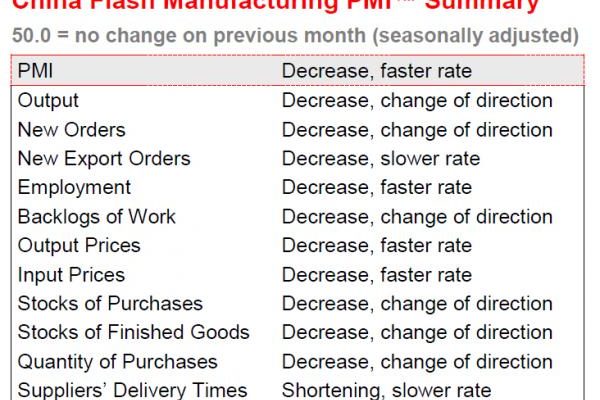

If there was any doubt that it was also snowing in China this winter, the February Flash HSBC PMI, which tumbled from 49.5 where it was expected to print, to 48.3, a seven month low, just sealed all meteorological conundrums. And with every sub-index decreasing or deteriorating, it is no surprise that headline index tumbled.

At 48.3, this is the lowest since July of last year with the employment sub-index the lowest since Feb 2009.

The commentary from Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, was about as dire as could be:

“February’s flash reading of the HSBC China Manufacturing PMI moderated further as new orders and production contracted, reflecting the renewed destocking activities. The building-up of disinflationary pressures implies that the underlying momentum for manufacturing growth could be weakening. We believe Beijing policy makers should and can fine-tune policy to keep growth at a steady pace in the coming year.â€

Markets are not happy that the dream of a sustainable escape velocity growth miracle is not coming true and for now bad news is bad news (as The Fed’s minutes suggested they will – just as Yellen stated and the market ignored – stay the course on the taper). USDJPY and the Nikkei 225 has erased all their post-BoJ gains on this news.

USDJPY and Nikkei 225 have erased all gains post BoJ

Â

S&P futures are also fading fast as they recouple with USDJPY as it tests the critical 102 level…Â 27 points off today’s highs

Â