Daily Market Commentary: S&P And Russell 2000 ‘Bull Traps’

Somewhat inevitable events in the Ukraine were going to nix the nascent breakouts for the S&P and Russell 2000. The net sum is to drop these indices into broad trading …

Read More

Somewhat inevitable events in the Ukraine were going to nix the nascent breakouts for the S&P and Russell 2000. The net sum is to drop these indices into broad trading …

Read More

Today brought three better than expected economic releases from Construction Spending, ISM Manufacturing, and Personal Income. The ISM figure was quite unexpected and Personal Income was well above expectations. If …

Read More

Having ripped higher by over 200 points after the US close, Nikkei 225 futures have “glitched”: *JPX SAYS NIKKEI 225 FUTURES STOPPED TRADING AFTER 11AM TOKYO *JAPAN EXCHANGE SAYS NIKKEI …

Read More

Last week featured testimony by two Chairpeople of the Federal Reserve or more specifically the current and latest former. Janet Yellen, the newly minted Chair of the Fed, was most …

Read More

Note from dshort: This commentary has been revised to include the January Real Personal Income (excluding transfer payments). Official recession calls are the responsibility of the NBER Business Cycle Dating …

Read More

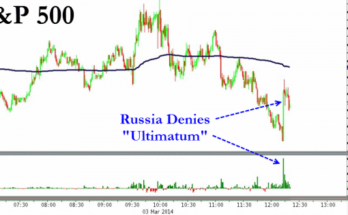

While the news actually broke earlier, once the headline that Russia denies an “ultimatum” threat to assault the Ukrainian fleet hit Reuters, the algos smashed USDJPY higher and that lifted …

Read More

In a nearly $13 billion settlement with the US Justice Department in November 2013,JPMorganChase admitted that it, along with every other large US bank, had engaged in mortgage fraud as a …

Read More

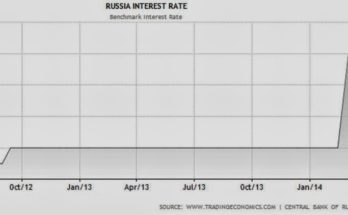

Russia’s central bank finally raised its overnight rate to 7% (from 5.5%) to stabilize the ruble. Apparently there is only so much currency depreciation the central bank is willing to …

Read More

Dear Reader, I’m shivering in Toronto as you read this, here to participate in the biggest mineral explorer conference of them all, the annual Prospectors and Developers Association of Canada …

Read More

Quietly February’s ISM came in stronger at a PMI of 53.2%. PMI courtesy of ISM Breaking down the details new orders are notable, although inventories are backing up a little. Also …

Read More