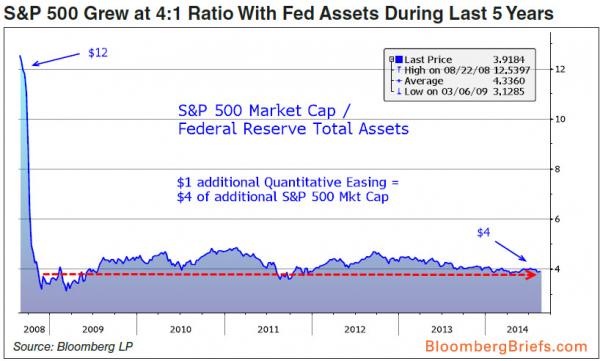

For each $1 of additional quantitative easing by The Fed, the S&P 500 adds $4 of market capitalization.

This correlation-is-causation ‘fact’ has been remarkably constant since the Fed unleashed QE on the world, but, as Bloomberg’s Chase Van Der Rhoer notes, still well below the $12 market cap gains pre-2008 and that it now takes $41 billion in additional stimulus to nudge High-Yield credit spreads 1bp tighter. However, the largest ‘diminishing effect’ of QE is seen in job creation (were one to believe there was any causal link). It now takes a record $37,400 of additional QE for each additional job created (5 times the pre-Lehman levels).

It seems it is indeed time to retire QE…

But what happens when the balance sheet stops expanding?