S&P 500 futures are jumping exuberantly as Japan and China PMIs print above expectations and back in expansion territory (Japan best in 3 months, China best in 7 months). This is China’s best 2-month PMI rise since Oct 2010(which makes perfect sense amid the collapsing housing market and CCFD ponzi probe) – which provides the perfect propaganda meme that targeted RRR cuts work. However, while stocks don;t care to scratch the surface, there are 2 glaring similarities that could become a problem. Both China and Japan saw employment drop (Japan’s first in 11 months) and furthermore both China and Japan saw input prices rise and output prices decline – not exactly the margin expansion dream everyone is hoping for… and all this as China’s Beige Book shows the slowdown deepening on weak investment.

China’s Manufacturing PMI saw its best 2 months since Oct 2010… so RRRs work right?

Which is odd given that GDP expectations continue to collapse… (h/t @M_McDonough )

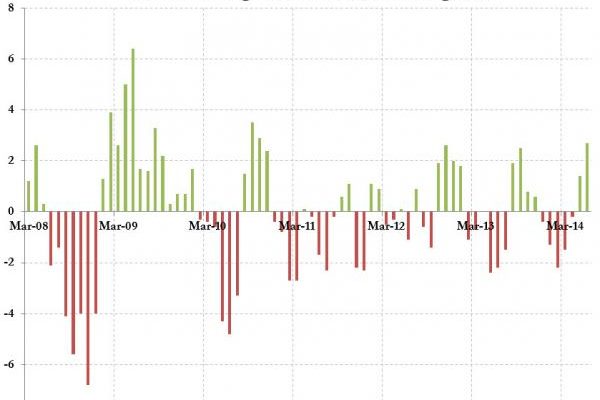

And China and Japan both see employment drop and margin pressures build…

Â

as Japan employment tumbles…

But none of that “fact” details matter – you buy stocks…

Â

As China’s Beige Book was anything but positive…

- CHINA BEIGE BOOK SAYS SLOWDOWN DEEPENING ON WEAK INVESTMENT

- CHINA BEIGE BOOK SAYS FEWER COMPANIES ACCESSED CREDIT IN 2Q

China’s economy continues to decelerate quarter-on-quarter, driven by “perhaps unprecedented weakness†in capital expenditure, China Beige Book says in its 2Q survey released today.

* Fewest number of firms increasing investment and most pronounced quarter-on-quarter drop in 10 quarters of surveys

* Fewer companies surveyed accessed credit from banks, shadow lenders and the bond market

* Survey finds loan rates inverted, with bank interest rates ticking up in the quarter while non-bank rates saw a “substantial slide†to below levels offered by banks

* Firms appear to be responding to current economic conditions by borrowing and spending less

* Weakness in investment has “sweeping effects†on sectors, regions and gauges of company performance

* Services weakened more sharply while transportation, mining, and retail slowed

* Manufacturing showed year-on-year growth for the fourth quarter in a row and was stable vs previous quarter

* In property sector, residential and commercial realtors “were pummeled,†while builders reported higher starts and rising prices, with stable or larger proportions reporting revenue growth

* Investment slowdown depressed growth in hiring, wages, laboractivism

* Worst-performing sector was minerals as coal producers sawrevenue contraction