UPDATE: It’s happened – China has suffered its first domestic corporate bond default as Chaori fails to meet interest payments on schedule and rather more surprisingly failed to receive a last-minute mysterious or otherwise bailout…

- *CITIC BANK WON’T HELP CHAORI MAKE INTEREST PAYMENT: 21ST HERALD

- *SHANGHAI CHAORI DEFAULTS ON BOND INTEREST PAYMENTS, WSJ SAYS

But hey don’t sweat it, Moody’s think it’s great news…

- *MOODY’S: DEFAULT BY CHAORI SOLAR WOULD ADVANCE CHINA’S BOND MKT

Maybe tell the issuers that couldn’t get their deals off today!!!

Of course what they mean is – maybe the market will finally start pricing in some real risk…

“Over the past few years, municipal governments and banks in China have stepped in to help distressed companies meet their bond payment obligations. These bailouts have led some investors to overlook the fundamental credit risks in bonds,” says Ivan Chung, a Moody’s Vice President and Senior Credit Officer.

…

“A default would likely make investors recalibrate their risk-return consideration for onshore bonds. Credit risk would play a more important role in pricing, thereby making the bond market more efficient in the allocation of capital,” adds Chung.

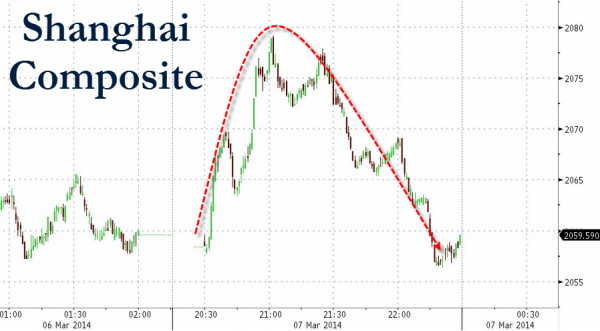

Chinese stocks are not happy

Wondering who’s next? We explained here…

and there are a lot to come…

As Bank of America reports in an analysis by David Cui, the Trust defaults are about to get hot and heavy. To wit:

We believe that during April to July the market may see many trust products threatening to default, especially those related to coal mines. By our estimate, the first real default most likely could happen in May with a Sichuan lead/zinc trust product worth Rmb140mn. This is because the product is relatively small (so the government may use it as a test case), the underlying asset is not attractive (so little chance of 3rd parties taking it over) and we also have heard very little on parties involved trying to work things out. Whether this will trigger an avalanche of future trust defaults remains to be seen and this presents a key risk to the market in our opinion.