding merchandise surplus – as well as a great deal unrelated to pure trade (financial). That kept the currency stable, but it also created the Chinese “dollar†short whereby all those “spare†“dollars†were left on account at the PBOC rather than flow, as is commonly believed, to the importers who needed (and still do) them. As the asset side built up due to foreign accumulations, primarily “dollarsâ€, the liability side (China money) could follow along, meaning Chinese money wasn’t purely fiat in the very strict sense of the term. It was “backed†by forex conditions even more than balances.

You can appreciate the willingness of Chinese monetary authorities to incorporate this odd arrangement; before the 1990’s, China’s economy was a basket case of authoritarianism as well as unevenness. That uncertainty was the dominant view of the currency, as well. Thus, to peg CNY meant to do so credibly, and what better shortcut than to “back†CNY by “dollars?â€

No one envisioned that the credit-based global currency system would ever run so afoul of regular order. Even in March 2009 when Governor Zhou was pleading for Western authorities to actually understand the world’s monetary arrangements he wasn’t at that time doing so with the expectation that the eurodollar, the wholesale format was no longer workable; Zhou just wanted a more stable eurodollar. As you can see plainly on the chart above, it wasn’t until September 2011 that it became clear any such hope was a futile one (though it wasn’t until 2013, it appears, that Chinese authorities finally realized it; which still puts the Communists so many years ahead of the “free market†West in terms of figuring out what is actually going on). The Chinese don’t have the luxury of pretending it is still 1950 – not that “we†have any such benefit, either, only the Chinese monetary system is more directly and heavily affected such that they are forced into direct and immediate confrontation with reality whereas the Federal Reserve merely questions the more indirect economic and intermittent financial effects of the global economy slowly strangulating from the tightening.