This cycle of entrenched interests protecting their skims and scams via central bank monetary policy is self-liquidating.

I finally figured out that the core purpose of central banks’ monetary policy is to enable vested interests to avoid desperately needed reforms in the real economy.This might have been blindingly obvious to others, but I finally caught on to the dismaying reality: the only purpose of central bank monetary policy is to keep the bloated, corrupt, inefficient and self-liquidating vested interests of the state-cartel crony capitalism from having to suffer the consequences of real reforms.

Â

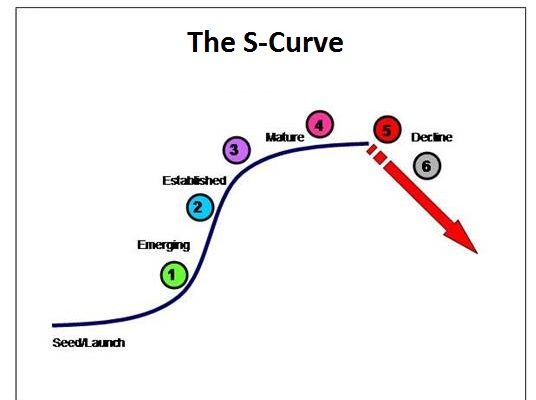

Japan ably serves as Exhibit #1 of this core dynamic. The broad narrative in Japan is a template for state-cartel crony capitalism everywhere: after World War II, the system of state-managed cartels was re-instated with modest structural changes. The Central State and bank enabled the expansion of export-sector cartels–an expansion that followed the classic S-Curve of expansion, maturity and stagnation with great precision:

We can grasp just how sclerotic and fixed this system is by asking: how many of Japan’s top 20 electronics hardware corporations entered the top 20 after 1946?The answer: none.

Indeed, Abenomics can be properly understood as a last-ditch effort by the state and central bank to avoid the structural reforms Japan desperately needs to adapt successfully to the realities of the 21st century. Alas, these structural changes– loosening the grip of quasi-monopolies and cartels, writing down unpayable debts, freeing up the labor market, ending the completely arbitrary skims and scams of the entrenched interests currently protected by the Central State–will necessarily crimp or destroy the fat profits these interests have skimmed since 1946.

As a result, the political resistance to meaningful reform is immense. A few of these rigid skims are described inVoodoo Abenomics: Japan’s Failed Comeback Plan (Foreign Affairs):