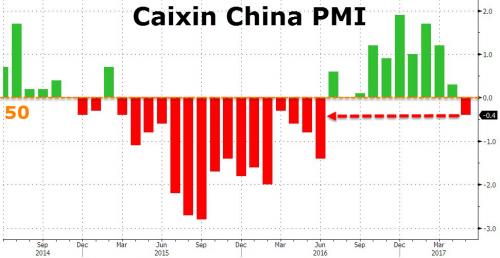

Following yesterday’s official (if less credible and focused mostly on SOEs) manufacturing and non-mfg PMI reports from China’s National Bureau of Statistics, both of which came either in line or slightly better than expected, Caixin/Markit reported its own set of Chinese manufacturing data, and it was far more disappointing: at 49.6, not only did it miss expectations of 50.1, but by printing below 50, the operating conditions faced by Chinese goods producers deteriorated for the first time in nearly a year. As shown below, this was the first contractionary print sine last June when China’s massive, anti-deflationary fiscal stimulus kicked in.

The seasonally adjusted PMI posted below the neutral 50.0 value at 49.6 in May, the first contractionary print since the middle of 2016. Although only indicative of a marginal deterioration in operating conditions, Caixin conceded that the index fell from 50.3 to signal the first decline in the health of the sector for 11 months.

The fall in the headline index coincided with slower increases in output and new orders, while staff numbers were cut at a quicker rate. Subdued demand conditions underpinned a renewed fall in purchasing activity, albeit only slight, and the first increase in inventories of finished items in 2017 so far. The latest data also signaled the first fall in input costs since last June, which in turn led manufacturers to lower their selling prices for the first time since February 2016.

Commenting on the data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

The Caixin China General Manufacturing PMI fell 0.7 points to 49.6 in May, marking its first contraction in 11 months. The subindices of output and new business stayed in expansionary territory, but both fell to their lowest levels since June last year. The subindices of input costs and output prices dropped into contractionary territory for the first time since June 2016 and February 2016 respectively. The sub-index of stocks of purchases signaled a renewed decline, while the sub-index of stocks of finished goods rebounded, indicating that companies have stopped actively restocking as inventories began to stack up. China’s manufacturing sector has come under greater pressure in May and the economy is clearly on a downward trajectory.