Time For Bulls To Be Skeptical – Weekly Market Outlook

After five weeks of bullishness that took stocks to record highs, it didn’t come as a complete surprise to see the market take a modest tumble last week. Â All told, …

Read More

After five weeks of bullishness that took stocks to record highs, it didn’t come as a complete surprise to see the market take a modest tumble last week. Â All told, …

Read More

Welcome to edition 195 of Insider Weekends. Insider buying declined sharply last week with insiders purchasing $37.85 million of their stock compared to $81.57 million in the week prior. Selling increased …

Read More

The weakness last week in U.S. stocks was entirely expected. As I mentioned in last weekend’s article, the technical condition had become quite overbought and the market was overdue to …

Read More

While Goldman is quickly down-playing the decision by the PBOC to double the size of the daily trading bands for USDCNY to +/2.0% as a risk-off event (just as it was in …

Read More

At Friday’s close the eight markets on my world watch list turned in their worst collective weekly average of the past two calendar years, an eye-opening -3.19%. The second worse …

Read More

Econintersect: Christopher Lewis if FX Empire has posted a video which gives his summary of the weekly outlook for thew Nikkei 225 Index in Tokyo. He is looking for an …

Read More

Excerpted from this week’s premium report, NFTRH 282: Last June when tidbits about a would-be future ‘taper’ of T bond purchases (QE) were popping up in the media NFTRH 241 (June 2, …

Read More

Rightly or wrongly, markets continue the Fed fixation. Many expect (or demand?) a change in Fed policy. This week marks the first FOMC meeting with Janet Yellen as the Chair. …

Read More

Over years working with professional traders, I’ve found it interesting how each individual has their bellwether stock they follow to gauge the stock markets trend and identify reversals before they occur. …

Read More

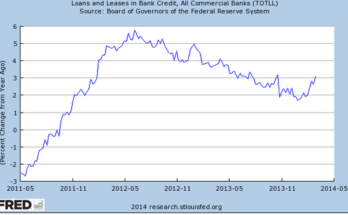

Credit growth in the US seems to have stabilized and may be on the rise. It’s worth mentioning that the bottom in loan growth just happened to correspond to the …

Read More