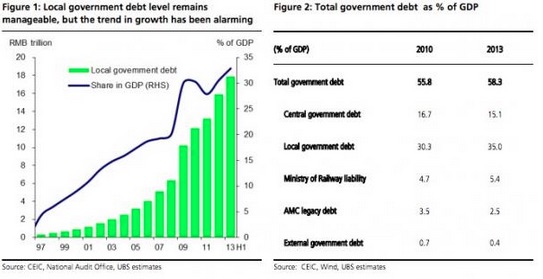

A little over a month ago we suggested that QE in China may take the form of local government debt purchases by the PBoC. As a reminder, China is allowing local governments to refinance a portion of their ~17 trillion yuan debt pile by swapping it for lower yielding bonds. As a percentage of GDP, local government debt has grown to 35% and because a sizeable amount was accumulated off balance sheet via shadow banking channels, it carries relatively high interest rates.

The pilot program will allow for the refinancing of around 1 trillion of that debt, a move which could save local governments some 50 billion yuan in interest payments. As a reminder, here’s what the local government debt picture looks like in China:

The problem with the scheme however, is that the banks who purchase the newly issued local government bonds will have that much less cash to lend at a time when the central bank is keen to keep liquidity flowing and as we’ve seen over the past several months, several factors are conspiring to undercut or otherwise limit the effectiveness of interest rate and RRR cuts. Essentially, China is caught between a peg to the strong dollar, decelerating economic growth, and capital outflows, meaning that devaluation to bolster flagging exports risks aggravating capital flight while not devaluing gets more costly by the quarter. It’s this currency conundrum that has led us to predict that in the end, China will resort to QE.Â

Given the new refinancing progam, it seemed logical to suggest that if China wanted to integrate QE into its current efforts to assist local governments with their debt load, the central bank could simply buy the local government debt. Here’s what we said last month: “It seems as though one way to address the issue would be for the PBoC to simply purchase a portion of the local debt pile and we wonder if indeed this will ultimately be the form that QE will take in China.â€Â As the WSJ reports, China may do just that, although the program, should it become a reality, will still be one step away from outright QE: