2024 has seen the most aggressive central bank easing globally since the 2020 pandemic and 2008-09. Whatever ‘stimulus’ impacts may flow from this will filter into the economy over the next few years. In the nearer term, the 22-fold tightening cycle of 2022-2023 will continue to weigh on borrowing and spending ability over the next year and beyond as ultra-low interest rate loans come up for refinancing.

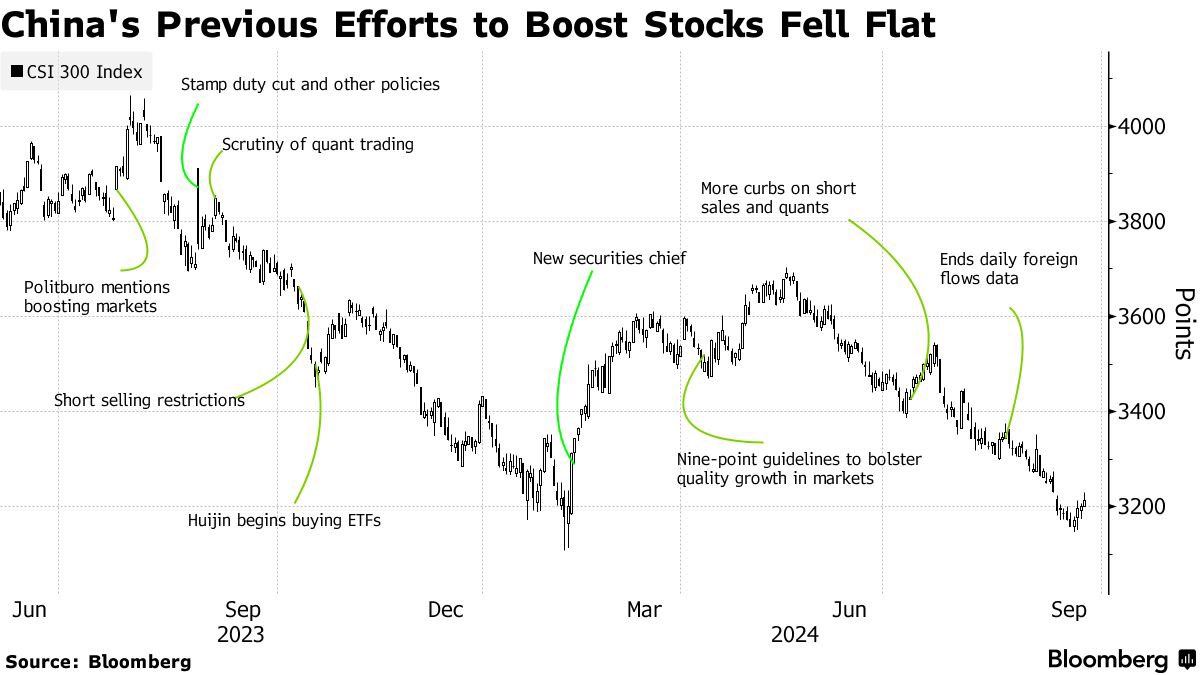

Negative economic momentum and moribund asset prices prompted the Chinese central bank (PBOC) to launch another flurry of easing efforts over the last week. While Chinese stocks have spiked on the news, similar spates of jubilance proved short-lived (CSI 300 Index price below since June 2023) as a balance sheet recession continues to weigh on consumer confidence.(Click on image to enlarge)

See, :

“For China’s long-suffering homeowners, help cannot come soon enough. “I don’t feel optimistic,” said another Beijing homeowner who asked not to be identified. “Prices are dropping, so no one is buying or selling. I don’t know how they [the government] can solve this problem.”

China Beige Book’s Leland Miller offers his assessment in the segment below.

China’s central bank just shocked markets with several impressive sounding stimulus measures, causing the biggest one-week rally in Chinese stocks since 2008. But how effective is this stimulus actually going to be to the Chinese economy? Leland Miller, co-founder & CEO of China Beige Book, joins Monetary Matters to weigh on this very important issue. Leland says he thinks the rally in Chinese stocks could continue for up to two months but that the effect on the Chinese economy will be to stabilize rather than to stimulate. Here is a direct video link.

More By This Author:Housing Downturn Intensifies With Motivated Sellers Employment Cycle Drives Reactionary Monetary Policy Rate Cuts Offer Less Ease Than Many Need